The adults in the room

Even when VCs blow up, employees are collateral damage

If this newsletter was shared with you, subscribe now for free:

TOGETHER WITH CREDIT DIRECT

At Credit Direct, we do not ask too many questions. We simply build tools that meet real-life needs, whether loud or unspoken.

That is why you can access instant loans of up to ₦2.5 million through the channels that make life easier for you.

Use USSD by dialing *5120#, chat with us on WhatsApp via 09070309430, or visit portal.creditdirect.ng

Because for many people, a loan is not just money. It is a lifeline.

Even on the VC side, employees are collateral damage

More than 50 employees lost their jobs in May 2025 when 54Collective (formerly Founders Factory Africa) entered business rescue.

In the world of venture-backed businesses, venture capitalists are the adults in the room.

Sure, founders are brilliant, but they sometimes quit college at nineteen to build flying taxis or some other thing on the blockchain that may not find users; creative restlessness is the sort of thing that’s encouraged when you’re founding a startup.

Naturally, nobody hands the relatively inexperienced founder $50 million of other people’s money to invest.

That’s left to middle‑aged, reputation‑conscious venture capitalists who can resist the temptation to insult cofounders in ill-advised Medium articles.

But now and then, strange things happen:

54Collective, one of Africa’s most active investors, entered business rescue (an attempt at rehabilitation, not a straight bankruptcy liquidation) in May 2025 following a legal wrangle with MasterCard Foundation, according to now public court filings. (Disclosure: I wrote 54Collective’s Africa pre-seed newsletter from 2022-24).

Here’s a high-level summary of the matter according to a filing from a South African court:

Founders Factory Africa rebranded to 54Collective after receiving a $114 million grant from the Mastercard Foundation in 2023. The relationship between both parties imploded spectacularly after the foundation accused 54Collective of using grant money to finance a $690,000 rebrand. MasterCard Foundation terminated the partnership and began a legal process to claw back unspent funds.

54Collective then filed business‑rescue proceedings and laid off all its employees.

Bongani Sithole, the former CEO of 54Collective, claimed the “grant agreement was not terminated due to a breach,” but he didn’t offer much else.

These donor–manager blow‑ups seldom spill into the open. Instead, disputes are typically pushed into confidential arbitration.

The last time “mission capital” publicly torched its manager at this scale was in 2018 with Abraaj’s health fund scandal, when the Gates Foundation and DFIs accused the firm of misusing $1 billion and pursued clawbacks.

While the 54Collective matter winds its way through the courts (and we’re likely far from the final word), it’s jarring to watch the supposed adults in the room stumble into the same missteps they warn startups about.

We’ve seen promising companies with real impact collapse because someone mishandled board processes or blurred the line between mission and management. The irony here is impossible to ignore: the same VCs who often preach transparency and sound governance found themselves undone by those very lapses.

I can’t help but wonder: did Mastercard Foundation fail to define spending guidelines clearly enough? Was the rebrand explicitly approved or just poorly communicated?

We’ll eventually hear 54Collective’s full side of the story. But in the meantime, more than 50 employees are out of work and are collateral damage in a fight that the adults in the room could have prevented.

A continent sized bundle for Canal+

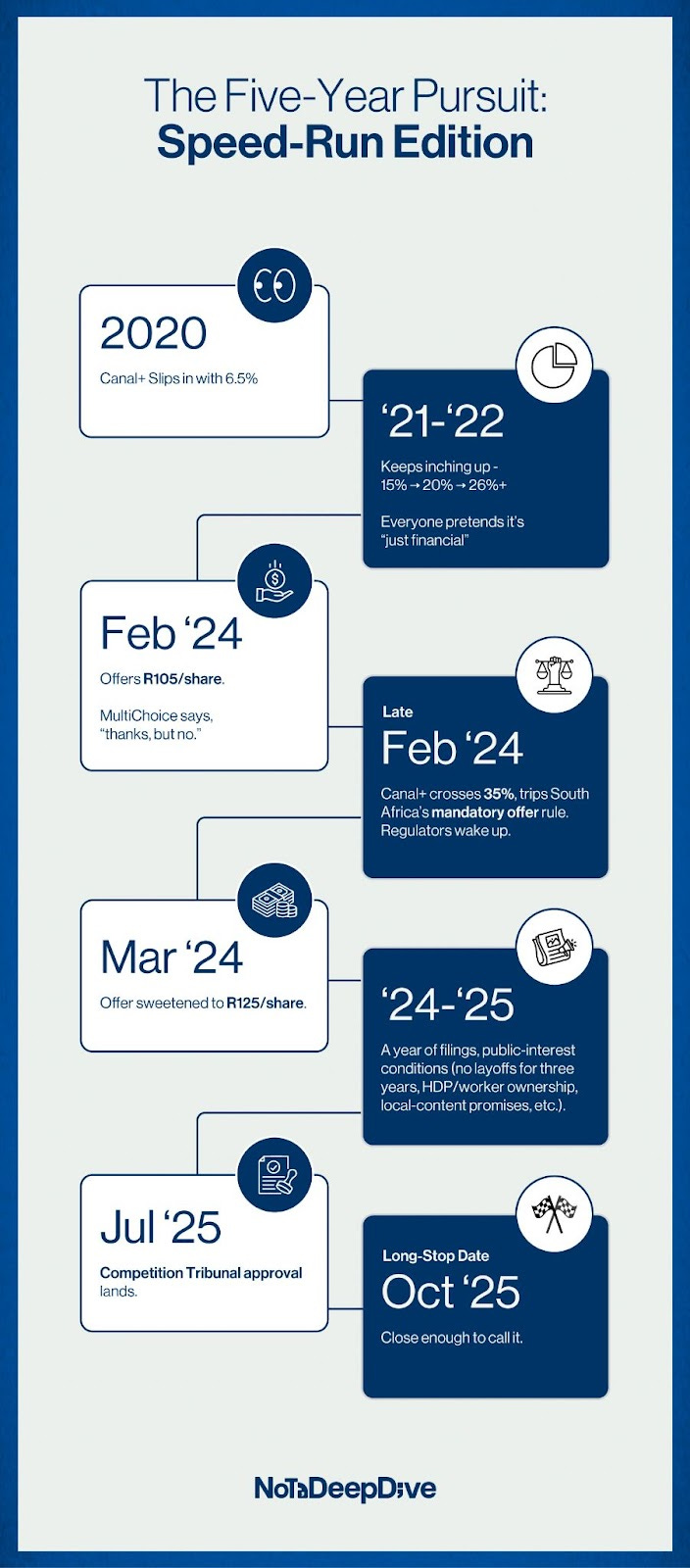

When Canal+ began circling MultiChoice, the only real question was not if but when the deal would be done.

The French broadcaster has rehearsed this slow-motion takeover before: in 2019, it spent a year buying up Europe’s M7 Group until regulators approved the €1.1 billion purchase. It ended up owning satellite platforms in seven countries.

Before it got the final approvals to buy MultiChoice this week, everyone had already adjusted to a world where Canal+ was in charge.

The long, drawn-out acquisition suggests South Africa’s political class understood exactly what was at stake. Controlling the country’s biggest broadcaster isn’t just a financial transaction; it’s cultural power, labour, suppliers, and who gets to write the continent’s prime‑time stories.

So the green light came with guardrails: no retrenchments for three years, a worker/HDP ownership slice in the South African licence entity, and a suite of public‑interest promises around local production and supplier treatment.

Now that the deal is (almost) official, what exactly is Canal+ buying? To put it bluntly: a patient in intensive care.

The African pay-TV company has lost 2.8 million subscribers in the last two years. A mix of currency devaluations and the rising cost of sports rights that once made DStv untouchable has made profitability elusive.

Showmax 2.0, rebuilt in partnership with Comcast, was a calculated gamble to outrun decline, but streaming is notoriously expensive and it’ll be years before we’ll know if it was the right move. Not much has been clicking for the company lately.

Things could not be any different for Canal+, which already dominates francophone Africa and understands how to bend satellite, IP, and mobile bundles into a single habit.

Canal+, by contrast, is walking in with leverage. It dominates francophone Africa and with MultiChoice strong in anglophone Africa, the combined reach spans the continent. Diaspora demand flows both ways, and content can be monetised across multiple markets. A Nollywood series that premieres on Africa Magic can live again on Canal+ Afrique, then as a Thema‑packaged diaspora channel, and finally on myCanal in Paris.

So maybe this is less of a deal to resuscitate yesterday’s pay-TV model, but to wrap Africa’s most valuable sports rights, deepest local content library, and broadest billing network into one bundle you can’t easily quit. MultiChoice tried to stream its way out of trouble; Canal+ will bundle and price its way to control, proving once again that inevitability favours the patient.

And before I run off, here’s a reminder of why I write the newsletter:

When you read Notadeepdive, you’re always ahead of the curve, and you’ll always know what the stakes are.

On Sunday, I wrote about a new streaming war and a potential announcement from a major Nigerian film producer. On Thursday, Filmhouse Group and Inkblot Studios announced the launch of their new streaming platform, Kava.

See you on Sunday! Don’t forget to leave a comment.

The adults in the room wanted to be children for a moment.

Wow. See how you trucked that sub in. 😂