What we learned from Kuda’s moment in the sun

A.k.a Lending is a difficult beast to tame

Notadeepdive is brought to you by Fincra, SweepSouth and Geegpay. Fincra provides reliable payment solutions for fintechs, online platforms and global businesses. SweepSouth allows you to get vetted and experienced cleaners at the best prices; use the code “DEEP1K” to get a discount. Geegpay lets freelancers and remote workers get paid in minutes.

If you missed last week’s newsletter, catch up here. Follow along by subscribing:

Today’s Notadeepdive is 1,063 words.

TOGETHER WITH FINCRA

Fincra offers several different flexible payment solutions for global businesses. Businesses across multiple sectors can easily accept online payments via cards, bank transfers and Pay with PayAttitude giving customers the convenience and flexibility they want. Fincra also has POS Terminal, which provides various payment collection options like Pay with Transfer and Pay with Card for in-person transactions.

“Fi Naira MasterCard fo Gucci store ni London” - Reminisce (2012)

It feels like ages ago when the Nigerian rapper, Reminisce, wrote those lines as a nod to the penchant of Nigeria’s upper middle class–who have all but disappeared–for shopping in London. Those shopping trips were paid for with Naira Mastercards, and until April 2020, it was possible to spend $3k monthly on international payments using your Naira card. You can find a brief history of international spending limits since April 2020 here.

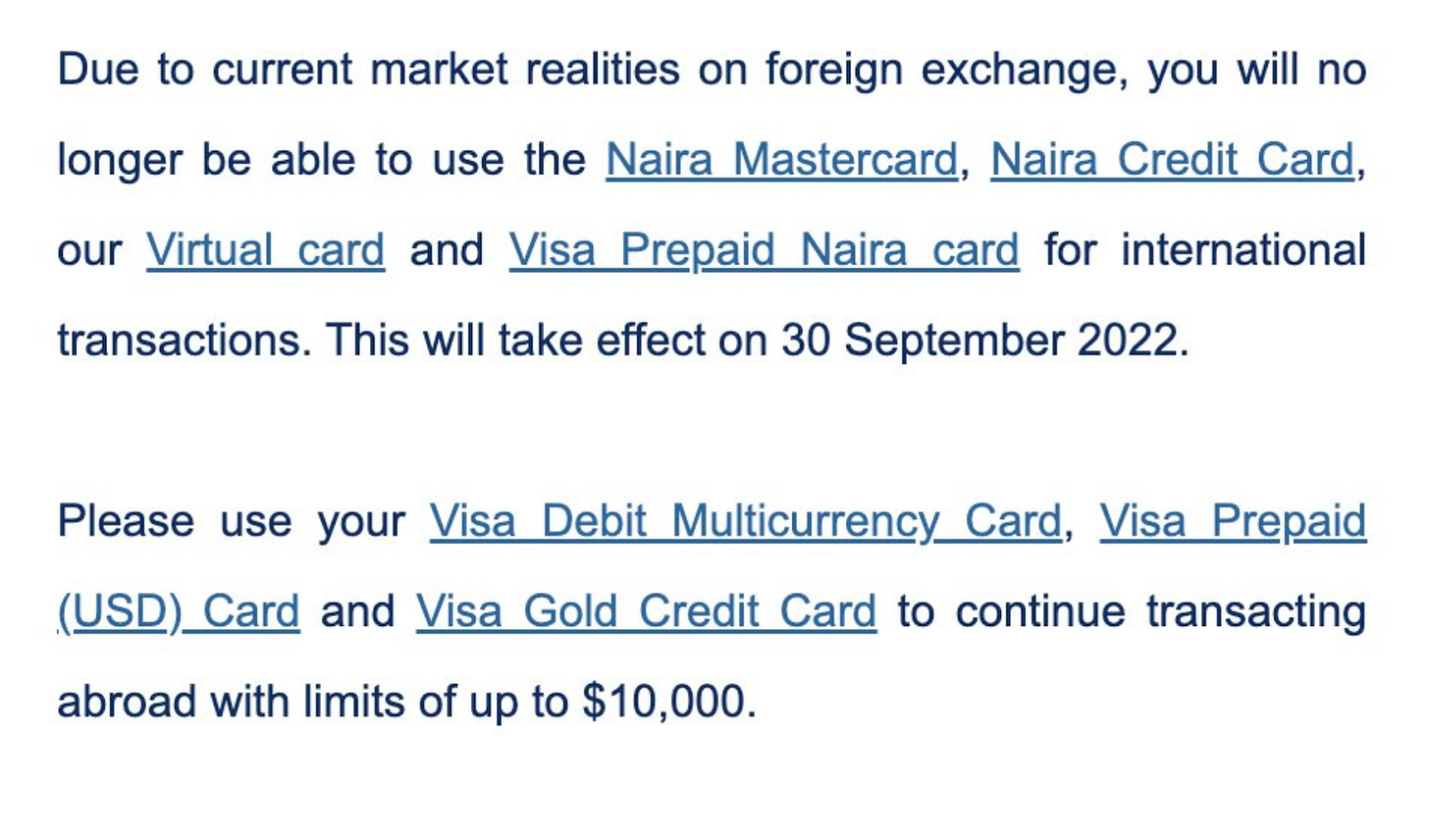

In the last couple of months, as Nigeria has found it difficult to earn FX–oil production is down to its lowest levels in decades–the restrictions on FX movement have worsened. Two months ago, FCMB was one of the first banks to stop all international payments with Naira cards. Yesterday, First Bank followed suit, and you can expect that this will happen in most Nigerian banks.

To be fair, at this point, you’re likely not missing much with the new announcement, considering that the old limit was $20 per month. What can $20 buy on Amazon these days? Moving on!

TOGETHER WITH SWEEPSOUTH

It's that time of the month!

Be honest, you're due a spring cleaning aren't you?!

Don't spend your quality time doing all the spring cleaning work this weekend. Instead, book a thoroughly vetted cleaner from SweepSouth to do all the work that keeps your space cute .

Book a Spring Clean Now at ng.sweepsouth.com/booking

What we learned from Kuda’s moment in the sun

It’s been a tricky couple of weeks for Kuda, Nigeria’s leading digital bank. To be fair, they’ve had two years of good press and marketing. They sponsored Big Brother Naija, hit 2, then 3 million customers, and signed one of the breakout stars from the reality TV show. It felt a lot like Kuda was pretty big on acquiring a boatload of customers and betting they would retain them.

With the promise of “no fees,” the bank put its ads everywhere, predictably leading to high marketing costs– one report from TechCabal put the figure at a little over $1m. In a newsletter from August 2021, I referenced a financial report that put the exact figure at $1.3m for Q1, making up almost half of its expenses for the quarter. Yet, it’s easy to be distracted by all of the losses and miss the most interesting part of the Kuda Bank story.

According to TechCabal, the bank raised its revenues from ₦72,649,000 in 2020 to ₦3,207,177,570- yup, you read that right. That’s a 41X increase in under two years. In Q1 2021, Kuda’s revenue came from airtime commission, interest income and a small share from Paywithbank commission. I was initially surprised by how much revenue came in from airtime and bill payments commission, but when you do the math, it adds up. Back of the napkin maths shows that If 250k customers average ₦20k of Airtime/Bill Payments (a modest assumption) at an average commission of 4%, that's ₦200m revenue from processing ₦5bn.

So simply increasing their number of customers definitely did something for the bank’s income–there’s also some revenue from its overdraft service, despite its early struggles.

What happened with Kuda’s overdraft product?

There was a time when it felt easy to say that the clearest path to sustainable revenue for Kuda bank was simply tacking on a lending product. It’s such an easy solution to proffer from the outside, but the reality of lending suggests that it’s not as easy as slapping on lending for customers, especially in the Nigerian market.

Kuda launched its overdraft program in March 2021 and as part of the announcement, the company shared how the program would work. “Participants in the pilot program can borrow up to 50,000 naira at a daily interest rate of 0.3% of any amount they borrow. The amount available to borrow varies for different participants depending on credit reports and how much the participant has been using their account.”

How did a simple overdraft product lead to a reported 69% nonpayment rate and an impairment rate valued at ₦2,258,698,669? The answer lies somewhere between Kuda’s implementation and customer perception. In conversations with two former employees who asked not to be named because they are not authorised to speak on the matter, I got a sense of some of the challenges that come with lending.

At the start of the overdraft offering, the neobank’s approach was to assess active customers and pre-qualify them for overdrafts on the back end. The pre-qualified customers then got notifications that told them they were eligible for overdrafts.

This straightforward process had some blind spots. If customers were simply prequalified, what happened if they took loans from other lenders before accessing Kuda’s overdraft? If that sounds like an edge case, consider that there are a good number of bad actors who take loans from several digital lenders with no intentions to repay.

Another challenge the overdraft product ran into was customers’ misunderstanding of the product. While the overdraft facility was intended to run for 30 days, people seemed to think they could repay over a two or three-month window. It left the neobank needing to educate users on the product. According to some sources, this eventually led to the decision to disable the product for anyone who hadn’t completed their payment past the structured repayment period.

It was a period of expensive lessons for Kuda in the period between May to July 2021, but several sources say that there’s now more clarity around how it is thinking about lending. The details of its new approach remain sketchy, but with the launch of Kuda Business, we can guess that it is thinking around salary accounts and loans tied to salaries. It’s an argument I’ve made before here.

If Kuda Bank can convince corporate organizations to move their business accounts, it’ll mean they also will be able to corner more salary accounts. Salary accounts not only encourage stickiness, but they also make loan decisions some way easier. For now, Kuda’s moment in the sun is another reminder that lending (I’m looking at you too, BNPL) can be really tricky businesses. And everyone learns expensive lessons along the way.

TOGETHER WITH GEEGPAY

The work is already hard, receiving payments for it, shouldn't be.

Easily create a USD, GBP & EUR virtual bank account to receive foreign payments for your work.

- Instant account verification

- USD virtual account supports ACH & local wire transfers

- Best exchange rates

- Fastest payouts to banks

What I’ve been reading

If you go to the cinema this weekend to see “The Woman King,” you may find articles like this that argue that maybe the Dahomey were not really heroes.

This very strange story of a jet-setting, Ferrari-driving CEO who was owing employees salaries

Are we inventing our struggles? This article makes an interesting argument in a few paragraphs

Six ways to turbocharge your job search in the UK

What are logistics startups doing these days?

See you on Sunday!