Today’s newsletter is brought to you by GetEquity. GetEquity allows you to invest in some of Africa’s most promising startups, ensuring you can own the next African startup unicorn. Learn more about GetEquity here.

If you missed last week’s newsletters, catch up here and here.

Solve the world’s selfishness epidemic by sharing today’s newsletter.

It’s official, Jiji is Africa’s biggest classifieds business

If you missed last week’s newsletters, catch up here and here.

On January, 28, Notadeepdive exclusively reported that the online classifieds company, Jiji had entered into a strategic partnership with Ghana’s largest online marketplace, Tonaton. While Jiji refused to officially comment on the partnership at the time, I speculated that it had all the looks of an acquisition.

“While Tonaton didn’t explicitly mention it was being acquired, it is not the wildest assumption to make seeing as it is turning over customer data to Jiji and will adopt the latter’s privacy policy. I sent an email to Jiji but the company said it won’t not be taking any questions until next week. You can only imagine what that announcement is.”

On Wednesday, Jiji formally announced the acquisition of Tonaton, which means it is now officially Africa’s biggest classifieds business. Until the acquisition, Tonaton.com, founded in 2013, was owned and run by Sweden-based emerging markets startup operator, Saltside Technologies. With 140,000 listings and some 750,000 monthly visitors, Tonaton.com is particularly popular among Ghanaians for used Car Listings.

Jiji has shown interest in the used car listing space recently, with its acquisition of Cars45. It also bought out OLX, making it an interesting couple of years for Jiji, and with all that activity, you’d be forgiven for thinking that there’s no big play left in their playbook anymore.

You couldn’t be farther from the truth, says Jiji’s CEO and co-founder Anton Volianskyi. In the company’s press release, he was clear that the company is aiming to solidify its place as the regional leader. “Jiji is the largest e-commerce company in Africa by GMV (more than US$10billion), leading in small to high-involvement key categories such as cars and real estate…the picture is much larger.”

While Jiji is gearing up for domination, OLX quietly closed its South African operation and its parent company, Naspers, will focus its attention instead on Property24 and AutoTrader. Need I say that the classifieds business is not for the faint of heart?

While that’s playing out, one problem seems to be snowballing out of control in Nigeria…

Nigeria’s bank phishing scams are becoming audacious

On December 22, 2021, almost a month before Nigeria lifted its Twitter ban, *Tunde, frustrated at having his Zenith Bank account debited for a Netflix subscription he had already cancelled, tweeted his dissatisfaction. In minutes, a ‘Zenithbankplcng’ handle responded, asking him to send a DM for issue resolution. The account asked for his account number with the bank and his debit card number and in under an hour, the phishers had stolen N20,000 from his account.

Tunde’s experience is shared by over a dozen people who shared similar stories with me. While the amounts that they lost varied, the methods remained the same. While phishing scams are not new, they’ve become widespread on Twitter, first because many banks stayed off the social media platform during the ban. Their absence allowed thousands of desperate customers who had pressing issues to resolve to fall prey. Since the end of the Twitter ban, the phishers have only become more brazen.

*Janet shared with me a recent attempt by one of such fake handles to defraud her after she tweeted about having an issue with her bank. She received this link which led to a Google Form that asked for her bank and card details.

While we wait for more comprehensive action from the banks on this scourge, I’ll reiterate a message you should remember at ALL times: Your Bank would NEVER call, SMS or e-mail requesting your card details, PIN, Token codes, Mobile/Internet Banking login details or other account information. If you receive such messages, please DO NOT respond.

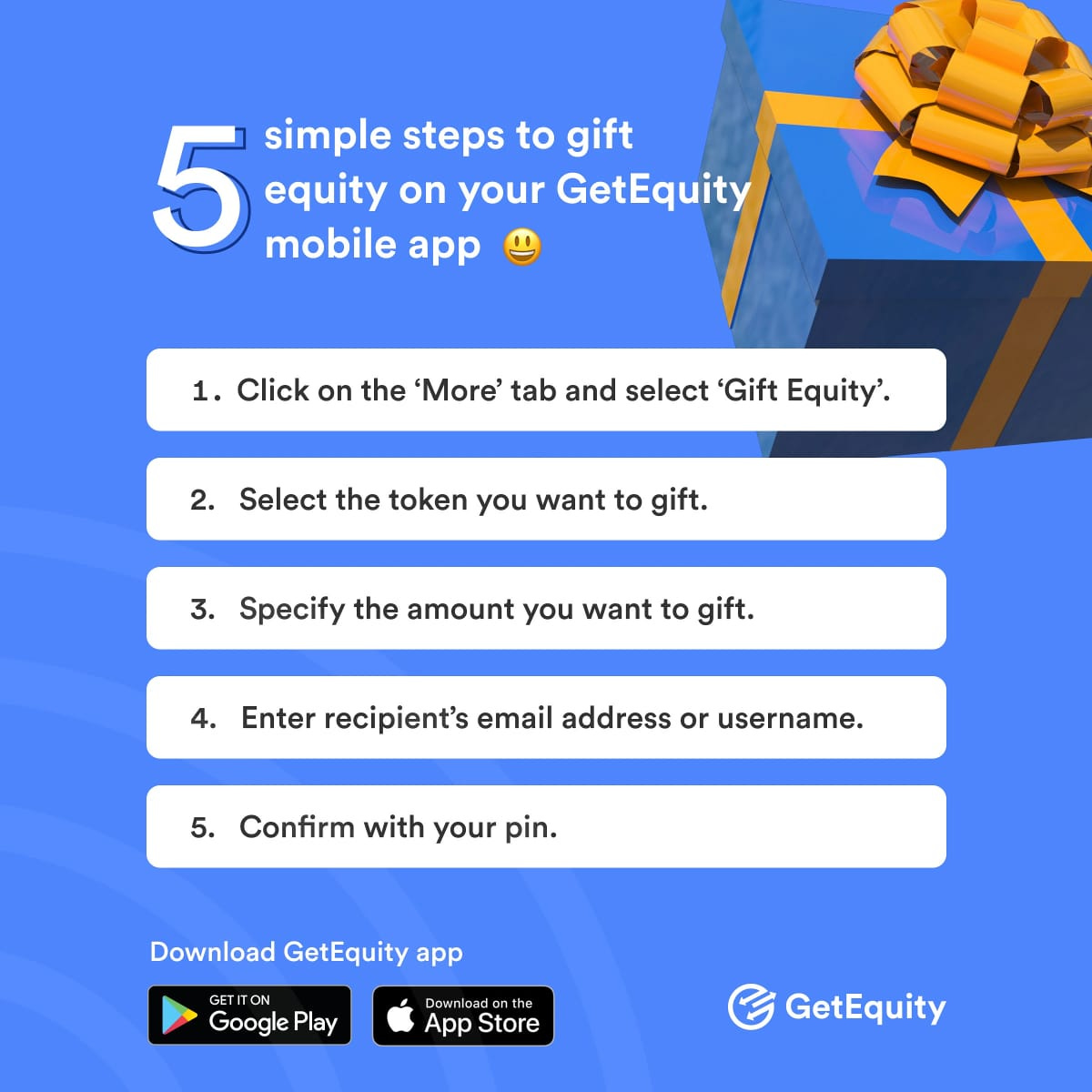

TOGETHER WITH GETEQUITY

UP YOUR GIFTING GAME THIS VALENTINE

What’s something of increasing value.

Something that says "I care about your future"...

Now, here's an idea: how about equity as a valentine's gift?

This valentine, gift your lover something they've never received before - a token in their favourite startup on GetEquity. Ready to win partner of the year? Set up the perfect Valentine's day gift now.

The long road to LagRide

The decision of the Lagos state government to ban okadas and tricycles in early 2020 still remains a talking point when transportation is discussed in Nigeria’s mega-city. But the government’s dance with the taxi-hailing companies like Uber and Bolt isn’t referenced half as much, despite the uncertainty it created. In March 2020, vehicles belonging to taxi drivers on Bolt and Uber were impounded in Lagos, over claims that they did not have Lagos State Drivers Institute (LASDRI) certification.

While the government was playing hardball with Uber and Bolt over registration and fees, a government-backed ride-hailing company, Ekocab, launched. Here’s an excerpt from one article at the time of Ekocab’s launch:

“The launch of Ekocab comes a month after a ban on motorcycles and tricycles in Lagos. Some Lagosians are implying that the timing of Ekocab’s launch is suspicious. Many believe it is an attempt by the government to have a monopoly on ride-hailing in the state.” - TechCabal

While Lagos state and ride-hailing services eventually agreed on a ‘road improvement levy’ of ₦20 per trip, Ekocab became a forgotten partnership, perhaps because of the backlash or the bad optics. Today, the events of 2020 are behind us and the government is launching another ride-hailing service called LagRide. It’s tempting to think of it as the same, but there are some differences between LagRide and EkoCab.

Unlike EkoCab, LagRide is not about digitizing the process for traditional yellow cab operators. Instead, it’s a partnership between the Lagos state government, and CIG Motor Co, which will supply the 1,000 vehicles that will be used. In fact, LagRide looks more like Moove and less like Uber or Bolt.

Under the hood: The LagRide vehicles, described by Governor Sanwo-Olu as a “socio-economic intervention programme,” is basically a vehicle-financing scheme. Drivers will apply through a cooperative society (with a ₦1000 fee to the Ministry of Wealth) and will own the vehicles after a four-year payment period.

One source close to the situation claimed that the Lagos State Employment Trust Fund (LSETF) will provide the 20% down payment for the vehicles to CIG. Over a four-year period, drivers will repay the entire sum; it is unclear what the interest rates are. The arrangement means the Lagos state government carries the risk of the scheme; the vehicles cost N9 million (SUV) and N5 million (Sedan) respectively. But the government will argue that the cars come with 360-degree cameras and that drivers can remotely be denied access to the cars if they default on payments.

Who manages LagRide? Governor Sanwo-Olu assured that “LagRide will be professionally managed in line with global best practices,” although he refused to name the company involved in managing the process. One source told me that Ibile Holdings, the investment company of the Lagos state government, will manage LagRide and, in partnership with LSETF, collect repayments from drivers.

There are lots of questions around the capacity of Ibile Holdings to manage LagRide, and the company’s website, which may help answer some of the questions, was down at the time of this report. Nonetheless, it’ll be interesting to see if the government can get this off the ground in the six-month timeline provided. With 1,000 cars provided by the government and reportedly no down payment required by the drivers, it’s tempting to predict that the process will be riddled with corruption. But let’s not jump the gun, we’ll be back to examine progress in six months.

What I’ve been reading:

“The city took time to get used to. You had to learn to love it without makeup, puffy-faced…” is how this lovely short story had all of my attention.

Can you change your personality? This writer shared her attempt at trying to and it makes for good reading.

I’m a sucker for good interviews and this short one has one of my favourite rappers, LadiPoe, as its subject tickles me.

The Netflix documentary, The Tinder Swindler, is the talk of social media, so I thought it would be apt to give you a throwback to the feature story where it all really started.

What was it like to be the first Nigerian to study at Eton, one of the most exclusive private schools in the world? The answer will leave you reeling.

See you on Sunday when we’ll be bringing you another story on Emefiele and a Notadeepdive exclusive on another regulator. Be sure to leave a comment.