PalmPay, Moniepoint, and Moove: the media game behind fundraising

Silence breaks when the pitch begins

Why let your money sit idle when it can earn up to 21% annually?

With Yield by Credit Direct, investing is simple and rewarding. No stress, no noise. Just smart growth you can count on.

If you missed last week’s newsletter, catch up here.

Here’s today’s reminder that you can win limited edition Notadeepdive merch when you share, like, and comment on the newsletter. This week’s merch winners will be announced on Sunday.

When startups break their silence

PalmPay doesn’t talk much.

The consumer fintech startup is one of Nigeria’s largest by transaction volume, but it rarely shares numbers.

So it was surprising when PalmPay popped up on the Financial Times list of Africa’s fastest-growing companies in May 2025. It was second on the list, reporting $64 million in revenue. The FT doesn’t just take your word for it. They cross-check, validate, and generally make it difficult for anyone to cook numbers.

Last week, PalmPay gave TechCrunch even more information: market breakdowns, expansion plans, and performance metrics. It validated the whispers that PalmPay’s fundraise (which began in 2024, according to two people close to the company) is now in second gear.

And in Africa, even the most secretive startups start to talk when they’re raising money.

Most startups take their status as private companies seriously. They won’t share revenue. They don’t talk about margins. If you email them about anything, you’ll get a PR-sterilized line about “being focused on execution,” or nothing at all. They don’t owe you disclosures.

But when they’re in the middle of raising money, something shifts. The media becomes useful because these companies understand that momentum is part substance, part signal.

And nothing signals like a nice headline in TechCrunch, Bloomberg, or the FT. For a brief moment during the fundraising cycle, the private startup becomes partially public.

The aim is to get their name out, showcase traction, and craft a version of the future that is fundable.

This need to create perception is crucial. Growth capital is scarcer, investor risk appetite is shrinking, and the “Africa Rising” narrative that once fueled bullish funding rounds is outdated. Storytelling has to work harder to find opportunity in uncertainty and convince capital that a local startup can scale globally.

In 2021, Bloomberg reported that Moniepoint was raising $150 million at a $1 billion valuation. It eventually raised $50 million at a $400 million valuation in 2022. The unicorn status didn’t happen until 2024.

The fundraising media circuit is not just about what is, but about what could be. You float the valuation you want, see who bites, and hope the story becomes reality.

And even after the money lands, the stories don’t always stop.

On Tuesday, TechCabal reported that two Moniepoint employees cashed out billions of naira through the company’s ESOP. It read like a feel-good moment: employees winning, the company maturing. But by Thursday, The Condia published a different kind of story: a former employee suing Moniepoint, claiming he was shortchanged of nearly $900,000 in stock options.

Coincidence? Maybe. But more likely a narrative play. When private companies choose to talk, it’s rarely random. They’re not big on transparency, so anytime they willingly share, assume there’s a reason, and that reason is usually the pitch.

Moove: A Story Rewritten

Then there’s Moove, the startup that began by financing cars for Uber drivers in African cities.

The idea was simple: drivers get an affordable car a.k.a. a Suzuki (those silver ones that now feel like background furniture in Lagos) and repay the loan as they drive. The concept had traction, and Uber invested. This stuff was going to the moon!

Then a string of tough breaks interrupted the momentum.

Currency devaluation in Nigeria and Ghana made car imports expensive and ride-hailing economics, already shaky, almost fell apart. Drivers struggled with repayments and journalists asked questions. The model looked doomed.

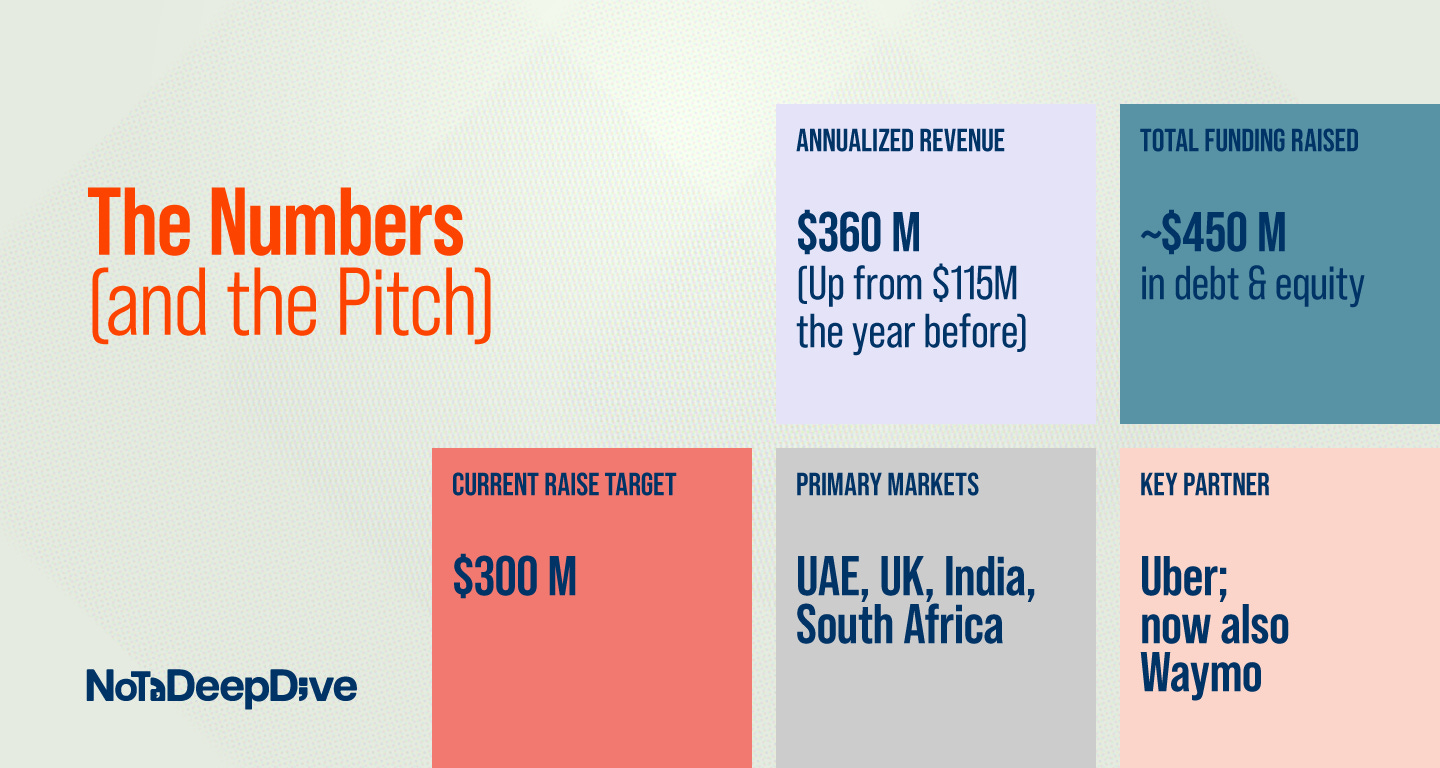

At that point, most startups would “de-risk” their Nigerian exposure. Moove went the whole hog. It expanded to the UAE, India, South Africa, and the UK. By 2024, it was managing fleet operations for Waymo, Alphabet’s self-driving car arm, and by 2025, it claimed profitability in four international markets.

In an interview with Rest of World, co-CEO Ladi Delano put it plainly:

“You have lots of import duties on new cars… banks are rightly skeptical about expanding their loan books to include ‘problematic’ consumer segments of taxi drivers.”

It is now based in Dubai, generating revenue from Waymo and angling for a $1 billion valuation as it looks to raise $300 million. The African origin story still exists, but it’s no longer the headline.

Moove has become a fundraising machine and a poster child for narrative reinvention.

At a conference I attended in Uganda last year, two separate investors pointed to Moove as one of the few African-linked startups that had “figured it out.”

We’ve long told African startups to chase USD revenue, expand globally, and find scalable models beyond domestic pain points. Moove has done that.

But what its foremost achievement is recasting itself in a story global investors want to hear.

That’s the real pivot. Not the geography. Not even the business model. The storytelling.

The Africa Rising pitch doesn’t land like it used to. So startups like Moove are learning what Eneke the bird taught us:

“Since men have learned to shoot without missing, he has learned to fly without perching.”

If the old story is outdated, write a new one.

Questions Without Easy Answers

What happens when storytelling becomes instrumental, rather than cultural? When disclosure exists to raise capital, not build trust?

What does it do to credibility when results lag behind the media momentum? Can startups maintain investor belief without a tradition of transparency? And as journalists join the storytelling teams at these startups, can they shape the narrative or just protect it?

If you enjoyed this newsletter, please like, leave a comment or share!

See you on Sunday!

I’m commenting because of Merch oh!!!

great stuff muyiwa