Flutterwave and the art of the restart

Caught between a growth plateau and the relentless glare of public expectations.

Happy New Year! I hope this finds you with a cold beer in hand and your feet up, finally recovering from the week.

Today’s guest is a friend of the house, Abubakar Idris. While Flutterwave’s acquisition of Mono dominated the headlines this week, Abubakar takes a different view, situating the “butterfly unicorn” between Scylla and Charybdis. It’s a sober look at a giant trying to grow while the world watches for an exit.

Enjoy, and I’ll see you in the comments.

TOGETHER WITH CREDIT DIRECT

Sustainable businesses aren’t built on process alone. They’re built on kept promises. At Credit Direct, that shows up as consistency: showing up when it matters and still being there after the moment has passed.

Continuity isn’t a campaign for us. It’s the job. So whether you’re planning for today or protecting tomorrow, we’re built to stay in the picture.

Flutterwave Attempts to Restart Growth as IPO and Competitive Pressure Mount

Abubakar Idris

In mid-September 2023, as the United Nations General Assembly convened in New York, a different sort of assembly took place in a packed room at Manhattan’s Flatiron Building. The attendees represented the bedrock of Nigerian finance: Temi Popoola of the Nigerian Stock Exchange; Iyin Aboyeji, the country’s most prolific seed investor; and Bolaji Balogun of Chapel Hill Denham. Oswald Osaretin Guobadia, a former aide to the Nigerian president on digital transformation, and Tayo Oviosu, CEO of Nigerian fintech Paga, were also present.

All eyes were on Olugbenga “GB” Agboola, CEO of Flutterwave, Africa’s most valuable startup and the primary symbol of the continent’s fintech gold rush. Bolstered by a $250 million Series D round in 2022, the company sat on a $3 billion valuation. In that room, the conversation wasn’t about whether Flutterwave would go public, but where and if the valuation might double to $6 billion upon listing.

But Agboola was cautious, declining to commit to any timeline or process.

Three years later, the atmosphere has shifted from speculation to sobriety. As we enter 2026, Flutterwave finds itself at a critical juncture: attempting to reignite growth while defending its flank from increasingly agile incumbents and global challengers.

Devaluation and macroeconomic challenges in Nigeria, its key market, have slowed its growth. A spate of controversies, including allegations of sexual harassment and fraud in Kenya, raised major concerns about its corporate culture. A flurry of exits in its leadership ranks remains topical in African fintech circles.

Now, Flutterwave is looking to restart growth across its product segments and remain competitive as its rivals encircle. A revived global IPO scene raises the prospects, for the nth time, of going public.

From Payments Pioneer to Incumbent Facing Heightened Competition

Founded in 2016, Flutterwave built its reputation on helping businesses accept and move money across Africa’s fragmented payment rails. Rave, its enterprise checkout and collections stack, became the company’s center of gravity. Today, Rave still shapes how investors think about Flutterwave: not as a consumer fintech, but as infrastructure for merchants, platforms, and payment service providers.

The startup has processed over $30 billion for customers since 2016, according to my analysis of its annual total payment volume (TPV).

Flutterwave has periodically flirted with the mass market, then retreated. Its most visible consumer product, Barter, was shut down in March 2024 as the company refocused on enterprise and remittances.

The renewed consumer push is now narrower with a hand in remittances (Send App) and cross-border tuition payments, products that can ride Flutterwave’s existing compliance and settlement strengths rather than compete head-on with digital banking giants.

Despite this refinement, Flutterwave faces intense pressure across every segment it occupies. Its attempt to build a merchant marketplace faltered due to weak adoption, and its original pullback from consumer payments created an opening for fintechs like OPay, Interswitch, and Moniepoint. These rivals have since cornered the market for peer-to-peer transfers and in-person retail payments—two of the fastest-growing segments where Flutterwave lacks a presence. In the remittance space, the company faces an uphill battle against newer upstarts like Lemfi, which has executed an aggressive marketing and product ramp-up to penetrate African diaspora communities in the UK and US.

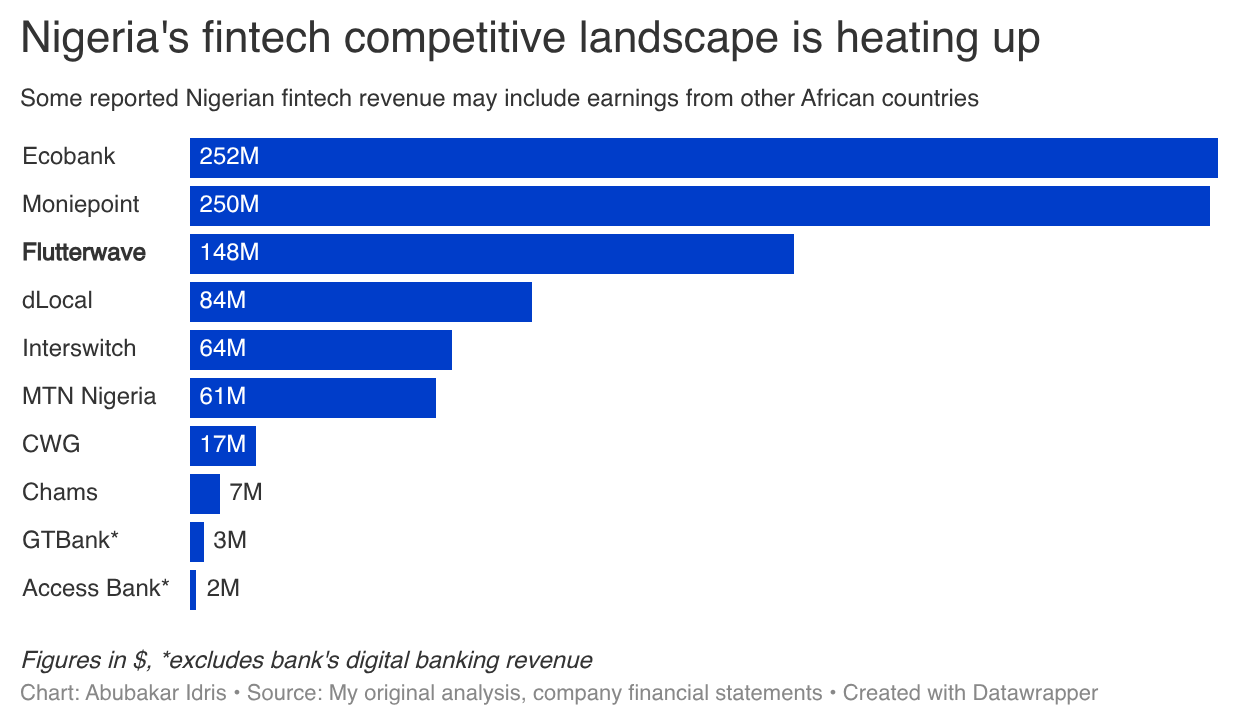

Even Flutterwave’s core enterprise segment is under siege, most notably from the Uruguay-based global payments firm dLocal. Having secured a local license in 2022, dLocal generated over $84 million in revenue from Nigeria in 2023, representing a 155% year-on-year increase. While Flutterwave does not publicly report full financials, its UK subsidiary disclosed annual revenue of $7.4 million in 2023. If the European business represents roughly 5% of total revenue, Flutterwave’s estimated 2023 revenue would be approximately $148 million, underscoring the scale of the threat posed by dLocal’s rapid Nigerian expansion.

Growth Struggles and Controversies

These competitive pressures are compounded by the macroeconomic realities of Nigeria. The country has endured an accelerated economic decline over the last four years, driven by a combination of high inflation, currency devaluation, and insecurity. While Nigeria’s nominal GDP in local currency terms nearly doubled between 2019 and 2024, its GDP in dollar terms shrunk by over 40% during the same period, according to World Bank data. This volatility has spared no one; dLocal’s revenue from Nigeria plunged 84% in 2024 as it contended with devaluation. Consequently, it is estimated that Flutterwave’s 2024 revenue may have also declined to approximately $90 million.

Further dampening the mood is the wave of exits from the firm, as the company lost several key executives, including its growth, human resources, technology, and finance chiefs, over the last two years.

However, as the Nigerian economy enters a period of relative stability, Flutterwave appears to be finding its footing again. In 2024, the company processed an average of $430 million in monthly TPV, translating to an annualized volume of $5.2 billion. Data from the first six months of 2025 suggests a 20% bump in TPV, with half-year volumes hovering around $3.1 billion.

Flutterwave’s Growth Restarts

To bolster its technical capabilities, Flutterwave has pivoted toward acquisitions. This week, it acquired Mono, an open banking pioneer whose infrastructure allows fintechs to bypass traditional card rails and interface directly with bank accounts. The all-stock deal valued Mono at roughly $30 million, according to TechCrunch. This follows a failed 2023 attempt to acquire the British embedded finance startup Railsr.

As the global market enters a new cycle of dealmaking following the IPO and M&A activity of 2025, the clock is ticking. Flutterwave must now decide whether to seek fresh private funding to signal a new phase of growth or finally commit to the public markets that have watched it from afar for years.

Please like, leave a comment, and don’t forget to share. See you on Sunday!

The Butterfly would be warmly welcomed on Broad Street. A local listing would provide liquidity, help gauge investor appetite, and serve as a stepping stone toward a future LSE listing.

The enduring challenge, as always, is valuation and the discount typically applied to developing-market-focused fintechs.