Myth busters: Are Nigerian Legacy companies losing talent to Startups?

On Nigeria's talent war and Jiji's aggressive expansion

Today’s newsletter is brought to you by Turbosend and GetEquity. Turbosend allows you to send money from the USA to Nigeria for free.

GetEquity allows you to invest in some of Africa’s most promising startups, ensuring you can own the next startup unicorn. Learn more about GetEquity here.

If you missed last week’s newsletter, catch up here. Also, don’t hide a good thing, share the newsletter with your friends or your office Slack channel!

TOGETHER WITH TURBOSEND

Turbosend allows you to send money to Nigeria from the USA for free! With Turbosend, you will no longer have to pay up to $10 every time you want to send money to Nigeria.

Sign up here to join the waitlist and get access to Turbosend! Don't leave your friends behind - share the good news with them so they can send money to Nigeria for free with Turbosend!

Jiji continues to expand quietly

Since the great e-commerce wars that saw two of Africa’s biggest e-commerce giants—Jumia and Konga—face-off, interest in online retail companies has waned. These days, the focus has shifted to more sexy business models like checkout pages, niche marketplaces, creator economy tools and small business services that boost social commerce.

But while attention gradually shifts to that theatre, the classifieds website, Jiji, has been able to keep expanding its business with very little media attention. While the business launched in 2014 at the height of the popularity of classifieds like OLX and Dealdey, it has outlasted other businesses in its category.

Jiji is a horizontal classified: a marketplace that caters to multiple categories, from building materials, furniture, electronics, real estate to cars. It makes money off advertising from premium listings. This differentiates it from vertical marketplaces like Jobberman (for vacancies), Spleet (for housing) and Autochek (for automobiles).

In the last three years, Jiji has been on the expansion path, tweaking its business model to capture a greater share of revenue flowing to verticals like those listed above. It made its first move in 2019 when it bought OLX’s online assets in Ghana, Tanzania, Uganda and Kenya for a rumoured estimate of $1.5 - $3.4 million, making it Africa’s biggest online classifieds by geographical spread. Last year, it made an ambitious acquisition of Cars45.

But Jiji is not done with its expansion. This week, Ghana’s largest marketplace, Tonaton, told its customers it was entering into a strategic partnership with Jiji. A curious part of this ‘partnership’ is the transfer of customers' personal data to Jiji.

While Tonaton didn’t explicitly mention it was being acquired, it is not the wildest assumption to make seeing as it is turning over customer data to Jiji and will adopt the latter’s privacy policy. I sent an email to Jiji but the company said it won’t not be taking any questions until next week. You can only imagine what that announcement is.

What’s the method behind Jiji’s madness? As a horizontal classifieds business, Jiji draws in users easily because it has a bit of everything. With thousands of listings, Jiji rivals Jumia as the place to shop, even with no payments feature or shipping support.

Yet, this generalist approach has its disadvantages. For one thing, the platform has limited usefulness once a customer has found the contact of the person who listed the item they’re looking for. You go up on Jiji, see a car you want and get the number of the seller. Every other thing happens outside the platform, including payment.

But the experience is different with verticals like Autochek, Spleet and Jobberman. These platforms cater to a single category of need and provide an end-to-end commercial experience. When you see an ad for a car, a job, or a house, these platforms do not list the ad, you’d have to sign up to apply, and if you ever have to pay for anything, it happens on the platform. You never have to leave until absolutely required.

Jiji’s new strategy is an outlook of a horizontal and vertical classifieds business. In buying Cars45, it acquired one of Nigeria’s two trusted car listing services, which also had the value addition of inspecting used cars. In OLX, it got the advert information of thousands of sellers, replaced and got the traffic of a popular brand that had a presence beyond Nigeria, making regional expansion easy.

So with a presence in Ghana, why is a Tonaton ‘partnership’ important? “In Ghana, Jiji is more popular for real estate and property listings,” Helena, who lives and works in Ghana, tells me. “Tonaton lists everything but most people go to their website to search for cars.” It looks like Jiji is replicating the horizontal and vertical mix in Ghana like it’s doing in Nigeria, with the belief that real estate and car listing is the magic sauce for increasing profitability. It also sets up interesting competition in the car listing space, given AutoChek’s expansion to Ghana in 2021.

TOGETHER WITH GETEQUITY

Vendly is a platform that makes sending and receiving money possible with only your social media handle. It means you can send me money without the pesky process of asking for my account number.

Sounds fascinating? Then you should know that you can invest in Vendly and own equity in the company with as little as $10. Download the GetEquity app now to invest in Vendly.

The data says legacy companies shouldn’t be worried…yet

Let’s play a drinking game: take a shot of tequila whenever a founder/CEO tweets about how difficult it is to find ‘talent.’ If you’re lucky, you’d be drunk before 7 pm. But away from trying to get you drunk, companies are finding that there’s a global competition for talent. Last year, a Canadian firm reportedly poached an entire department of a Nigerian bank. Those workers were offered multiples of their former salaries and the option of working remotely, two things the bank could not compete with at the time.

Nigerian banks, which continue to employ large numbers of people, are reacting slowly to the global talent war. While they maintain a talent pipeline through their graduate trainee programs, entry-level salaries at many of these banks have remained unchanged for at least a decade. It may explain the conversation I got drawn into on my timeline last week. A few recruiters and HR practitioners claimed startups are now poaching talent from banks and other multinationals at an increasing pace.

It was a big claim and it seemed unfair to hold a position without any data to back it up. So, with a little time on our hands, and thanks to Google Forms, we set out to test this claim, putting out a survey that got 131 responses. We limited this survey to people who have changed jobs within the last two years.

Where did people move from? In the last two years, 33% of respondents have worked at Nigerian Startups, 19.8% at Multinational Organizations,16.2% at single owner (One-man) Businesses, 14.4% at Banks and 6.3% at Global Startups.

Where are they now? Almost half of the survey respondents (44.1%) now work for Nigerian Startups, 30.6% work with Multinationals, 18% for Global Startups and 6.3% are with Banks.

The data also shows that around a third of respondents that had worked for Banks now work with Startups. Almost half of those who had worked at multinationals quit and moved to Nigerian and global startups.

Majority of respondents (75%) who worked for single owner businesses now work with startups, while more than 80% of those who worked at startups switched careers at other startups.

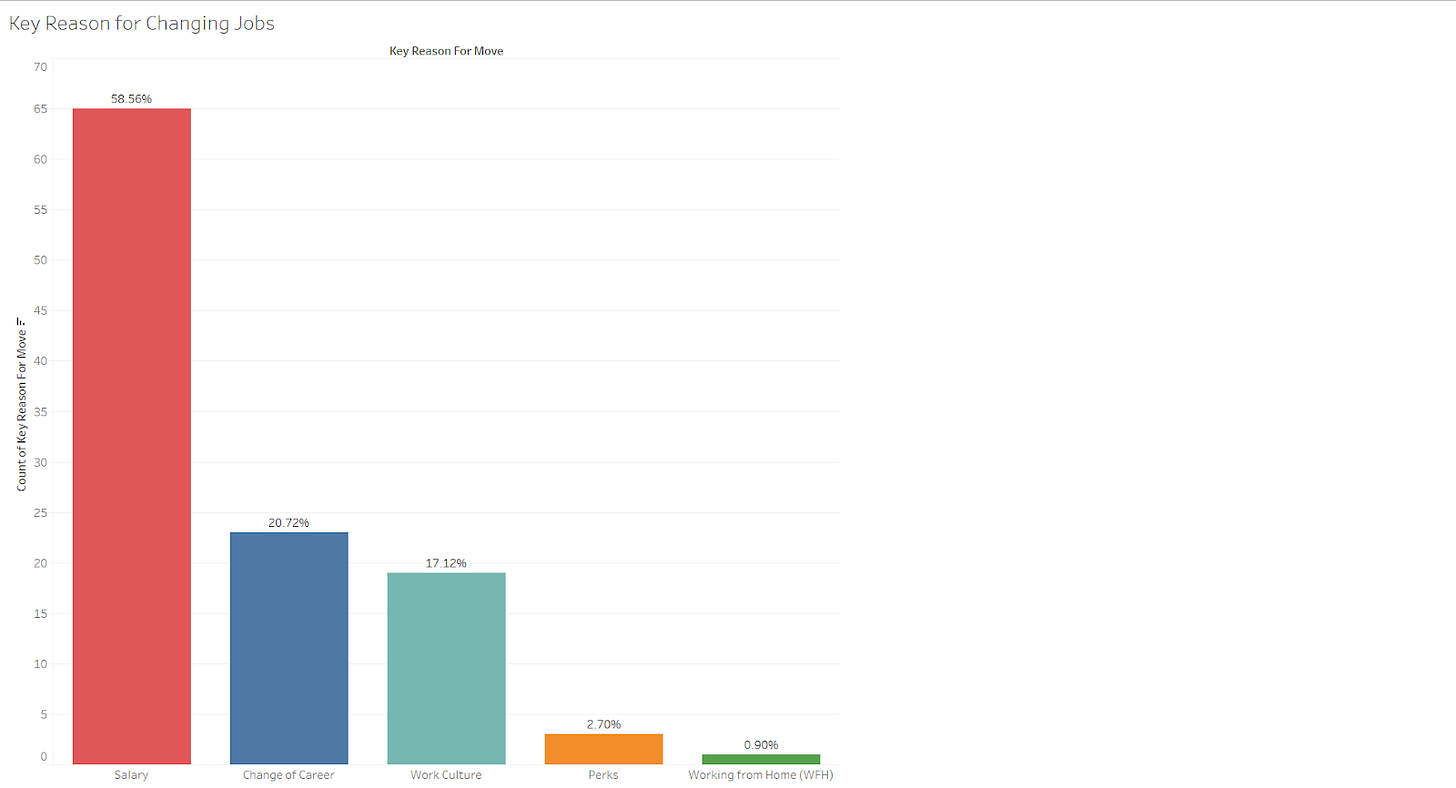

Why are people moving jobs? For most people, their job change was influenced by financial reasons. But around 17-21% of respondents said they switched jobs for workplace culture and career pivots respectively.

Mid-Level workers represent a majority of the folks at the career revolving door: Around 55% of survey respondents who had changed jobs within the last 2 years had between 2-5 years of work experience under their belts. 19.8% had 5-8 years of work experience.

What job roles allow for mobility? The data showed that those in the *IT category still maintained or switched to other IT roles when changing jobs. Most people (35%) who make career changes often end up in this job category as well. Operations is another job category that is popular for people who are changing careers.

Can we reach any conclusions from this data? Talent mobility from legacy organizations to startups may be happening, but it’s certainly not at a pace we’ll describe as alarming. Sole proprietorships seem to be the type of companies losing workers to startups.

What we noticed instead is that people are more likely to move from startup to startup within the same roles. It’s also the same for multinationals where workers there move to other multinationals.

My thoughts: Startups can be great places to work, especially because they give you more responsibilities, promote you quicker and give you social proof for your work, making job mobility easier. But it’s not all Uhuru, startups also face their own struggles and it’s not uncommon to hear about an absence of structure or some struggles with timely payment like I reported a few weeks ago.

*The IT category includes jobs like business analysis, software engineering, products, data science, crypto, IT sales, software development/Quality assurance.

WHAT I’VE BEEN READING

Most of us think that most things are distributed, or should be distributed according to bell curves. This essay argues that we need to do away with that thinking.

I love journalism that is rigorous, and reports that do the work. One of the big stories from last year from you know who had factual inaccuracies about the origin of Boko Haram. So it was refreshing to find this report that unpacks, with rigour, the origins of Boko Haram.

Some of the commentaries around the coup in Burkina Faso this week has been about one question: is a putsch possible in today’s Nigeria? Part of that question is in this brilliant article by Alexander Onukwue.

In a week where there have been controversial Twitter conversations about immigrants, this essay says: “I was 12 or 13 when I started to associate the word “border” with violence.”

Please leave a comment and let me know what you think of today’s newsletter; see you on Sunday!

*Edited by: Abubakar Idris and Jimi Osheidu

Data analysis by: Eric Ekpenyong Effiong (It’s his birthday today!)

Hello, sign up yesterday and this is my first newsletter.

Great content driven by data on the Talent war in the tech industry, it seem like Banks are the biggest loser of talent in Nig, the train more through the Graduate program and loose More.

Thank you.