If you missed last week’s newsletter, catch up here.

Today’s newsletter is brought to you by GetEquity. GetEquity allows you to invest in some of Africa’s most promising startups, ensuring you can own the next African startup unicorn. Learn more about GetEquity here.

If you’re not subscribed to the newsletter, smash that subscribe button right now 😒:

At a bakery in Lagos, there’s a sign posted on the “show glass” where all sorts of doughy treats are displayed. The notice, written by hand, warns us that there will be new and increased prices for bread and other pastries. Everywhere you look across the Nigerian economy this week, you will find similar notices, although many haven’t been written by hand.

Earlier in the week, Nigerian airlines shared their intention to raise base fares for economy class tickets for domestic air travel to N50,000 ($119) from around N25,000 ($59) from March 1. The rising cost of aviation fuel and unavailability of FX are the top reasons hampering the operation of airlines in a sector where making profits is almost impossible. Who will be the biggest losers when the new prices go into force? The Nigerian people, many of whom can hardly afford to fly by air anyway.

Only 6.5% of Nigerians travelled by air in 2021, and a majority of those travellers were on domestic flights. While 6.5% is a small number, it represents an increase in the number of travellers year-on-year for the sector. With the exception of 2020, the aviation sector has seen growth in the number of people taking flights; will this increase in fares force people back to Nigeria’s insecure interstate roads?

While the answer to that question will only become clear at the end of the year, there’s one place where clarity is needed immediately: the Nigerian customs and its new changes to valuations.

Understanding the confusing freight forwarders strike

A few weeks ago, Nigeria’s Central Bank launched a policy that didn’t receive a lot of attention in the media: the price verification system. The price verification system means that importers and exporters must bring in or take goods at not more than 2.5% of a global benchmark price. To be able to monitor the markups importers and exporters put on goods, the CBN created a portal for online valuation and invoicing. Anyone whose prices were more than 2.5% above the CBN’s globally determined valuation would be denied access to Meffilian dollars.

The price verification system isn’t new; the CBN first launched it in 2021 and seemed to abandon the idea when there was some pushback. Today, the price verification policy is the primary reason why operations at Apapa and Tin Can port have been grounded since Monday. The strike and implementation also highlight one of the biggest failures of the CBN under Emefiele: poor policy communication.

Across three of Nigeria’s leading newspapers, the news of the strike broke on Tuesday, but these publications are none the wiser about what the issues are. Some reports say there has been an increase in import duties and one freight forwarder who works at Tincan admitted his confusion over the CBN’s e-valuation policy.

E-valuation explained: before now, car importers, for example, paid import duties on vehicles by manually applying for a valuation. The new process uses price guidance for vehicles from which import duties are automatically calculated, which in theory means that importers cannot avoid paying the correct rates on vehicles by bribing port officials.

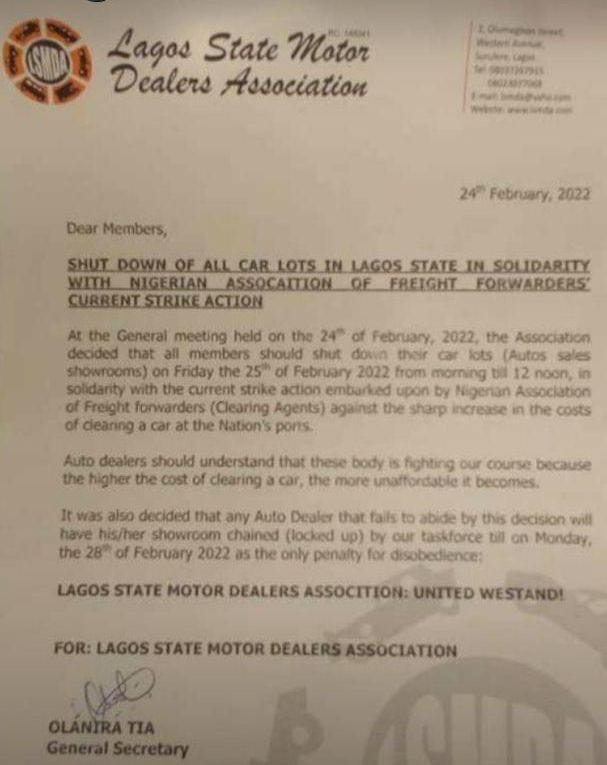

The problem for forwarders is that a lot of them didn’t understand the new e-valuation. Beyond that, one freight forwarder I spoke to told me that the strike started when people received 2-3 times the import duties on cars they’d always exported. It felt to them like the import duties had been increased overnight and like one port official said, “we’re just fighting for simplicity.”

The bottom line: Going by the experiences of the freight forwarders with the new e-valuation system, the price of cars is about to go up. While the policy may have the best intentions, all it’s signalling to operators is a price hike which they say will reduce their ability to sell to the final consumers.

TOGETHER WITH GETEQUITY

THE SIGNAL - PUT SOMETHING AWAY FOR THE FUTURE

The stock market is real-time, and the swings can be violent. But with GetEquity, you invest on a timeline of generations—over 30 years. If a company is showing promise as a startup today, that company could still be churning out returns when your grandchildren are in college. Come and invest in some of Africa’s most promising startups with GetEquity today.

Imagine having invested in today’s unicorns 15 years ago, now that would have been a boon!

Ready to buy equity in Africa’s next unicorns? Invest in the most promising African startups, today.

Lagos rolls out LAGRIDE

Two weeks ago, when the Lagos state government announced its own ride-hailing company, LAGRIDE, there were a lot of concerns and speculations about how it would work. LAGRIDE has the look and feel of an empowerment scheme, with the government giving the cars to drivers on a hire-purchase basis.

I earlier reported a few details on the payment structure, and now that the government has published how it’ll work, I’ve never been happier to be wrong. According to the government’s information, drivers will pay 20% equity (N1.8m/$3,200) upfront to get one of the Chinese vehicles. After they take ownership, drivers will pay N8,700 ($15) per day towards the cost of the vehicle and 25% commission on revenue.

Let’s do some back of the napkin math: If a driver makes N15,000 daily, a daily payment of N8,700 leaves him/her with a balance of N6,300 from which another N3750 (25% commission on revenue) is deducted. It leaves the driver with N2,550, which is too small to fuel the vehicle or think about any sort of monthly maintenance.

It’s easy to feel like the government is in over its head here, especially when it doesn’t have a history of success with schemes like this.

Something I couldn’t resist adding:

With inflation at 17% and a wildly unpredictable FX market, Nigeria’s Central Bank governor is patting himself on the back.

What I’ve been reading

It feels fortuitous that in the same week I spoke to Zikoko about the importance of friendships, I found this article about how friendships end. “It is completely normal for friendships to fade; the real aberration is keeping friends,” the article says.

This Rest of World feature examines something very few people think about: when you shop online and return the clothes you buy for whatever reason, how do those clothes get back to the manufacturers?

This week, I received an email from an investment company with the title, ‘how to invest in a bear market,’ and it brought this excellent article to mind. One part of the article says, “I don’t think there’s any way to understand what a bear market feels like until you’ve lived through one.”

When crossword puzzles first swept across North America in the mid-1920s, The New York Times sneered, calling them “a familiar form of madness.”

See you on Sunday!