The League table

Form, finance, and fortune collide

Friday’s newsletter was a no-show because of a few fact-checking delays, so expect an off-schedule newsletter during the week. If this email was forwarded to you, subscribe here for free:

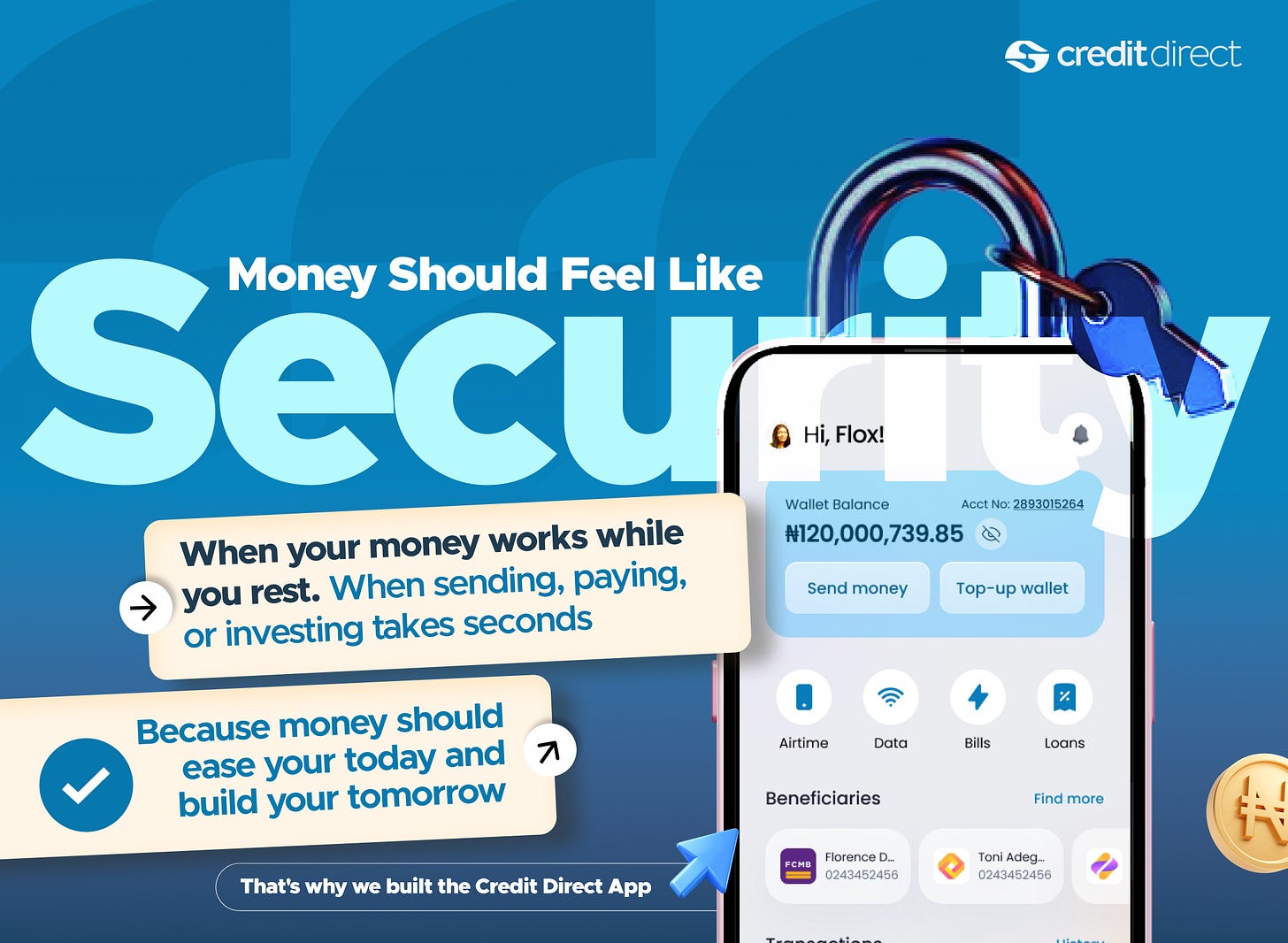

TOGETHER WITH CREDIT DIRECT

Security is not just about keeping money safe.

It is about knowing your money is working, growing, and moving with ease whenever you need it. That's what you get with the Credit Direct App.

Form, finance and fortune

Depending on this weekend’s results, the Premier League may or may not be your favourite topic right now.

If you’re not the biggest football fan, don’t fret, I’m not either (this may or may not have anything to do with my team’s recent performance). You want to stick around so the raucous Monday conversations in your office make perfect sense. Regardless of what you think of football, there’s no doubt that it often swallows the weekend.

I had some doubts about another comp-type weekend, then I played an interactive game on the Financial Times about running a football club and decided to give it a go.

Football is a mirror: form, finance, and fortune collide like in the startup world.

In week two, the narratives continue: Will the once-inevitable Manchester City figure out this new rebuild? Will Arsenal, who have started pretty strongly, be runners-up once again, even as they swear they could have won the Champions League if they had magically appeared in the finals and faced Inter?

Manchester United are hoping a second season under a new manager will move them towards the kind of success that has been elusive for a decade. And Liverpool are rebuilding frenetically like they aren’t defending champions. Talk about fixing what ain’t broken.

Anyway, let’s get to the comparisons. This is all lighthearted humour (my editor made me add this). Feel free to argue, swap picks if you must, and tell me who has been criminally overlooked.

Manchester City → Moniepoint

Serial winners, unicorns, once invincible. Now competition is everywhere, and there’s pressure to deliver another title-grade release. Is it international expansion, remittances, or SaaS/inventory management? Whatever it is, it’ll make headlines, hopefully without 115 FFP charges.

Arsenal → Paystack

Several seasons among the elite after a unit-economics era. But that’s not enough. Now comes a big swing with Zap, its B2C play. Is this the leap to glory, or a near-miss?

Liverpool → LemFi

Champions with forward thrust, but instead of coasting, they’ve doubled down: Champions with momentum, but instead of coasting they doubled down: Series B raised, Pillar acquired, a fresh look to the attack. Win again while upgrading the squad. Solid plan.

Chelsea → Yassir

Deep pockets, big squad, and an appetite for everything: ride-hailing, food, and payments. The pieces are there, but can they turn the sprawl into title-winning consistency?

Manchester United → Jumia

Old glory, Africa’s first unicorn. But recent years are doctrine, new coach, new promise of profitability. Amorim or Francis Dufay — can either deliver? How long does the brand live on legacy?

Newcastle United → Flutterwave

Spent big, and now eyeing international success. The new focus is governance, product harmony, and profitability. Still always a magnet for drama.

Tottenham → PiggyVest

Which is more difficult: negotiating with Tottenham chairman Daniel Levy or breaking your Piggyvest safe lock? Enough said.

Aston Villa → Credit Direct

Flew under the radar for a while, committing to staying up and competing. For the last three years, it’s shown it belongs in the big six, playing in Europe and winning respect. No longer a surprise package; they’re part of the club.

M-KOPA → Bournemouth

A clear, high-tempo system. M-KOPA was on FT’s list of Africa’s fastest-growing startups with 65% YoY revenue growth in 2024. It’s now trending toward a $500m run-rate. They really belong.

M-Pesa → Nottingham Forest

Giants at home with an unassailable model. Its Ethiopia expansion is raising questions about whether the dynasty scales beyond its city grounds. Anyway, home form has delivered great success, so why question it?

Crystal Palace → Andela

Pipeline merchants: Palace minted Eze/Olise; Andela minted engineers, then evolved into a marketplace, hit unicorn status, and now exporting the impact you feel on rival “pitches.”

Brentford → Wave

High-IQ disruptors that make giants sweat. Wave pressed telcos with near-zero fees and brought a unicorn shock in 2021 and raised $137m more this year. Will always be taken seriously.

Brass → Everton:

Once an investor darling, now known more for belt-tightening and a bruising layoff cycle. Still alive, still serving users, but the story is less about dominance and more about survival in a harsh market.

Brighton → Chipper Cash

Looked like fine seafood on the menu: unicorn funding, super-app promises. It served something more modest. Still tasty, still valuable, just not the feast the hype once predicted.Fulham → TymeBank

Turned up for a sprint, found out it was a fun run, and still finished mid-pack with a record haul. Calm, steady, profitable growth and continental expansion without the chaos.

I’ve made my picks, but I know you’ve got better ones. Who’s missing from the squad?

If you missed previous comps, catch up here and here.

See you mid-week!

Always refreshing to read your comps.