Will surge pricing end Uber and Bolt’s dominance in Nigeria?

While riders complain about surge pricing, one dark horse is taking advantage

Big shout out to Joy who referred 22 people to sign up to the newsletter. I’m going to be saying ‘big Joy energy’ throughout this weekend.

Thanks to the over 85 people who joined us in the last week. We’re still on our way to 3k subscribers and I think it’s pretty doable. If you’d like to help us hit that goal, please take a second to share this newsletter.

"There's no time I open my Uber app when there isn't a surge. What's the truth?" asked one Twitter user, commenting on what is now a common complaint against ride-hailing apps on social media. The responses are many if you search the terms "Bolt surge" and "Uber surge" on social media. The answers show that while technology provides new ways to do things, it brings peculiar problems. One of the problems ride-hailing has brought is surge pricing, the practice of charging more for a product or service during periods when it is in high demand.

Surge pricing happens when a ride-hailing app a) has increased demand and raises prices to reflect that demand b) wants to incentivize drivers to get on the roads — this is common during weekends and public holidays. One paper provides a great summary: "surge pricing is based on a fundamental principle of economics: when supply and demand get out of whack, raising or cutting prices will bring them back into equilibrium."

Yet, reports like this hardly consider price-sensitive markets like Nigeria, where ride-hailing services skirt the line of luxury services. While South Africa had over 12,000 active Uber drivers in 2017, Nigeria had 9,000 drivers in 2018. In Nigeria, Uber has found it difficult to grow those numbers because of a mix of factors: a high standard for cars and driver onboarding, the questionable viability of ride-hailing outside of Nigeria's biggest cities like Lagos and Abuja, stiff competition from the Estonian company Bolt and a pricing war.

"Uber has high standards," Christian, who has been driving on Uber for two years tells me. For a while, those standards included not accepting cars with a year of manufacture older than 2006. While that has been relaxed, Uber has retained a certain reputation. Another driver who preferred not to be named and only drives with Bolt told me, "their [Uber] registration process is too long and other drivers asked me not to bother, that I can make money from Bolt."

Bolt's answer to the issues Uber threw up has led it to become the bigger market player. Some estimates claim that there are 20,000 active Bolt drivers. It attained those numbers by taking a 10% commission on rides — it has since increased this to 20% — lower than Uber's 25% commission. It’s also more relaxed on car quality while speeding up the registration process for riders. Most importantly, it solved the chicken and egg problem of ride-hailing; riders only join an app if they can find drivers, and drivers only join if they can find rides.

Today, Bolt and Uber control Nigeria's ride-hailing market, and new entrants have found it difficult to break the duopoly despite a low barrier to entry. Rideshare, GidiCab, Jekalo, OgaTaxi, Lagos Ride, PamDrive, EasyTaxi, NaijaTaxi, OCar have all tried and failed. Of those contenders, OCar seemed the most likely to succeed, given its success with bike-hailing service, ORide. At the time of OCar's launch I mentioned that, "Many fringe players have faded into irrelevance, with little or no online presence." But the absence of a “third force” doesn't mean that drivers and riders are satisfied with Bolt and Uber's services.

In April, Uber and Bolt drivers under the umbrella, Professional E-hailing Drivers and Partners Association (PEDPA), planned a week-long strike to protest "systemic slavery." These drivers say that with rising inflation and these companies taking up to 25% in commission, they don't make enough money to cover their costs, even with surge pricing. It's a problem gig workers are facing globally, with one headline from the Washington Post saying, "you may be paying more for Uber, but drivers aren't getting their cut of the fare hike." Bolt and Uber respond by saying they provide the best earnings for drivers on their platform. Yet, the agitations continue, with drivers asking for a seat at the table in deciding Uber and Bolt's commission.

So far, complaints from drivers and threats of strike actions haven't worked because these driver associations cannot get many members to join the strike. One driver told me that more than 90% of drivers did not comply with the planned strike in April because most drivers earn so little, they couldn’t afford to take the day off. There is also division within these associations and unions. "There is no association as divided as Uber and Bolt drivers association in Nigeria," Deji, who drives for Uber and Bolt, tells me.

"There are more than five associations,” Deji adds, “and more than ten Whatsapp groups where all we do is fight and never agree on anything. The causes of division are the same as what is obtainable in the general Nigerian society: lack of trust and bad leadership."

However, one small victory is that Bolt and Uber have increased the frequency of bonuses to drivers since the strike. Yet, that may be because of the new competition, not the strike action.

"Independent Driver, styled as InDriver, a new entrant in the ride-hailing space, is hoping to win people over with their unique model," I wrote in December 2019. "Unlike Uber or Bolt, InDriver does not determine fares with an algorithm but instead lets you "choose your fare". When you request a ride, you also set the fare you're willing to pay. This information is sent to drivers on the app, who decide if the fare you've proposed works for them. It is too early to judge adoption for InDriver."

Two years down the line, it is easier to judge InDriver. Ola, a driver who before now only used Bolt, tells me, "InDriver charges drivers low commission on rides, and you get to determine the pricing rates. The only advantage the major players have over them is that sometimes the price could be too low." This is a view Deji agrees with; "InDriver is gaining traction because of low driver entry barrier and low prices. It's the same way Bolt gained against Uber in the early days. For instance, all you need to do to join InDriver is to send a screenshot of your Bolt account profile page." But the biggest reason why more drivers are signing up to drive for InDriver is that more riders are using it to avoid surge pricing.

“I downloaded the InDriver app this morning after paying N4,900 for a Bolt Ride from Bode Thomas to Victoria Island,” Tobi Balogun, a lawyer in Lagos, tweets. That’s a trip that costs N1500- N2,100 without surge pricing. In Lagos,several other riders like Tobi are using InDriver to avoid near-constant surge pricing on Bolt and Uber. While I didn’t get a response from Uber, Bolt’s response suggests that surge pricing is inevitable as long as demand outstrips supply. “Bolt continues to add thousands of new drivers to improve rider experience by improving supply availability.” The company said in an email. “This mechanism [surge pricing] is a key feature that makes it possible for Bolt to fulfil as much demand as our drivers can manage.” Unlike Bolt, InDriver takes a different tack, notifying users when demand is high, while it still lets them set the price they’re willing to pay, reinforcing the idea of flexibility. This nimbleness is vital because drivers are noticing that surge pricing is pushing customers away. Deji tells me, “in times of surge pricing, you can wait up to one hour to get a good ride on Uber or Bolt. Why wait that long when rides are waiting for you on InDriver — it’s a ‘half bread is better than none’ situation.”

Rilwan, who uses the app as a backup, tells me, “riders like cheaper rides, and that’s why most people use it these days.” It also helps that for the first year of operation, InDriver charged 0% commission on rides — it recently introduced 10% commission. In a Whatsapp group chat which I saw, several drivers complained that InDriver, with its low prices, is stealing market share from other players.

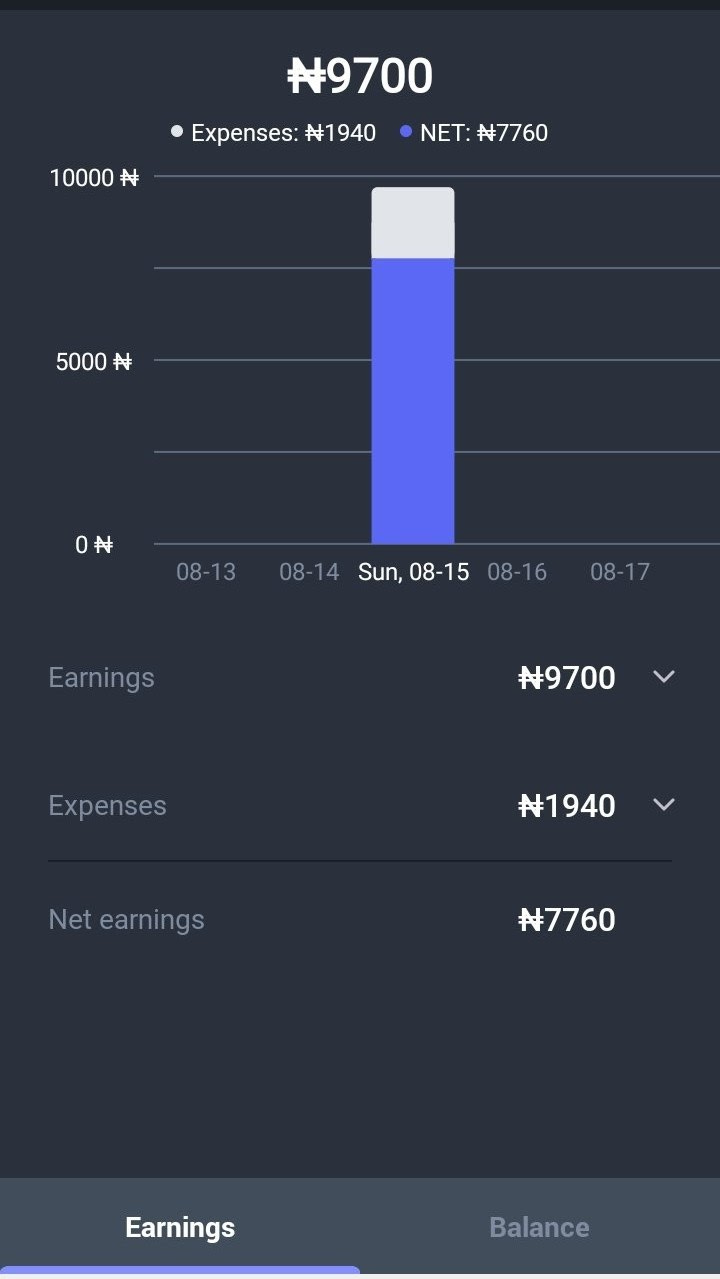

One driver shared his weekly earnings dashboard

Yet, InDriver has its share of problems. Rilwan says that the company charges a commission even if the driver does not complete the trip. “If you get to a pickup location and the rider doesn’t show up, once you click on ‘arrived’, you will be charged a commission. The app will not let you find rides if you owe more than N500 in outstanding commissions.” Beyond monetary concerns, another worry is security and issue resolution. None of the drivers I spoke to was aware of any issue-resolution processes for InDriver. Christian, another driver who uses InDriver told me, “there are concerns for me, the driver, and for the riders as well. InDriver isn’t like Bolt or Uber; you arrive, pick the rider, drop them and then say you have completed the trip. If something were to happen during the trip. In that case, I don’t know how I’ll track that.” His concerns point to the fact that without clear processes, InDriver could find itself with a reputation for not solving issues like the market leader, Bolt. In March, a Rest Of World report said, “passengers were unwilling to report incidents to Bolt because the company has a reputation for not responding to complaints. Several young Nigerians who spoke to the publication, Rest of World, after having one or more bad Bolt experiences said they have never had their grievances resolved.”

Join the conversation: What are the biggest price changes you’ve seen in the past month?

As I speak to drivers, it is clear that all these apps have their problems. But because companies don’t seem committed to solving these problems, they get little loyalty from gig workers. Instead, the ultimate allegiance is to money, meaning that many drivers use all three apps. “There is nothing difficult about juggling three apps,” Deji assures me, “but what is difficult is driving 8-15 hours a day and taking N5,000- N15,000 home.” Deji also leaves me with a pretty decent summation of the state of play: “the truth is that the ride-hailing market is still there for the taking. If you get the pricing right and badass marketing, and you combine this with excellent customer service, you would be the market leader in two years.”

What I’m reading this week

My perpetual famzing of Abubakar Idris continues, with this brilliant article on how the world’s biggest VC’s want a piece of the action that is Nigeria’s tech

Many people don't have the best relationship with their parents, often for good reason. Yet, I wonder if knowing the context in which they grew up can help us understand them. Feyi Fawehinmi’s tribute to his late father will give you something to think about.

I live in Nigeria, so I never really have to think about race, racism and representation. But this week, I saw El Nathan John’s tweet about how even the nicest white people say some pretty racist things. Then mother luck brought this peach of an article to me. It talks about Hollywood, Writers’ rooms and representation.

Corruption in Nigeria is an age-old problem, but every now and then, you read a report that shows the mind-boggling scale of graft in the country. This news report will make your jaw drop.

Beijing’s breakup of Alipay was inevitable. The real question was how it was allowed to get so powerful in the first place.

I haven’t shared “what I saw this week on Twitter” in a minute, but this really cracked me up. Go get your vaccines people!

Reproduced with the permission of the artist.

Before you run off, don’t forget to tell me what you think of today’s newsletter here.

NO AUDIO LOVE - SHARE NOTADEEPDIVE

Friends always tell friends about Notadeepdive, so click that button to share Notadeepdive with your network. The more, the merrier; so invite everyone you know and you’ll earn rewards for being so selfless.

P:S This newsletter was powered by the subscriber who sent me money for big stout on my Abeg app on Wednesday — that was a funny touch. Thanks to Fu’ad, Jimi and Hassan for editing this newsletter. See you on Sunday!

This is the first I'm hearing of Indriver and the first time I'm actually contemplating Bolt's origin (never knew it was an Estonian company so thanks for this new piece of info).

Great read. I always look forward to reading from you.