Jumia (Again)

Is our e-commerce giant beating Temu at the Africa game?

If you missed last week’s Notadeepdive, catch up here. If this email was forwarded to you, subscribe here for free:

TOGETHER WITH CREDIT DIRECT

Your goals deserve more than good intentions. Target Yield gives them the structure they need to grow steadily.

Now you can set a goal and earn up to 15% interest p.a on your Target Yield plans.

Beating China at their game?

When you subscribe to Notadeepdive, the broad idea is that you’ll read some of the most interesting analyses of what matters in business and technology. A more implied idea is that you’re signing up to share in a deep, slightly worrying obsession with – you guessed it – Jumia.

This week, Jumia released its Q3 2025 earnings report,, so you already know where this is going.

Jumia coverage usually follows a well-rehearsed routine: “losses, still losing, losses narrowing, maybe one day profit.” I’m often the first person to roll my eyes at that kind of reporting. It almost always means people miss the sweet bits: Jumia’s quietly impressive response to Temu and Shein, its growing sourcing machine in China, or the fact that its charm offensive with investors is finally starting to work.

But this might finally be the quarter where the boring “are we close to profitability” question actually matters. At the start of the year, CEO Francis Dufay committed to profitability by 2027 – a target that already cost two previous CEOs their jobs.

With only about $82.5 million in liquidity at the end of Q3 and roughly $15–16 million in cash going out the door every quarter, Jumia doesn’t have the financial leeway to be a “we’ll figure it out later” company anymore. Reaching profitability by 2027 is an existential matter.

Dufay, for his part, believes he’s right on track:

“We believe Jumia has reached an inflection point. The combination of rising consumer adoption of e-commerce, a compelling value proposition, and improving operational discipline is driving durable momentum. We are building a solid foundation for sustainable, profitable growth, and the results are becoming increasingly visible.”

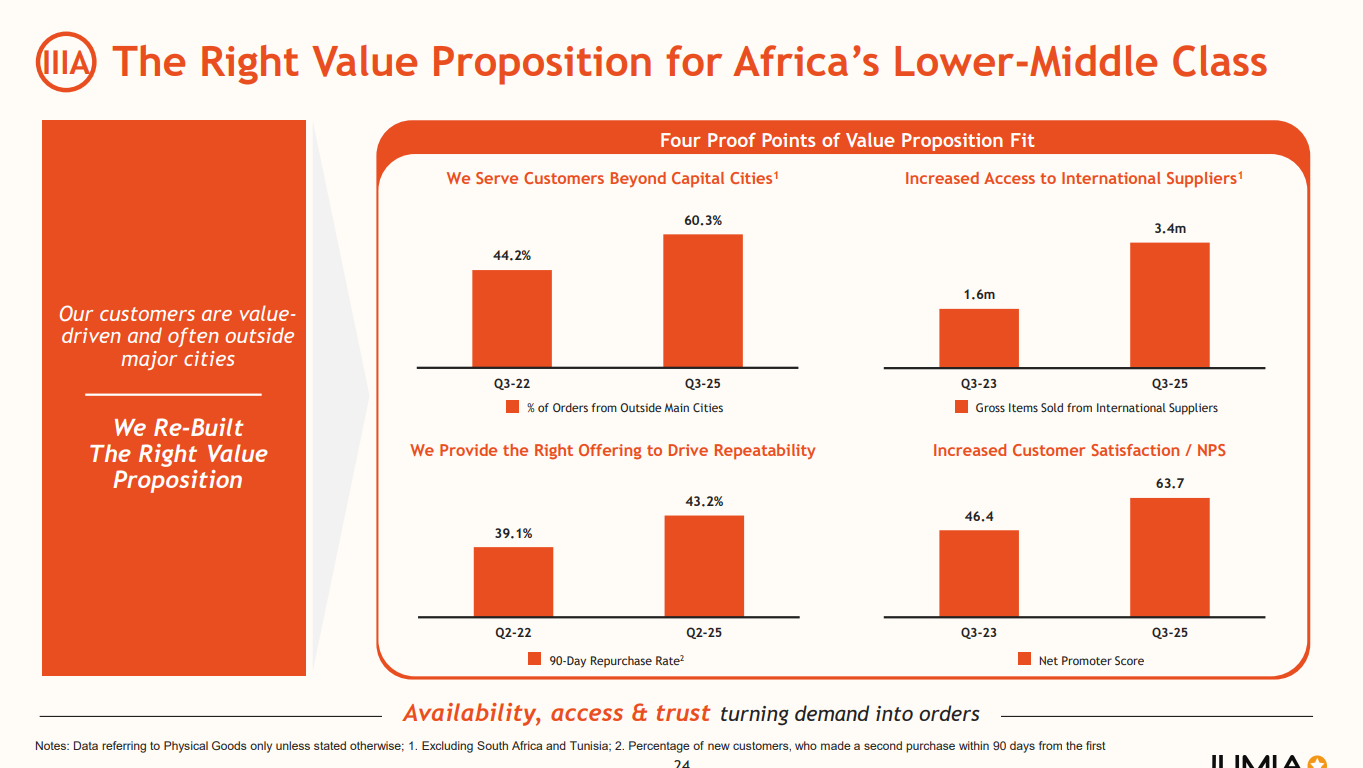

On 2.4 million quarterly active customers – up 22% year-on-year, but still fairly small for a company that’s been at this for more than a decade – Jumia grew revenue 25% to $45.6 million without blowing out its sales and advertising spend. For once, growth and “discipline” are in the same paragraph.

Yet those aren’t even the most interesting bits. Thanks to yet another investor presentation this week, there’s a lot more to understand about what Jumia thinks it is building.

The crucial thing is that the original thesis for Jumia’s existence still looks surprisingly solid. E-commerce penetration in Africa remains low compared to the rest of the world, even as internet and smartphone usage keep climbing. In Nigeria, online retail is still a small slice of total retail compared to roughly 20% globally. Meanwhile, people are obviously willing to pay for convenience – ask Glovo or Chowdeck. If you believe that more Africans will keep paying to have things show up at their doorsteps instead of sitting in traffic for two hours, there is still a big opportunity here.

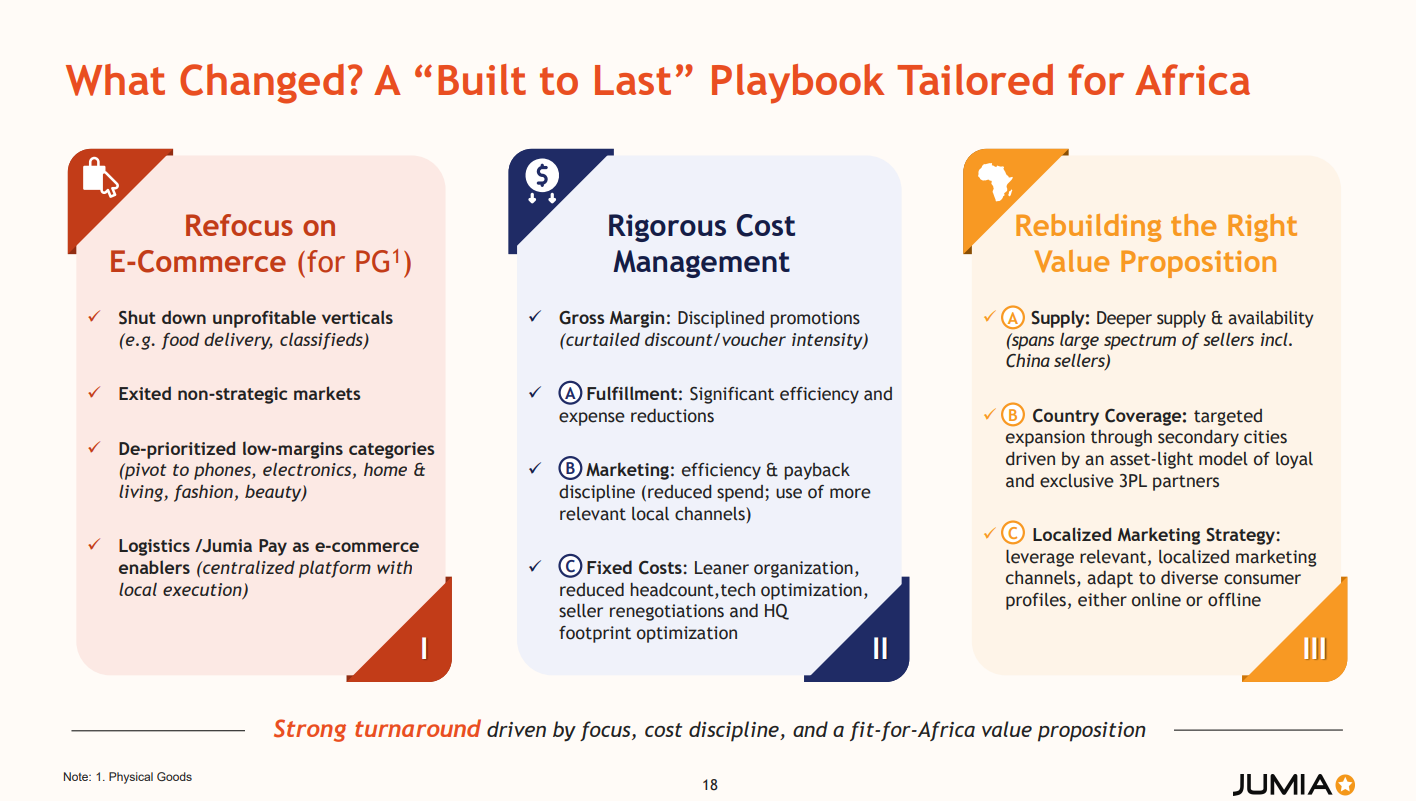

What Jumia is telling investors now is that it has figured out the business model that lets it survive long enough to enjoy that upside.

Jumia doesn’t need to own 10% of Nigeria’s entire retail economy to justify its life choices. If Nigeria’s online retail doubles from ~6% to the mid-teens over the next decade and Jumia captures a mid-single-digit share of that growth, it can double its customer base (2.4 million quarterly active).

Beyond all this analysis, we went one step further and actually ordered items from Jumia. The process was straightforward. Communication was prompt, the item was in stock, and it showed up when Jumia said it would. It was the first time we’d used Jumia this year, but on the strength of that experience, it probably won’t be the last. #NotAnAd.

One thing that’s hard to miss in Jumia’s description of its “transformation” is what’s gone. The company exited “exciting” but loss-making experiments like Jumia Food and stepped away from low-margin categories like groceries even though I loved their “your everyday delivered” era (Somebody should ask GoLemon how they’re threading that needle).

And then there’s competition. Here’s Dufay again on the earnings call:

“We continue to see a pullback from certain global entrants in some markets like Nigeria, while we continue to steadily gain local market share… That comment is mostly focusing on international non-resident platforms, the likes of Shein or Temu. What we see in those markets is reduced marketing investment and price points increasing in several markets like Nigeria… these markets are pretty hard to operate at scale for these players.”

Ain’t that something. It looks like Jumia is beating Temu and Shein in the African market.

If Jumia is right about that, then this quarter isn’t just about narrowing losses. It’s about something bigger: the local player finally having a business model and a structural advantage, with only a finite amount of cash left to prove that Africa e-commerce wasn’t a very expensive mistake.

One of the ways I know you read and enjoy this newsletter is when you like, comment and share the newsletter:

See you on Sunday!

This is the kind of analysis that bridges the gap. For the average person who just sees an app, the real story is Jumia's fight to prove that the model of e-commerce itself can be profitable in Africa.

At Africa in Beta, we see this as a crucial case study. It's not just about Jumia's survival, but about building the foundational trust that lets a whole continent feel comfortable moving from "traffic for two hours" to "things showing up at their doorsteps." Their discipline, not just their growth, is what paves the way for mass adoption.