How Offline Payment Became the New Battleground for Nigerian Fintechs

P2P payment trends are unlocking exciting growth territories for local fintechs

Today’s Notadeepdive is a guest post by Abubakar Idris. Check him out on Substack!

If you missed Friday’s Notadeepdive, catch up here. If this newsletter was forwarded to you, subscribe here for free:

TOGETHER WITH CREDIT DIRECT

Your money sitting idle in a regular account is a quiet inefficiency most business owners overlook.

Credit Direct Business is designed to fix that, offering up to 15% per annum on deposits, while giving merchants a structured home for their Buy Now, Pay Later earnings. It’s not just a wallet. It’s leverage.

Offline Payments Are The New Battleground for Nigerian Fintechs

On June 23, 2020, during the pandemic, I published an article explaining how Nigeria’s biggest payments companies were racing to launch new online marketplace platforms. The behavioral changes triggered by COVID lockdowns had seemingly created the perfect opportunity to scale local e-commerce while accelerating transaction activities on the payment systems. Flutterwave, Remita, Interswitch, Habari, and OPay made the first leaps by the start of June.

Paystack, the Stripe-owned fintech, announced Paystack Commerce, its own marketplace, minutes after that article. It shared an ambitious roadmap to turn the product into a sophisticated global shopping tool, loaded with invoice features, sales analytics, and integrations with Substack and Google Pay.

These fintechs, equipped with technology to help businesses accept payments, believed they could unlock new growth if only they could get more businesses to sell to customers using digital marketplaces. As compelling as this proposition was, it failed.

Paystack hasn’t added any features since 2022, effectively abandoning the e-commerce play — a rare misadventure for a company that takes a careful approach to product rollout.

The e-commerce platforms of Flutterwave and Remita have also stalled; while OPay shuttered its OTrade and OMall marketplaces after only a few months in operation to focus on its core fintech services. These misadventures highlight the challenges of e-commerce in Nigeria. But it also underscores a fundamental misread of the domestic market as offline businesses rapidly embraced electronic payments while ditching the need for online storefronts.

The Original Premise of New Age Payments Startups

Paystack and Flutterwave are two of the biggest names in Nigerian fintech. But they’ve only been around for a decade. Yet their creation in 2015 and 2016, respectively, heralded the dawn of a rejuvenated Nigerian payments industry by favouring quick API integration and a low-fee model to get more enterprises to accept electronic payments from consumers. Their raison d’être was built on four things:

That cash is being digitized, and the future of payments will be electronic.

That card payments will be the dominant form of retail payments as financial inclusion — an industry-driven initiative to get more people to use formal financial institutions for their savings and payments needs — scales banking.

That e-commerce platforms, which were nascent in Nigeria at the time, that allow people to buy and sell on the internet, will usher in the next era of electronic payments as businesses switch to digital sales channels.

And as these changes happen, payment providers can stay in the background, capturing significant economic value as processors without having to be on the ground, since merchants themselves will do all the hard labour to go digital.

But some of these things have played out differently.

E-Commerce Revenue ₦0, Payments Revenue ₦0

On the one hand, Nigeria’s macroeconomic struggles over the last decade greatly destabilized growth plans for local fintechs, their enterprise clients, and consumers’ purchasing power. Yet people didn’t stop spending, nor did it slow the pace of digitizing cash.

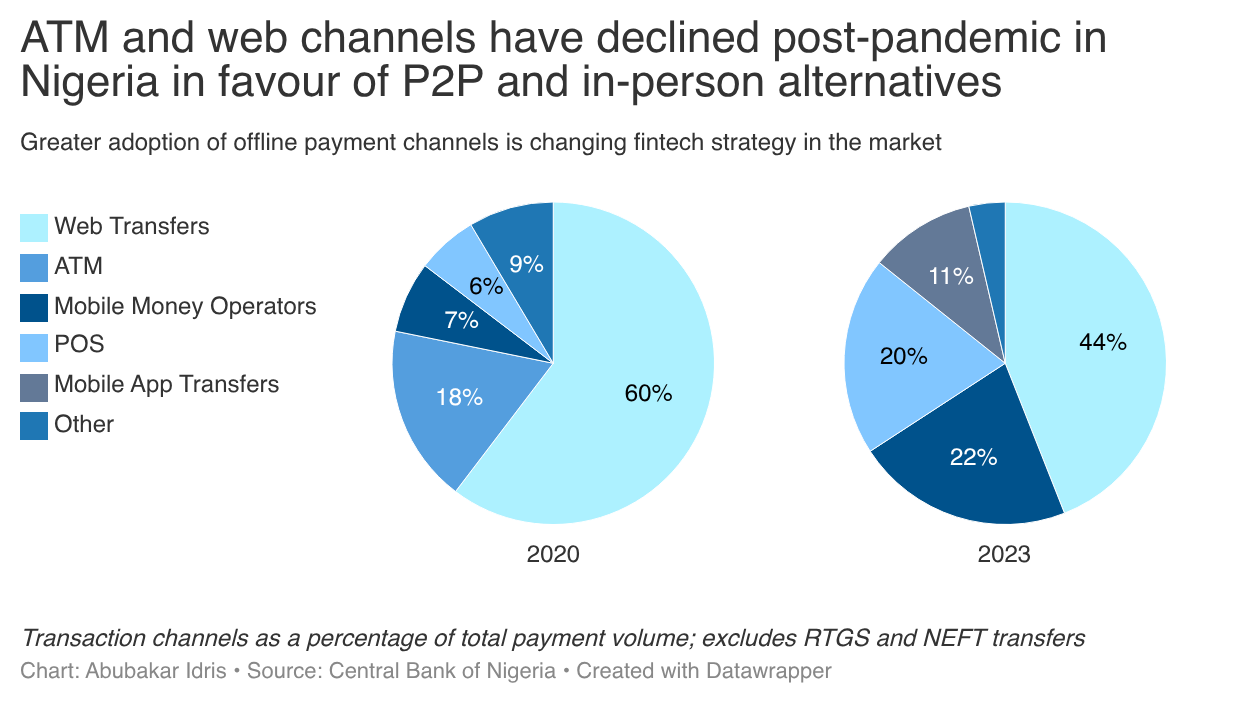

Instead, the channels of commerce and the methods of payment changed drastically during this period. In other words, most businesses remained largely offline, with no online footprint, and bank transfers and POS transactions, not pure online payments, became the fastest-growing methods of payment. Fintechs that didn’t get this memo were left for dead or suffered slower growth, especially post-pandemic.

Bank transfers, in particular, represented a big threat for two reasons. Unlike debit cards, still in growth territory and weren’t always efficient at the time, digital banking over smartphones or feature phones was ubiquitous. With a banking app, consumers could send and receive funds in seconds with a real-time alert to verify transactions. With peer-to-peer transfers, a customer can manually send money from their banking app to a recipient’s bank account, removing the need for bank cards entirely. And second, with banks already linked to each other, peer-to-peer transfers completely cut out the fintechs from the value chain.

OPay and Moniepoint were among the earliest fintechs to recognize this seismic change, which accelerated with agency banking. Moniepoint pivoted from its enterprise business model just before the pandemic, while OPay spent huge sums to incentivize consumer behavior towards the peer-to-peer or bank transfer trend. In 2020, mobile money operators and POS transfers accounted for 13% of consumer total payment volume (not value); by 2023, they represented over 40% of transactions.

TOGETHER WITH BUSHA

If you are a business exploring digital assets for cross-border payments or treasury management, you should check out Busha Business. Busha business also allows you to buy, sell, receive, and send stablecoins and digital assets.

Elsewhere, payment processors’ anticipated e-commerce boom never arrived. Jumia, the largest e-commerce platform on the continent, continues to report less than 1% market penetration after a decade. The willingness of consumers and merchants to transact entirely online — the loop from product discovery to consumer payments — never gained traction. Fashion businesses didn’t fully go online, car sales didn’t go online, nor did purchases of consumer goods. All of these things remained offline.

Typing “restaurant near me” in Lagos on Maps is not always so helpful in finding dining options. Googling “best hair salon in Maryland” is futile, and even searching for “plain white shirts” on Jumia most times doesn’t return quality results. Everything remained offline, away from organized storefronts. Yet that didn’t mean people didn’t shop online.

Once a consumer sees a local product while doomscrolling on Instagram, they message the seller, haggle or reach a price, wire the money to the seller via bank transfer, while the seller dispatches the item to the customer using a third-party logistics service. In this transaction loop, from product discovery to consumer payment, e-commerce platforms received zero revenue, and payment providers got nothing. Yet an online trade concluded successfully, but via social commerce and peer-to-peer transfers.

Payments Revenue ₦100, E-Commerce Revenue Still ₦0

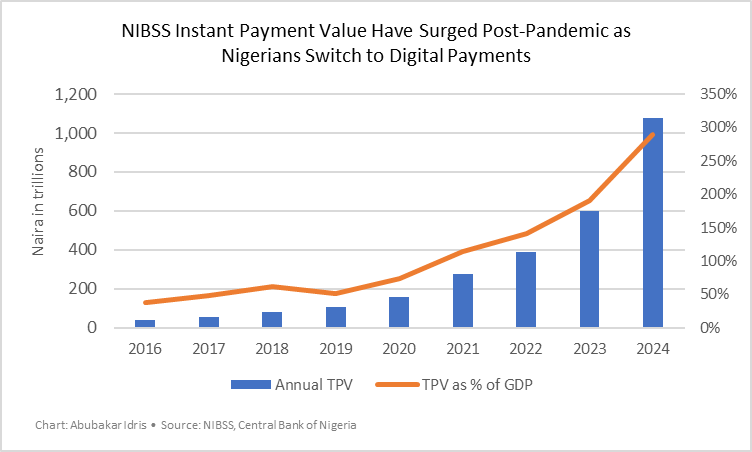

As these social commerce and peer-to-peer payments trends accelerated post-pandemic, fintechs glued to their original premise were sure to lose. They all recognized this, but slowly. Then comes the industry shift towards open banking and the creation of “pay with bank transfer”.

This revolutionary new payment method brought fintechs back into the peer-to-peer value chain. With open banking, fintechs can ditch cards and integrate directly with every bank in the country. This method has been wildly successful so far, yet it quickly exposed how many transactions were happening offline, away from cards and digital marketplaces. Everything from school fees payments to paying for stuff at a roadside food vendor is increasingly shifting to P2P payments.

So rather than focusing on getting businesses to sell online, the new goal for fintechs over the last six years is getting businesses that are offline to accept payments omnichannel — via cards, bank transfers, web, POS devices, or mobile money. Fintechs and banks are racing to arm every trader in the market with a POS device. In this value chain, while e-commerce platforms continue to earn zero revenue, payment providers earn a decent take rate.

All of a sudden, fintechs are realizing that the way to accelerate growth in the offline payments realm — to scale it — is to repurpose the original e-commerce playbook, but for offline. In other words, after onboarding merchants to their payment service, offer them working capital loans to scale up their inventory, a high-margin value-added service, to drive sales volume; merchant banking services to manage their business, including software for bookkeeping, payroll, and tax management.

This is what Moniepoint and OPay have achieved successfully over the last few years. Paystack recently started on this path, but is rapidly scaling. It first partnered with Titan Bank, then launched an offline payments service, and now it has launched Paystack Microfinance Bank, a licensing regime that gives it the same regulatory cover as Moniepoint.

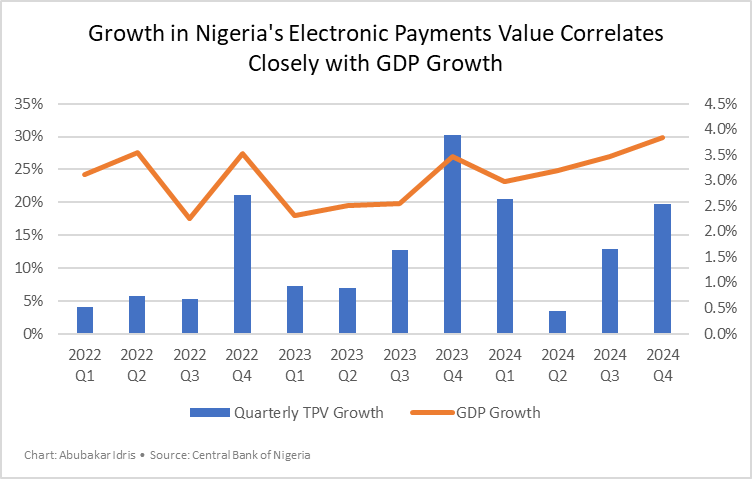

Unlike the traditional payments paradigm, fintechs on this offline path are poised for more geometric growth over the next few years. Their success is no longer anchored by any swing tied to Nigeria’s anticipated e-commerce pipe dream. Instead, their growth is tied to broader GDP activities in the domestic economy. In other words, as merchants and consumers switch to these payment providers for their daily transaction needs, these fintechs will keep scaling, and the more sales volume merchants record in general, the faster these fintechs scale.

The upside is massive since the majority of Nigerian commerce occurs in the informal economy, driven partly by small unregistered businesses that sometimes lack the corporate structure to access traditional banking services. But they can use P2P payments to keep serving customers.

For now, fintechs expanding in this direction are going to see a bump in key milestones as they push deeper into this market. And once the industry is at scale, the fortunes of these fintechs become closely linked to Nigeria’s GDP performance. This ensures steady revenue growth for the foreseeable future while ensuring that startups are directly tackling some of the biggest needs of small businesses.

But key risks are lurking for these fintechs. On the one hand, their credit exposure is increasing as they use value-added services like lending to appeal to merchants. On the other hand, the resilience of these startups is impacted by their source of capital. Companies that raised or are considering funding from abroad need to be careful when weighing the ROI against business performance because devaluation in recent years has had an impact on startups’ return profiles.

Nevertheless, the future looks exciting.

See you next week!