Salary accounts are dead, long live the neobanks

The new primacy is who moves your money

If you missed last week’s newsletter, catch up here. If this newsletter was shared with you, subscribe here while it’s still free:

If you left a comment in last Sunday’s newsletter, please email me with your shirt size and address and I’ll send you some merch!

TOGETHER WITH CREDIT DIRECT

We’ve all been there. You find what you need, fill out the form, and then wait.

Hoping. Guessing. Wondering. But it doesn’t have to be that way.

Know Your Limit lets you see what you qualify for before you commit, so you can buy with clarity, not crossed fingers. Because confidence starts when the guesswork stops.

The new ‘primary’ is who moves your money

Private companies hate exposing their numbers; journalists live for the leak. Last week, Kuda skipped the cat‑and‑mouse altogether and handed reporters parts of their Q1 2025 financial report on a platter.

Kuda steered the conversation toward transaction scale, remittances, and overdrafts, essentially framing the story. Smart.

Headline stat: ₦14.3 trillion processed (Retail ₦8.5 trillion; business ₦5.8 trillion) across 300+ million transactions in Q1 2025.

The figures got me thinking about an old obsession that deposits are destiny, and ergo, every neobank should be fighting to become your salary account. I made that argument in 2020.

Quick refresher: Ten years ago your only alternative to one creaky legacy bank was another creaky legacy bank, so most of us juggled six or seven bank accounts. Primary account simply meant the bank that got your salary. In 2025 it means the app that taps your cash ten times a day.

But the ground has shifted. Let’s interrogate the assumption using numbers from Kuda and a peer, FairMoney, and then zoom out to how Nigerians actually bank today.

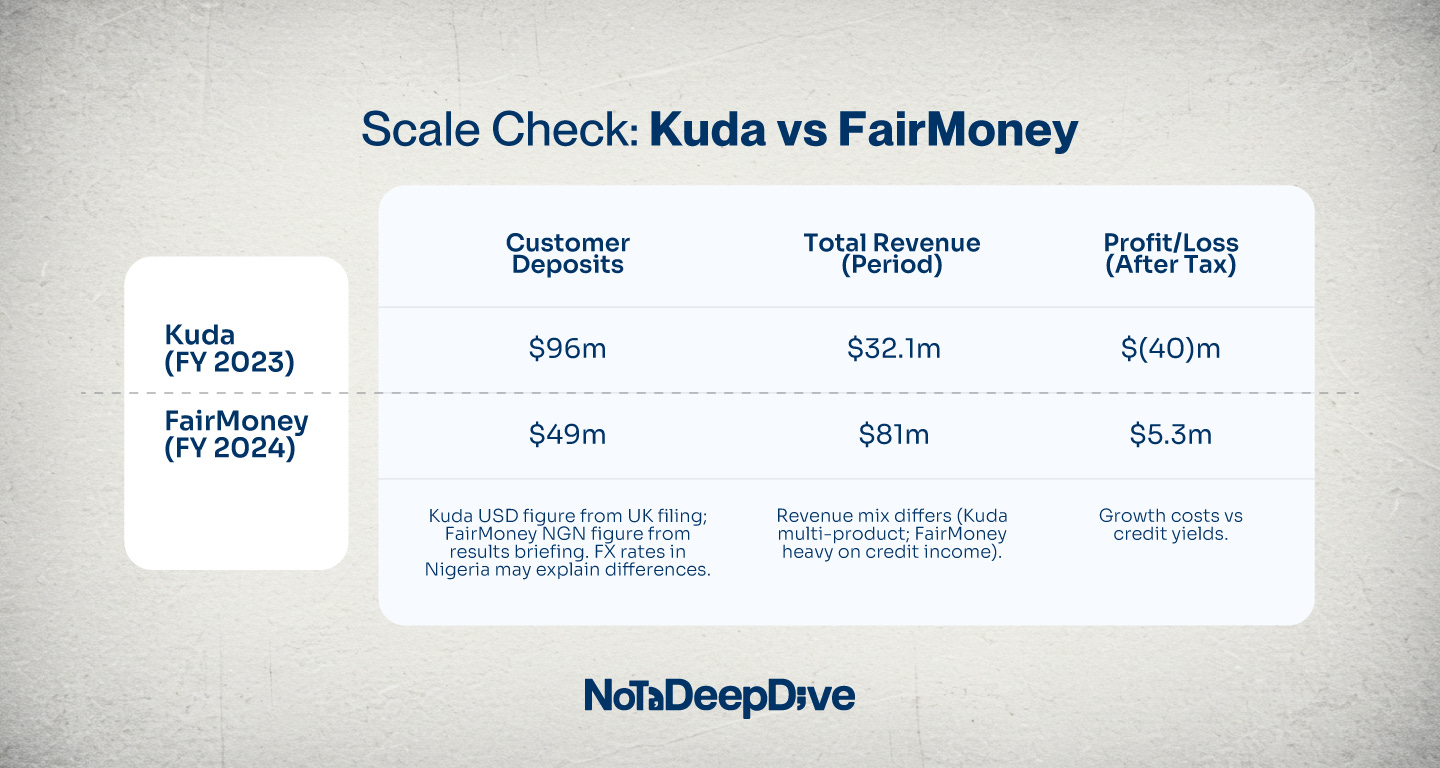

Quick scale check: Kuda vs FairMoney

Different fiscal years; not a perfect apples-to-apples. Might annoy the accountant beside you. Still instructive for scale.

With FCMB reporting ₦4.3 trillion in customer deposits for FY23, even the buzziest neobanks remain tiny beside tier-2 commercial lenders, but they’re not playing the same game. Deposits matter, but the 2020 notion of neobanks hustling to become your primary account now feels outdated.

We’re seeing an evolution; velocity and distribution are redefining primacy.

Why my salary account is just a pit stop

These days my salary hits a legacy bank and sprints out almost immediately to a neobank. Reliability governs where my active money lives (I can trust my neobank to always work so the salary account is just the staging area.)

Back in 2020 I wrote that digital banks needed to capture payroll/salaries because deposits were cheap lending fuel.

Traditional banks had proven the model: after the wonder-bank busts of the 90s, they ran national trust campaigns, leaned into deposit insurance, and blanketed the country with branches.

The result: tens of millions of new accounts and deposit growth that consistently outran lending through the late 2010s and early 2020s. NIBSS data show active bank accounts climbing to 151 million by December 2022 and blowing past 219 million by March 2024.

So digital challengers figured, “We’ll do that, but on your phone.” ALAT borrowed Wema’s legacy credibility; pure-plays like Carbon, FairMoney, Kuda and Rubies used free transfers, instant KYC, and small loans to buy trust and, hopefully, payroll.

Yet behaviour won and naira‑redesign outages only triggered grumbling; account inertia is a beast.

During that cash crunch, NIBSS e‑payments ballooned to ₦123.8 trn in Q1 2023. People went digital without switching salary hosts.

Wallets and distribution tore up the playbook

While some neobanks started out wanting to be your primary account, a different cohort—OPay, PalmPay, Moniepoint—went after frequent usage. OPay built a physical agent lattice (300k+ strong by recent counts) putting cash-in/cash-out in most informal markets.

PalmPay rode Transsion’s phone dominance, claims 35 million registered users and 15 million daily transactions, and layered a merchant network that now serves millions of offline customers, many new to formal finance.

Then came the 2023 cash crisis triggered by the naira redesign. ATM queues went biblical, and merchants scrambled. The pain became an unexpected growth hack for alt-rails: Moniepoint’s data show digital payment adoption among informal businesses effectively doubled through the crunch; analysts flagged OPay and PalmPay as two of the biggest winners as consumers hunted working rails.

Macro numbers back the shift. NIBSS tallied e-payment transactions worth roughly ₦600 trillion in 2023, up from ₦387 trillion the year before, a 55% leap that speaks to changed behaviour.

Neobanks have also muscled into NIBSS’s A‑league. The mobile‑money bucket—₦79.5 trn in 2024—now sits inside the top‑ten NIP leaderboard.

What “primacy” really looks like now

Old definition of your primary bank account: the institution that sees your salary first “owns” the relationship, gets the cheapest deposits and then cross sells other products.

Emerging definition: the platform that touches your money most often captures data, habit, and fee lanes, whether or not payroll ever landed there.

PalmPay’s claim of 15 million daily transactions and OPay’s nationwide agent density suggest frequency can outrun balance sheet heft.

During the cash crunch, informal merchants who adopted Moniepoint terminals to survive kept using them; usage stuck, and digital acceptance widened beyond salaried city professionals.

So when we compare Kuda’s deposit base (~$96m) to legacy banks, we’re grading it on the wrong curve. Kuda is orienting around transaction flow (₦14.3trn in a quarter), expanding business banking (already ~40% of value), and re-entering remittances to deepen relevance for diaspora users, moves aimed at boosting turnover and engagement, not just warehousing paychecks.

Where this goes next

Two structural shifts will accelerate the separation of “where money lands” from “who guides it”:

Open banking. Nigeria’s rules are live; broader compliance deadlines are due by August. Any licensed player you authorise can read balances and initiate pulls from whatever account you use. Salary primacy weakens.

Automation layers. Fintechs are already pitching AI assistants that sweep idle balances and schedule bill pays. As those get better, loyalty becomes a settings toggle, not a branch relationship.

Against that backdrop, Kuda’s push into remittances and FairMoney’s credit machine look less like side quests and more like hedges for a world where deposits fragment and activity concentrates in orchestrators.

Your turn: Do you still care where your salary lands first or only who keeps it moving? Hit reply and tell me your money routing routine.

See you on Sunday!

This is great data tracking mehnn, kudos !

Not a really a fan of NeoBanks. Only used one because I had to make payments for my subscriptions.. With the reintroduction of capped Naira Debit cards payments for FX purchases, I am back to my default and jettisoned the NeoBank that saved my ass for the last two years.