Exit strategies

If the global giants stop bending over backwards for your naira, it might mean they no longer have to.

Today’s newsletter is: 793 words. If you missed Sunday’s newsletter, catch up here.

TOGETHER WITH CREDIT DIRECT

Not every side hustle is worth the hassle.

Why settle for pocket change when your money can pull real weight?

With Fixed Yield, you can earn up to 21% per annum on the Credit Direct App.

If your startup emerges from stealth in mid-2023 with $580,000 in equity and a few million more in debt, and you’re selling it less than two years later, there are a few ways the story could play out:

MA financial services group sees strategic value and pays a premium for your moat. Your investors triple their money. You tweet something vague but self-congratulatory about the journey.

Things could also get bumpy. Repayments fall short, growth stalls, and a bigger player steps in to rescue what’s left. Investors get some of their money back. You might even land softly at the acquirer. Everyone walks away with their reputation intact.

There’s the tough ending. Defaults pile up, the money runs dry, and a firm swoops in to salvage whatever value’s left. Investors write it down. The founder moves on to the next thing.

And in unrelated news, remember Zuvy? The fintech-ish startup raised $4.5 million in 2023 (only $580k in equity) and just sold a majority stake to BAS Group. The founder has exited and launched a new startup, with fresh funding and a YC badge to match for his new venture.

It’s been quite the week for him. Or as Lenin once put it: “There are decades where nothing happens; and there are weeks where decades happen.”

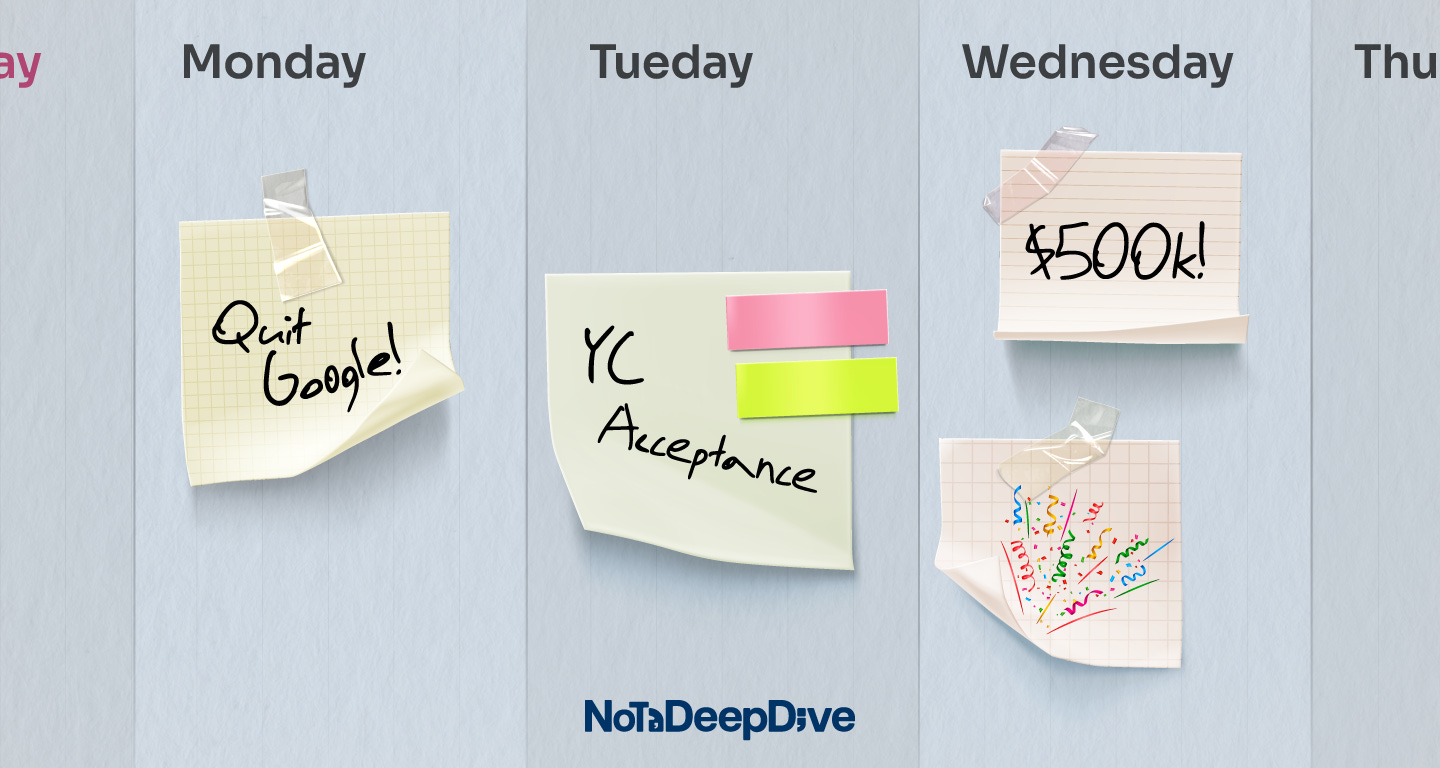

On Monday, he tweeted about quitting Google after four months. Said he should’ve skipped big tech and just built.

On Tuesday, he announced his new startup had gotten into YC and already raised $500,000.

By Wednesday, news of the Zuvy sale was out.

I don’t know what kind of week you had, but I’m willing to bet it didn’t span Google, YC, and a liquidity event.

It’s been a good week more broadly, too. HR startup Pade announced a $1.8 million seed round. And Mira—a social commerce startup that only launched in 2024—was scooped up by Chowdeck. No one knows what the deal was worth, but we got thoughtful blog posts and analysis that left little room for speculation or spicy takes.

So yes, fundraises and acquisitions are cool again. But there’s the viral way of doing it and the organic way. One grabs the spotlight. The other builds quietly until it no longer has to.

Or as Pete Edochie might say:

Some people light fireworks to announce their success. Others let the aroma of good stew do the talking.

AWS is Done Playing Nice

If the global giants stop bending over backwards for your naira, it might mean they no longer have to.

Amazon Web Services, the cloud vendor of choice for many Nigerian banks, is tightening the screws. According to three people with knowledge of the matter, at least two banks have had their AWS accounts temporarily blocked for failing to make timely payments, after AWS insisted on a new regime: monthly billing with prompt monthly payments.

Traditionally, enterprise customers—especially in Nigeria—prefer to settle cloud bills quarterly or even biannually. It helps with cash flow and procurement bureaucracy. But AWS is now demanding payment just weeks after invoices drop, even when the monthly bill runs into $10,000 to $20,000 or more.

The timing is telling. Last year, local cloud providers were talking a big game about undercutting AWS with naira pricing and more flexible payment terms. In response, AWS rolled out naira billing, but many enterprise customers still pay in USD because AWS requires a credit or debit card to process naira payments, a nonstarter for companies that rely on wire transfers and procurement cycles.

So while AWS talked local, it’s now acting global, shifting from market-capture mode to cash-collection mode. You don’t enforce strict billing unless you're confident customers are too entrenched to walk away.

One last thing before we go…

There’s a fintech out there—PSSP licence in hand, $750k valuation on the table— looking for a buyer. The whispers are out there in the wild.

A PSSP licence isn’t cheap or fast: you need to lock up ₦100 million in escrow, navigate compliance, and wait 6–8 months (if you’re lucky) for the final green light. That’s before you plug into any banks or push a single API call.

So if you’re a local or foreign player looking to enter the market or even an ambitious startup that doesn’t want to spend the next year in licensing purgatory, buying a clean, compliant entity with a licence and some infrastructure might actually be… efficient.

What kind of Notadeepdive reader are you?

The “open it immediately” it hits your inbox crew

The Sunday binge readers

The catch-up crew—quiet for weeks, then liking eight newsletters at once.

The likers, restackers, and loyal commenters.

The quiet lurkers (until merch week.)

Which one are you? Let me know in the comments.

I’ve been seeing talks about PSSP license lately. But is it really legal to Sell or Purchase one?

Well, I’m the anytime I open Substack reader😂.

The singular act of removal of “wallet” from PSSP license means the “soul left the body” a long time ago. With the number of bank owned processors now, it’s almost a worthless venture.