For Banks, USSD is basically Buy Now, Pay Later

A.k.a telcos dey work, but banks dey chop

Today’s Notadeepdive is 750 words. If you missed last week’s newsletter, catch up here.

It’s my birthday weekend so share the newsletter to tell me happy birthday!

And if you’re a big fan of the newsletter, you can make a contribution here:

Notadeepdive is brought to you by Fincra. Fincra provides reliable payment solutions for fintechs, online platforms and global businesses.

TOGETHER WITH FINCRA

Fincra offers several different flexible payment solutions for global businesses. Businesses across multiple sectors can easily accept online payments via cards, bank transfers and Pay with PayAttitude giving customers the convenience and flexibility they want. Fincra also has POS Terminal, which provides various payment collection options like Pay with Transfer and Pay with Card for in-person transactions.

For Banks, USSD is basically Buy Now, Pay Later

In Nigeria, USSD is a super popular way to make instant payments. While I’m more likely to use my bank’s mobile app for transactions, I use USSD when I’m too lazy or in a hurry. Beyond my laziness, there’s also Nigeria’s broader reality. Depending on what data source you trust, there are somewhere between 25-40 million smartphone users in the country. It means most people who have phones use feature phones, which takes us right back to why USSD comes in handy.

One of the fascinating things about building something that so many people use and that works so well (most of the time), is that most people really don’t know how USSD works. It took a roforofo fight between the banks and mobile telecom providers last year for a lot of people to know that they weren’t paying for USSD service. Yet, this fight over USSD dates back to 2019.

At the heart of it is how USSD works. USSD functions like a “call” or “session” that the customers make, thereby costing telcos money, and since it’s a service provided to the banks, the argument was that banks should pay. The banks didn’t see it that way, with Herbert Wigwe arguing at the time that, “There is no such thing as an obligation due from banks to telcos…“It is true that they continue to provide this service but this service has nothing to do with the banks.”

While the banks and telcos kept passing the buck, the tab kept rising and in 2021 when the telcos came to collect, the amount had risen to $103 million. Threats were issued, blows were not thrown and in the end, the banks agreed to pay off what was owed gradually. Additionally, both parties agreed to pass on the USSD bill of ₦6.98/transaction to customers. I argued at the time that the decision was a step back for financial inclusion.

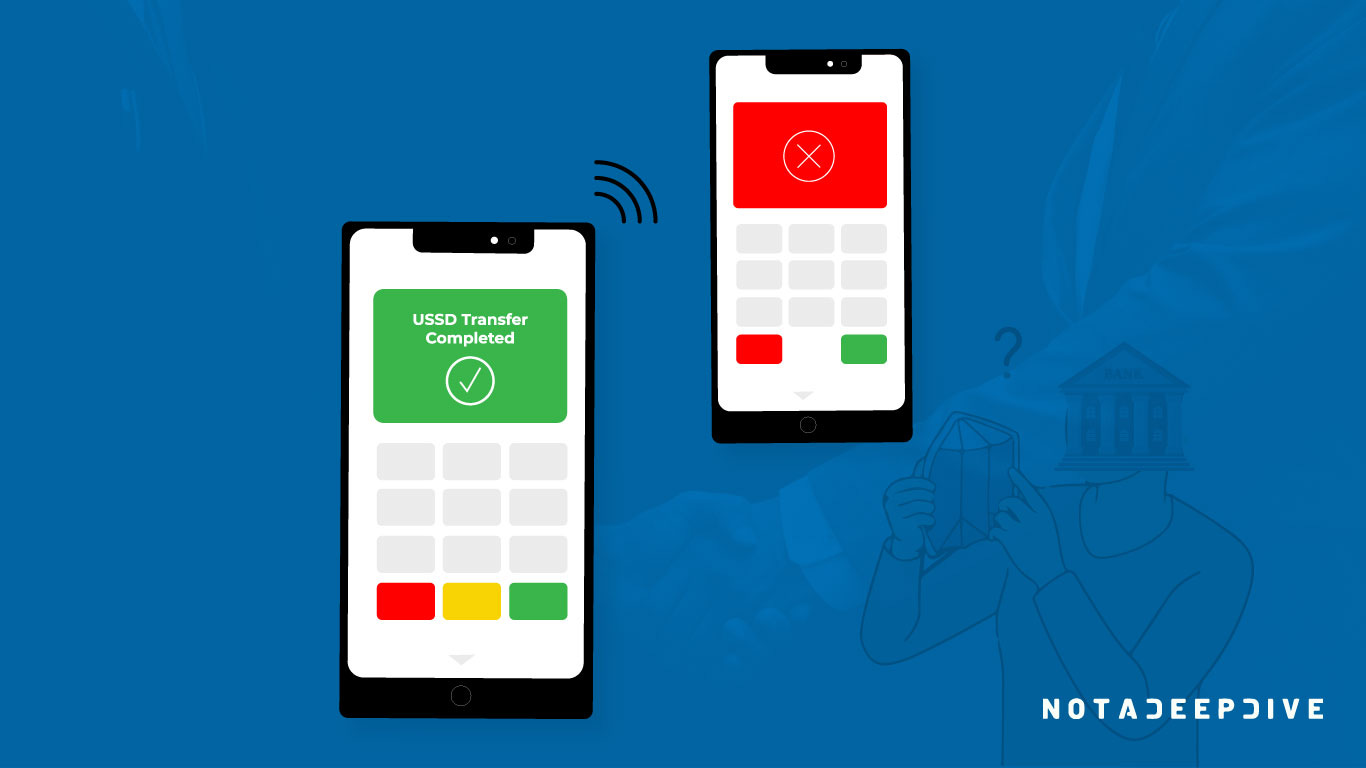

Despite the agreement, the telcos and banks are right back where they started. In some Buy Now Pay, Later type agreement, the banks remit the USSD fees charged to customers periodically. But the banks haven’t held up their end of the deal and today they now owe ₦80 billion.

Banks when telcos ask them for USSD fees

Where do we go from here? Association of Licensed Telecommunications Operators of Nigeria (ALTON) uses the same strategy to force the hand of banks: threaten to yank off USSD functionality. Seeing as we’re right here again, it’s not the most effective strategy.

The response I like instead was from MTN Nigeria in April 2021. It reduced the percentage commission it paid to banks for airtime purchases from 4.5% to 2.5%, squeezing the bank’s profits. The banks reacted swiftly, yanking off MTN from their mobile platforms, forcing customers to use Flutterwave and Opay. Digital banks like Kuda and Carbon were fine with the 2.5% commission, and it could have been interesting to see if it would have driven more users to the digital banks. But CBN stepped in and played big brother for the banks.

In the next few days, we’ll see how the latest USSD kerfuffle shapes up. But the last word on it is that telcos are learning that the BNPL model is a lot more difficult than it seems; perhaps we’ll get a blog post from them about their learnings.

A throwaway on renewables

This week, Daystar Energy got acquired by Shell for an undisclosed amount. It didn’t generate as much excitement as the Paystack Stripe deal–not a lot of sectors can match fintech for sheer sexiness–so it might be easy to forget that renewable energy saw a lot of investor action in 2020. Renewable energy startups got 22% of the funding that flowed into African startups in 2020. By early 2021, Daystar Energy raised $38m, raising the stakes again for the sector.

Why did it get acquired by Shell? Shell has been making investments in the renewable energy sector since 2016 and acquisition is par for the course for expanding its interests. Daystar Energy’s acquisition may make the sector more valuable for big players. One industry player told me that it’s a positive move all around. “Big players means that lobbying and government regulations around renewable energy will become easier to negotiate. I honestly think Shell, for instance, has more negotiating power/experience than any of the smaller players.”

What I’ve been reading

This gloomily titled article: your professional decline is coming much sooner than it seems.

Paul Graham on what he learned from users.

How PR/FAQs help launch successful products like AWS, Kindle & Prime Video.

How Elon Musk, Jack Dorsey, and Parag Agrawal cratered the Twitter deal, in texts.

I’ll be too busy enjoying my birthday so see you next week!