If you got a bank loan from a Nigerian bank last year, I've got news for you

If you got a loan through a Nigerian bank in 2020, you’re automatically on my eat the rich list

Much ado about digital banks a.k.a neobanks

“Own the balance sheet - you need deposits. The ability to lend from deposits is the ultimate super-power in banking”. - Samora Kariuki

If you got a loan through a Nigerian bank in 2020, you’re automatically on my eat the rich list. Because, believe it or not, there are only a few people like you in Nigeria — 2% of Nigerians got loans through banks in 2020.

You would think that since banks aren’t giving loans to most of their customers, those customers would close their savings accounts and put their money under pillows, right?

Wrong, that’s not really how Nigeria works. Five of Nigeria’s biggest banks hold N14.1 trillion in customer deposits — yep, you read that right.

Where are the rest of us getting loans from? Informal channels and an ever increasing army of digital lenders — loan apps that only need your name, phone number, access to your contacts so they can disgrace you when you don’t pay back and your BVN. These apps are extremely popular; in 2020, two of such lending apps, FairMoney and Carbon gave out loans of over ₦70 billion — ₦70 billion in a Panasonic!

It’s okay to want more: The way these digital lenders see it, they might as well become digital banks. Since they’re doing the risky business of giving loans, they figure they might as well help you hold your money.

As it turns out, customers don’t need to trust you to take loans from you, but they really need to trust you to move their savings and salary account to a bank with no branches.

You mean you don’t have a branch where I can go and hold someone’s shirt if my transaction fails?

What it means: If digital banks can’t get depositors funds, whatever banking service they provide is going to be expensive because the source of their funding is expensive.

Think about it; banks can offer really cheap retail loans — the orange bank offers 1.5% compared to 25% from some digital lenders because they have your money and they pay you some 2% interest on your savings. Now that’s the real reason why commercial banks s̶p̶e̶n̶t̶ ̶y̶e̶a̶r̶s̶ ̶h̶i̶r̶i̶n̶g̶ ̶o̶u̶t̶s̶o̶u̶r̶c̶e̶ ̶w̶o̶r̶k̶e̶r̶s̶ ̶t̶o̶ ̶o̶p̶e̶n̶ ̶t̶h̶o̶u̶s̶a̶n̶d̶s̶ ̶o̶f̶ ̶a̶c̶c̶o̶u̶n̶t̶s̶ spent years doing account opening drives to raise deposits.

The alternative is to raise bonds to give loans, which as you can tell, is the more expensive way to work around it.

“The company (FairMoney) says it is projecting to disburse $300 million worth of loans this year. How will it finance that? By raising bonds. FairMoney’s loan book is grown by its capital markets activity and has convinced some investment banks to invest a substantial amount in its unlisted bond.” - Techcrunch

Bottomline: Kuda, another digital bank, started out by not offering loans probably to because it wanted customers to think of them first as a bank and not a digital lender.

Today, it now offers overdrafts with the condition that it must be your main account. It means that the real challenge here for these new digital banks is to become the “main account” to millions of people. Will giving people debit cards, smooth ass apps and loans be able to convince them to dump their banks with physical branches?

Jiji eats up OLX again to move its ambitions forward

“All business for Nigeria hard, but some hard pass others” - Some wise guy like that

The graveyard of Nigerian classifieds — online businesses that allow you to list and advertise products and services — has all the names you once knew and loved. Efritin, which slapped its posters on buses in Lagos, closed in 2017. DealDey, which had the best spa deals back in the day, kept the lights on a bit longer, closing shop a year later.

The Past: While other classifieds were dropping like flies (see that nice quote block for reference), Jiji, founded in 2014, was optimistic. It wanted to build Africa’s biggest online listing business. It didn't matter to them that internet penetration in Nigeria at the time was meh — they were betting it would grow.

But Jiji didn’t become a household name because of its optimism. It caught everyone’s attention in 2019 when it bought OLX’s online assets in Nigeria, Ghana, Tanzania, Uganda and Kenya — rumours say the startup paid between $1.5 - $3.4 million. With OLX out of the way, Jiji was now Nigeria’s biggest online classifieds business.

The Present: Last week, Jiji announced its merger (with Jiji as the acquirer) with Cars45, the used cars marketplace. The merger comes one year after 11 top executives dramatically resigned from the company to set up AutoChek, which, you guessed it, also sells used cars.

Your weekly reminder that someone at Cars45 thought this was a good idea

Away from that bit of drama, the merger makes sense because back in 2019, Jiji said that most of its revenue was from motor vehicle and real estate listings.

The Future: Jiji will likely set up “Jiji autos” as a separate business. A few sources also told me there’ll also be an app that lets people do things like car verification and inspection.

As to personnel, no one also expects any big changes in the short term but Jiji, which runs a lean operation is unlikely to keep all of Cars45’s 358 employees in the long term.

TL:DR: Expect some layoffs in the future.

What else are we reading

If you needed more proof that the world is opening up, event ticketing startup, Tix Africa has closed its seed round

Daystar Power, which has raised $42 million so far this year, has now raised an additional $20 million

Cinch, a UK based used cars platform raised $1.4 billion in May 2021 but that was hardly the biggest funding round in Europe; here’s a list of the largest funding rounds in Europe for 2021

‘Financially Hobbled for Life’: The Elite Master’s Degrees That Don’t Pay Off

As seen on Twitter: “Before 2021, the last assassination of a President anywhere in the world was in 2009. We have had two so far this year.” - @amasonic

What I’m drinking this Friday: The future tears of Italy when the Euros come home, alongside a super cold Heineken.

Don’t forget to leave a comment!

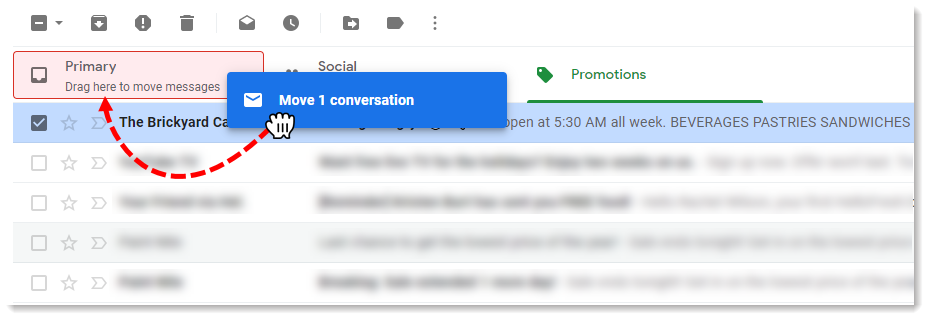

If you received this email in the promotions tab of your email, please move it to your inbox so you don’t miss Sunday’s email!

Like the newsletter and know others that would benefit from it? Then please share with your friends, lovers, enemies…you get the drift.

I need loan

“Orange bank” 💀

I’m dying at the Cars45 public notice