Starting in September, the Notadeepdive newsletter will launch a community on Telegram that will allow you early access to the newsletter, inside information and the opportunity to talk with a wide community of people. It’s going to be paid, but will likely cost very little! Let me know in the comment section if this is something you’d enjoy 🤓

If you missed last week’s newsletter, catch up here.

Today’s Notadeepdive is 898 words. Don’t miss another edition of the newsletter when you subscribe:

Notadeepdive is brought to you by Fincra, Native Teams and SweepSouth. Fincra provides reliable payment solutions for fintechs, online platforms and global businesses. Use my discount code, NADD, to get 30% off when you book a home cleaning on SweepSouth! If you’re a freelancer or gig worker, Native Teams helps you receive money from your foreign employers.

TOGETHER WITH FINCRA

With a single integration, you can receive payments from customers via debit/credit cards, virtual accounts, and bank transfers and make seamless payouts to beneficiaries across 100+ countries.

Layoffs or no layoffs?

Last week, the newsletter talked about salary cuts at the Nigerian startups, GetEquity and Quidax. The commonest reaction was shock, given that one of the startups is a sponsor of Big Brother Naija, the popular reality TV show. GetEquity on its part was already gearing up for what was supposed to be a week-long startup festival, before cutting salaries. Yet, such is the nature of running a startup; difficult decisions must be made quickly, and if you’re not yet profitable, extending your runway is all that matters.

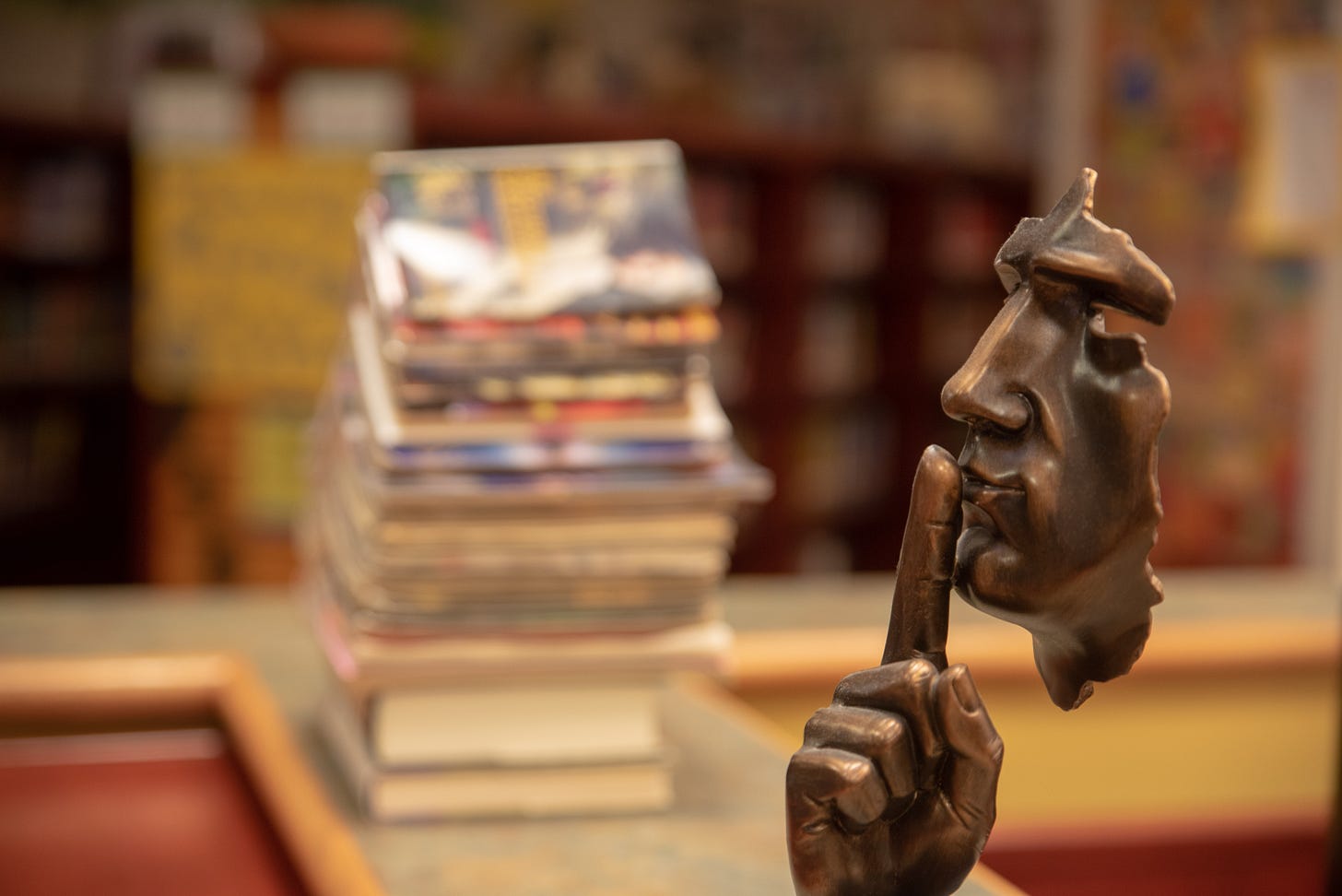

In a secretive tech ecosystem that’s a reflection of how hush-hush all things Nigerian can be, stories like this help us estimate the maturity or financial health of startups. Fund raises are all well and good, but tough times remind us that when all is said and done, founders have been given money to create sustainable businesses, grind out profits, and return massive value to investors. It’s a tough business.

This week, I spent more time following reports of job cuts and some high-profile exits at other startups. Some ex-employees told me they were laid off by these startups with HR citing the broader macroeconomic conditions. But those claims were refuted by the startups, as they both insisted that people were let go for performance issues. It’s difficult to know where the truth lies, but my sense is that if companies cannot easily raise follow-up funding, there will be more job cuts. And it may then be on a scale that’s a lot more difficult to deny.

That’s enough talk about startup struggles, let’s focus on the broader struggles of Nigeria’s FX policy.

TOGETHER WITH SWEEPSOUTH

What happens on PayDay, affects the other days.

Everybody Loves Payday! But we also hate a PayDay spend that makes other days of the month lean days.

Direct your PayDay spend towards the things that matter, like taking care of your home all month long.

With a SweepSouth recurring plan, you can get a thoroughly vetted, reliable and excellent SweepStar to look after your home cleaning needs through the month of September starting from from N7,400.

To the left, to the left, every airline carrier in Nigeria to the left

Two weeks ago, I wrote about how the USD is now a controlled substance in Nigeria. Part of my argument was this: “If you have USD or hold a dorm account or do some business that needs you to move USD, you might as well be selling cocaine. Of course, this isn’t to say that money laundering regulations are unnecessary. Instead, these constantly changing rules–which everyone is forced to keep up with– paint a picture of a Central Bank that’s making FX policies on the fly.”

On LinkedIn, I got the most curious response to the newsletter and Nigeria’s FX woes:

While we continue to advance strange arguments like this, the effects of our FX policies continue to haunt us. The newest face of this FX battle is with foreign airlines who now have revenues stuck in Nigeria. Last week, Emirates airline said it had $84m it needed to get out of Nigeria with no luck.

This week, British Airways, Kenyan Airways, Lufthansa and AWA held meetings in Nigeria over the fact that they have some $600m they can’t get out. The airlines are exploring all their options and there are already plans to suspend their operations in Nigeria. Yet, the real problem remains that the CBN has no $600m to give anyone at the artificial rates that it has pegged. Riddle me this: if you insist that the exchange value of the dollar is USD is N422, but no one can get it at that price, then what is the real exchange value?

Beyond the riddle, what I’m having a hard time with is that we’ve been here before. In August 2021, MTN Group had $280million stuck in Nigeria for over a year; Unilever had the same issues too. According to a Bloomberg article from 2021, “Nigeria Unilever Nigeria Plc is being compelled to buy dollars above the market rate because rationing of foreign exchange by the West African nation’s central bank has caused a shortage of the U.S. currency. The local unit of Unilever Plc bought the greenback from money changers and lenders at between 440 to 450 naira on an average in the first half of the year, Adesola Sotande-Peters, finance director at the company, said at an investor conference call in Lagos. That compares with 410.72 Naira to a dollar at 7:28 a.m. in Lagos on Friday.”

How did Nigeria and the CBN work around the problem in 2021? By devaluing the Naira in January 2022. Today, while the CBN insists that the USD is N422, the black market insists that it’s N690 instead, marking the biggest spread between the official and black market rates we’ve ever seen. Where will the CBN and Godwin Emefiele go from here?

TOGETHER WITH NATIVE TEAMS

Travelling for summer?

The heat waves are here and we hope you have found your favorite spot for cooling off! At Native Teams, we can handle all of your holiday management; from visas to work permits.

Yes. With our Visa and Mobility Assistance, you can forget about all of the paperwork and bureaucracy and leave it all to our experts to handle your visa applications, work permits, and travel documentation through Europe and beyond.

What I’ve been reading

Last week, I shared an article on how newsletters are easy to start but definitely difficult to make money on. This article on podcasting in Africa extends that conversation

It’s Japa season, so nothing is more perfect than this essay that argues that sometimes migration is a gesture of love

How to get published: a book’s journey from very messy draft to best seller

See you on Sunday!

This layoff thing ehn. How can you employ people to lay the entire department off in 3 months? This is one of the reasons why these startups won’t get quality talents

On the LinkedIn comment you shared

I honestly think people need to understand how macroeconomics work. Cutting your population or citizen from means to participate in the global economy doesn't in anyway help the Nigerian Naira... So what cause exactly are we contributing quota to