Nigeria is losing the only Jollof war that matters

Is it the best tasting Jollof if no one can afford it?

Today’s Notadeepdive is 1,104 words, a 6-minute read.

The situation: Nigerians love to talk about the supremacy of their Jollof rice. But there’s one big danger: millions of people may no longer be able to afford a plate of the country’s popular staple.

TOGETHER WITH FINCRA

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions. With Fincra’s customisable APIs, developers can build quick financial applications; online platforms and fintechs can integrate seamless payment flows into their web and mobile applications with complete SDKs.

Fincra has designed its API infrastructure for developers that build platforms that send and receive frequent payments and require flexibility.

Ready to build the best cross-border payment solutions?

Nigeria can’t afford the Jollof war

By August 2022, 19.4 million Nigerians will face food insecurity and will face limited or uncertain access to adequate food. Nigeria’s middle-class is insulated from the worst of it but everyone is feeling the pinch in the prices of food items.

I won’t bore you with the stats, but this week, everywhere I looked, I could see the signs of a looming food crisis. I spoke to butchers who now work all day to sell cuts of meat that would sell out in hours. A crate of eggs, generally regarded as the cheapest source of protein, are now the same price as 1kg of frozen chicken. Like a wise man once said: it’s tough out here.

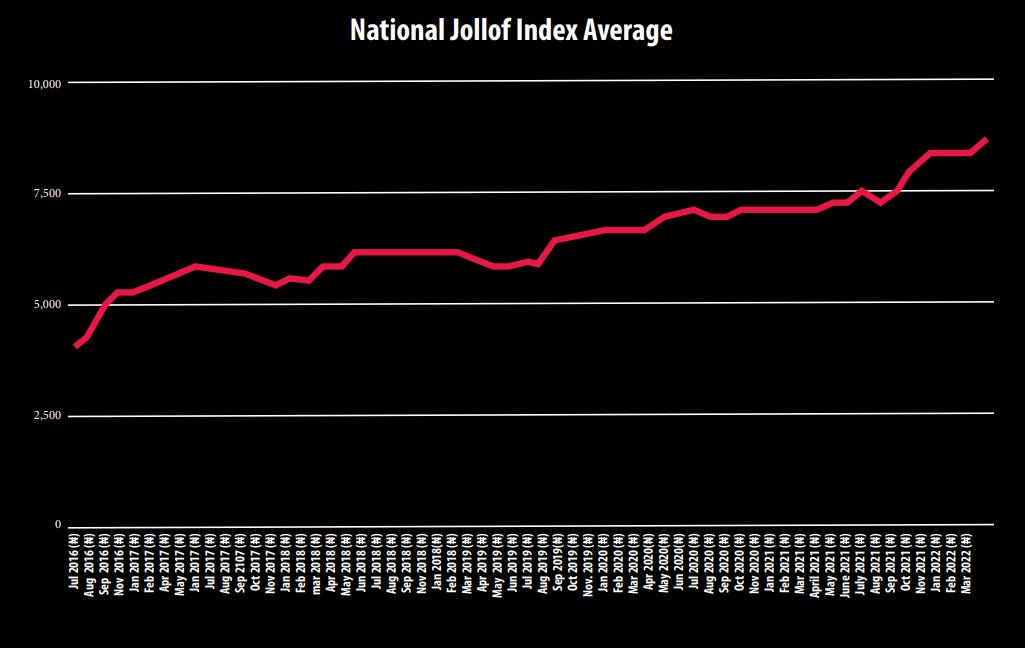

Jollof rice is a West African staple that Nigeria, Ghana and Senegal often tussle for supremacy over. But it is becoming a luxury in Nigerian households. Per SBM intelligence, it now costs ₦8,595 to make a pot of jollof rice for a family of five people in Nigeria; up from a little over ₦7,000 one year ago. In 2020, that figure was ₦6,500.

Where does this place our Jollof fortunes? Many families will struggle to put this staple on their table. This report that shows that 27.4 million Nigerians earn less than ₦100k per annum.

While there are global factors affecting Nigeria’s food prices, it’s hard to ignore how we got here. Insecurity, inefficiency in the food supply chain and the catastrophic decision to close Nigeria’s borders. Per an April 2022 World Bank report on Africa, “African policies should try to do no harm by avoiding past mistakes such as bans or other restrictions on food staples, and ensure the steady flow of foodstuffs across borders. Keeping food supply chains operational without breakdowns in transportation and logistics is essential.”

One thing is clear: Nigeria needs to treat its food crisis with more urgency. And no, the answer isn’t fancy food pyramids in Abuja.

That's enough talking about food. Let’s turn our attention to Nigerian banks and their digital offerings.

Nigerian banks are going digital, but customers remain unimpressed

Banking in Nigeria often gets credit for its instant transfers, interoperability and the sheer size of some of its leading banks. But for the customers of many of these legacy banks, the banking experience still remains choppy. Account opening processes are still mostly analogue, needing you to walk into a banking hall to fill out long forms. Getting your debit card is equally stressful. My bank, for instance, needs you to walk into a branch to activate your pin when you get a debit card. Let’s not even talk about loans which remain out of the reach of over 90% of the banked population. A combination of factors makes Nigerian banks shy away from retail lending. One of those is the risk of defaults, and another is that they have easier ways to make money.

Banks have done some big talk about going digital to improve their processes and to make the experience better for customers. What it has led to are mobile banking apps that are somewhat better but still lacking in a lot of areas. I have tried on more than one occasion to open bank accounts on the apps of some legacy banks with no luck.

“Simply digitising traditional onboarding journey does not work and results in customer pain points throughout the customer journey. The traditional onboarding journey is a manual process, characterised by long and cumbersome account-opening forms and lengthy information requests.” — KPMG Digital Channels Scorecard for retail banks.

While KPMG’s report on Digital Scorecard scorecards for retail banks is a granular look at the parts of the digital process which Nigerian banks struggle with, Agusto’s report on digital banking satisfaction is another great place to see how far off Nigerians banks are from providing memorable experiences.

“While the mobile and USSD banking applications are widely used across the coverage banks, when we delineate respondents across the various digital banking platforms, GT Bank’s mobile app and USSD code were the most selected channels in our survey. However, in the internet and WhatsApp banking cadres, UBA’s internet and WhatsApp banking platforms were mostly selected by our respondents. In our opinion, UBA’s dominance in the WhatsApp Banking section with its artificial intelligence ’Leo Chat bot’ as well as GT Bank’s ‘*737#’ USSD Code demonstrates the power of advertising and customer awareness campaigns.” – Agusto’s Consumer Digital Banking Satisfaction Index.

I think Agusto’s report does an excellent job of showing the digital capabilities of Nigerian banks, so instead of analysing the report, here are five things I found super interesting:

Approximately 49% of the survey respondents are aware of digital/neo banks. But only 14% of the respondents that are aware of these banks had an operational bank account.

Out of these account holders, a significant 36% have a banking relationship with Alat by Wema, 35% bank with Piggyvest and 21% with Kuda Bank.

Usage of USSD comes third place in this survey as bank customers are sensitive to the flat fee of ₦6.98 per transaction (excluding bank charges of ₦10 per transaction below ₦5,000 or ₦25 per transaction above ₦5,000) and thus prefer to use other payment channels of their select bank.

Approximately 25% of the survey respondents would like to have a further breakdown of their bank statements to reflect their spending habits.

Approximately 82% of the survey respondents are not willing to switch to another bank’s digital banking platform. We believe this to be due to the homogeneity in the service offerings and common complaints across the banks.

In the end, it appears that banks have a long way to go before anyone will be ready to declare them truly digital. Customers want seamless, friction-free experiences. They also want their banks to listen more, understand their needs better and create better solutions for them.

While the current situation may not translate into immediate wins for digital challengers like Kuda, it’s easy to conclude that if legacy banks don’t commit themselves to real digital improvements, they are in danger of becoming the dinosaurs they once disrupted decades ago.

What I’ve been reading

After months of failing to meet its OPEC production quota, Nigeria is looking to boost oil output in two weeks

Africa’s Newest Neobanks Make Unusual Bet On Customers Overseas [Paywall]

Before Netflix About-Face on Advertising, Months of Debate [Paywall]

Naira falls to its lowest year-to-date as forex supply declines further

CNN Plus is shutting down only a month after it launched

See you on Sunday!

Edited by: Jimi Osheidu, Alexander Onukwue

"jollof rice index" is now my favourite indicator of recession.