The big, beautiful business of airtime lending

The ₦83 billion fintech business hiding in your SIM card

Happy new month! I have three simple requests for every Notadeepdive subscriber. I’ll add my requests at various points throughout the newsletter; be sure to look out for them!

TOGETHER WITH CREDIT DIRECT

Not every money goal is about rising fast.

Sometimes, it’s about peace of mind, quiet wins, and the kind of growth that doesn’t need public validation.

We get that. And we built for that.

Airtime is life

When Globacom launched in 2003, it disrupted the telecoms industry. At the time, competitors MTN and Econet charged customers by the minute, meaning a 10-second call cost the same as one that lasted 59 seconds. Glo introduced per-second billing, and customers loved it. In a world where mobile internet didn’t yet exist, call pricing was everything.

Two decades later, the telecoms business has evolved. Data, not voice, now drives revenue.

While some might yearn for the yellow-umbrella era, when buying airtime, like buying bread, required a trip to a physical vendor, I quite like this version of things.

Before we dive in, here’s my First Request:

Our sponsors are crucial to Notadeepdive staying free and fearless, so show them some love and try their products:

Credit Direct (CBN-licensed, high-yield savings): sign up here.

Raenest (fast global transfers)—download here. I might even send $20 to one lucky reader who uses the app this week.”

Now back to our story:

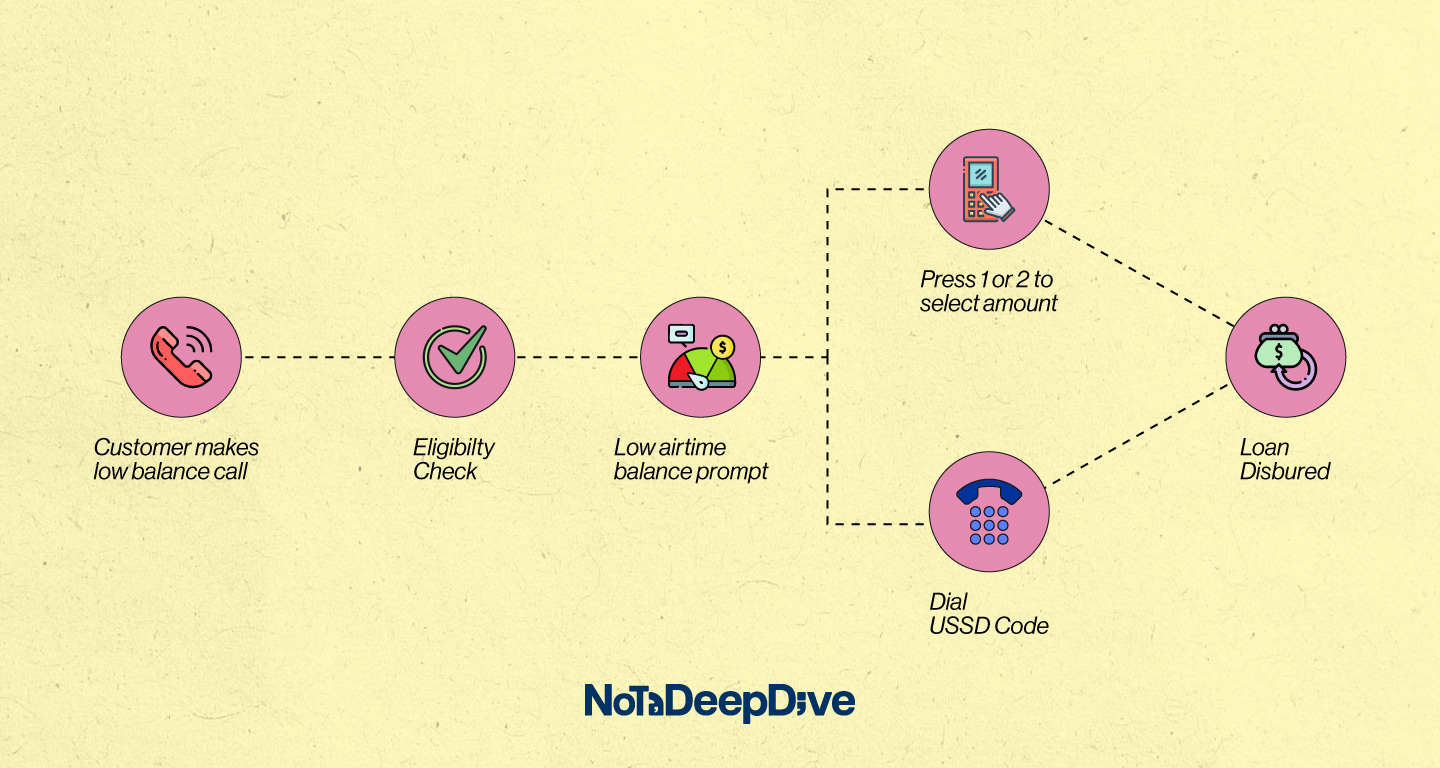

Today, the bread finds you. When you make a call with ₦0 balance, you could hear a voice prompt offering to lend you airtime; Press 1 to borrow ₦100. Other networks ask you to dial a USSD code to get an airtime loan.

What you may not know is that this loan isn’t coming from MTN or Airtel directly. It’s why Airtime lending—a multibillion-naira, vendor-run engine where telcos take a cut without credit risk— is underreported.

The real lenders are almost invisible backend operators a.k.a Value Added Services (VAS) aggregators like Creditswitch, Fonyou, Avyra, and ERL Telecoms Services Limited, who own the tech, assess risk, and lend airtime within seconds.

They’re not consumer brands with mobile apps, but they process millions of loans daily that allow you to make calls or use the internet when you’re in a pinch.

Here’s an excerpt from MTN’s H1 2025 financial report:

“Fintech revenue (₦83 billion) grew by 71.8%, primarily driven by the strong performance of our airtime lending product (Xtratime) and growth in advanced services, supported by the onboarding of high-value customers.”

Not everyone can borrow airtime

Like any type of lending, you need to determine borrower capacity and willingness to pay. You check for recharge cadence (amount, frequency, recency), SIM tenure, average spend for the user, and activity signals.

Telcos don’t have the time or motivation to build these systems themselves as it could also distract from their core focus.

Instead, they pass it on to vendors that can demonstrate scalability, compliance, and uptime. It’s common for telcos to select two or more vendors for the same value-added product and split traffic between them.

Traffic is split among vendors in many interesting ways. It could be as simple as routing odd-numbered phone lines to Vendor A, while even-numbered ones go to Vendor B.

TOGETHER WITH RAENEST

Transfer money to the UK, Europe, US, China, Nigeria, Kenya, Cameroon, Brazil, India and more. With Geegpay, you get low fees, fast delivery, free conversions and competitive exchange rates.

A huge business, hidden in plain sight

According to two executives with direct knowledge of the market, each vendor can disburse around ₦200 million in airtime loans daily. Multiply that across the year, and you’re looking at a market worth ₦73 billion annually for each vendor, and that’s just airtime.

While you let that sink in, here’s my second request :

Second Request: Let’s break the algorithm. If just 1 in 5 readers share this newsletter today, we’ll triple our reach.

Back to our story.

While all telcos charge a 15% service fee on data and airtime loans, the telcos collect the larger share of the revenue. It’s still good business for the VAS companies; back-of-the-napkin maths suggests they can earn somewhere in the region of ₦4-6 billion annually.

“It’s a high-risk, high-reward business,” said one VAS executive. “Most people repay within 90 days.”

This model is attractive to telcos: they get a share of the revenue, but none of the risk. If a customer doesn’t repay, the vendor absorbs the loss.

The VAS comeback

Airtime lending is only one part of the value-added services (VAS) stack. These same vendors also operate:

Call Collect and Beep Me services

Captive portals, the screen you’re redirected to when you run out of data

Data lending, a natural extension of airtime loans

It’s a welcome resurgence for an industry that was nearly regulated out of existence. In 2017, the Nigerian Communications Commission (NCC) cracked down on VAS firms that signed up users for services without their consent. The result: mandatory double opt-in and a sharp drop in revenues.

“A lot of focus had shifted from VAS after those NCC reforms,” said one aggregator. “But airtime lending brought the business back to life.”

Tariff hikes are fueling demand

In January 2025, telcos raised voice tariffs, driving demand for borrowing airtime. As inflation bites and discretionary spending shrinks, many users rely on airtime loans to make routine calls.

That’s turned airtime into Nigeria’s most-used microloan, more widely accessed than loans from fintech apps or digital banks, but with far less visibility.

On needing a new thesaurus…

On Sunday, I did a mini-rant about the sameness of language in how the tech industry communicates. “Somewhere between the deck and the product, meaning gets obscured,” I wrote, with not the faintest idea that I would be staring at a press release that would make me scratch my head a few days later.

Here’s the first paragraph from a PayPal press release dated July 28:

“PayPal is simplifying cross-border commerce for merchants by connecting an unmatched combination of cryptocurrencies, digital wallets, and merchants worldwide, while simultaneously reducing transaction fees by up to 90%....

Is Figma a sign worth watching?

Figma finally stopped hovering over the “File → Go Public” button and smashed it. After the Adobe deal collapsed in Dec 2023 (with Figma pocketing a $1B breakup fee), the company listed on July 31, 2025, at $33 and closed day one around $115.50. It was a monster debut that raised ~$1.2B and screamed “window’s open.”

Who else is (back) in the queue?

Chime — after years of “coming soon,” the US neobank went public in June 2025: priced at $27, raised ~$864m, and popped on debut. That’s a real fintech test of the window.

Klarna — shelved plans earlier, but is now reportedly reviving a US IPO as soon as September 2025. If it files, BNPL finally gets its big-board moment.

Circle (USDC issuer) — went public June 5, 2025, at $31; opened around $69 and was on an upward climb from there. Day one finished up ~170%, and the stock even hit $200+ before slightly cooling.

Ramp — Raised $500m this week at a $22.5b valuation, a sign that late-stage money is flowing again for profitable, AI-forward fintech infra.

Revolut — Signaling readiness for a 2025 IPO and pushing for a full UK banking approval, weighing London vs. US, and exploring buying a US bank. A 2025 IPO is possible depending on licenses and market mood.

So… Flutterwave?

The mood music has changed, but the bouncers are still picky. Chime’s reception + Figma’s blowout show quality names can get through. For an African fintech, the path looks like: string a few clean, profitable quarters, show governance/controls are boringly solid, and pitch a simple story (take rate, risk, and unit economics that hold up outside a bull market).If those boxes get ticked, the question shifts from “if” to “when.” The bar is higher; the door is open.

Last Request: smash that ❤️ button. I’m chasing 100 likes today (our record is 42); so help me hit it so I know I’m not just yelling into the abyss.

See you on Sunday!

This was really eye-opening. Well done

I really enjoyed this