Pulling paywalls

What will Africans actually pay for?

If this newsletter was shared with you, subscribe here for free:

TOGETHER WITH CREDIT DIRECT

Think of the last time you had to juggle five different apps just to do the basics with your money. Send here, receive there, pay bills somewhere else, and then another place to grow it. Exhausting.

That is exactly why we created the Credit Direct App. One home for your money, where ease is not a feature but the standard.

What’s worth paying for?

Within six days of each other, two smart independent newsletters, Frontier Fintech (focused on tech) and Communiqué (a media outlet), pulled down their paywalls. While the timing is probably a coincidence, it prompts a crucial question: what is the average African audience willing to pay for? If these savvy independents are opening the doors to non-paying readers, then what exactly will African audiences pay for, and how should creators design for that reality?

While subscriptions have become the respectable answer to media’s revenue anxiety in America, the model remains largely unproven in Africa.

Outside the U.S., paid media is effective, typically where three key factors are present: habit, painless billing, and bundles that offer value. Europe, parts of Asia, and Latin America show versions of this. The question for Africa isn’t “can subscriptions work?” It’s whether we’ve built the preconditions: daily reading habits, smooth local payments, and bundles people open without thinking.

Two things most people agree on:

(1) Over the last two decades, brands have been able to reach consumers directly through Meta/Google, breaking the mass distribution and advertising monopoly that news media publications enjoyed for decades until the 1990s. This disruption is directly responsible for the reduction in ad revenue for media publications.

(2) One increasingly popular way for news media companies to generate needed revenue is by charging a subscription to their content. The New York Times, the archetype, perfectly demonstrates this model, with nearly 12 million subscribers— digital-only readers form the bulk of its subscribers. Its readers are drawn not just to the quality of the news information, but also bundled products such as Games, Cooking, podcasts, and The Athletic, its sports publication, all of which nurture reader habits that improve predictable cash flows from the business.

The rise of the subscription model has made platforms like Substack important. The platform now claims roughly 5 million paid subscriptions across its network, putting it above WashPo (2.5M) and WSJ (~4.5M), and all signs point to continued growth.

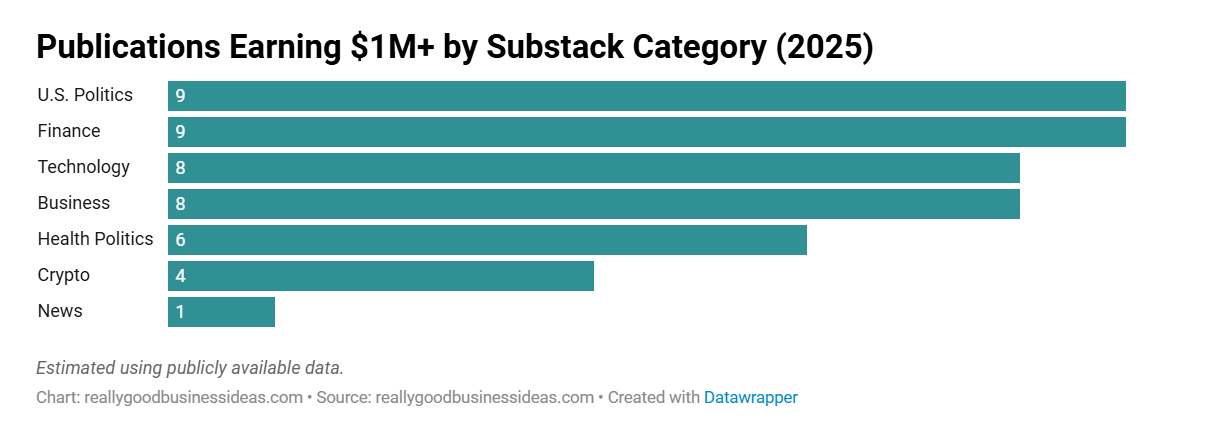

One recent compilation showed that about 45 Substack publications earn $1m+ Annual Recurring Revenue (ARR). Most of those publications are run by U.S. writers and concentrated in a handful of categories. It’s proof of the idea that there is real money in independent journalism, at least in markets with deep wallets.

Another U.S. advantage is creator portability: big-name columnists and TV faces can attract audiences when they become independent and set up paywalls. That exists here too, but for a far smaller set of names.

So if Substack and American journalists have shown you can build a media publication on the back of paid subscriptions, why is copying and pasting this playbook not delivering similar results elsewhere?

One reason is that building a sustainable media business on Substack is tough. The platform’s “going paid” guide advises that only 5–10% of a creator’s total readers will realistically become paid readers. But the reality is closer to ~3%.

“Over the last year, about 90% of our revenue has come from sponsorships and advisory, while subscriptions contributed less than 10%, even as we surpassed 100 paid subscribers. Sponsorships (especially Pan-African B2B partners) and bespoke advisory are growing faster than subscriptions.” - Frontier Fintech

Quick (hypothetical) math: With 5,000 free subscribers, that’s 150 paying readers. At $5/month, you earn $750/month (before fees and churn). To hit $5,000/month at the same price and conversion, you need ~33,000 free readers.

The math is a lot better if you raise the pricing to $10 per month. Yet at that pricing, it will take masterful juggling of showing people a mix of free and paid content to continue to grow your audience.

“Creators have to produce an incredibly high volume of both free and paid content in order to grow their businesses. If you don’t produce enough free content, then you’re not expanding the top of your funnel. If you don’t produce enough paid content, then you’re not doing enough to service your subscribers.” - Simon Owens

In Africa, subscriptions run into unique friction: fear of recurring debits, ensuring your card can make the USD payments, and a near-absence of a corporate expensing culture for niche media.

Editor’s Note: Nigeria had a newspaper-reading culture, but not a buying culture. At the peak, newspaper sales numbers were modest—industry snapshots put combined daily sales at ~570k in 2003, slipping to ~290k by 2009—and the newsstand habit of “read without buying” did the rest. In a country of 200 million people, it suggests that institutions paid while individual consumers mostly didn’t, an offline pattern that moved online.

Yet, it’s not all bad news. Reader revenue has worked in a few pockets in Africa:

South Africa — Media24, publisher of News24 and Network24 reported ~212,000 paywall subscribers by March 2025, although it said the growth in subscription revenue has not made up for falling ad revenues. Daily Maverick’s Maverick Insider has ~30,000 members, whose subscriptions contribute up to 40% of total revenue.

Kenya — Nation Media Group, publishers of the Daily Nation, put up a paywall in 2021 and claimed subscription revenues of $200,000 in the first year on the back of 21,000 daily paying users. While it doesn’t disclose its number of paid subscribers, it claimed they grew 100% in 2024.

B2B intel — Africa Confidential ($1,429 p/a) and Africa Intelligence ($6,437 p/a) have charged institutional prices for decades because they sell workflow-critical intelligence.

Back to our two independents with recent paywall removals: Frontier Fintech says ~90% of revenue came from sponsorships and advisory, <10% from subscriptions, so they opened up to grow the top of funnel for the revenue lines that actually move. Communiqué notes the paywall created a small, loyal core but “narrowed our reach,” so they’re prioritizing scale and community. The commercial logic makes sense.

When we strip the sentimentality out of “supporting good writing,” the pattern across most African markets suggests readers pay for two things:

Tools — Operator memos, regulatory explainers, market maps, data packs, vendor shortlists, hiring pipelines, training. Things a team can expense because they save time or reduce risk.

Tickets — Office hours with operators, curated intros, serious hiring channels, off-record briefings, and status they’re happy to claim publicly.

Everything else— $5/month analysis—is either a signal (“I like this writer”) or a luxury habit (more common in South Africa, and still not enough on its own).

In the U.S., a Times/WaPo/WSJ sub is also a tribal marker. It’s also a bundle of practical habit loops (crossword, apps, alerts, The Athletic) that keep people paying. Ideology + identity + habit + bundle is a potent flywheel.

Journalists like Eric Newcomer have crossed $1m with a mix of subscriptions and events.

In most African markets, audiences are smaller, billing is messier, and there’s no equivalent bundle to drive undeniable value. As a Lagos/Accra/Nairobi-based creator, who can’t import the identity politics of America, the bundle that may win still seems like sponsorships, events, and ad revenues. The lesson isn’t “you can’t do this here,” but without a larger mass with disposable income and an entrenched newspaper-reading habit to build on, the bar to justify subscriptions is a lot higher.

See you on Sunday! Don’t forget to follow us on Instagram.

So basically, poverty

Nice article. I would also add that disposable is low to non existent, data cost is high and most times, free alternatives albeit diluted in quality are readily available.