Water in a basket or a hedge against inflation?

Are foreign stocks really a hedge against Naira inflation?

Today’s newsletter is brought to you by GetEquity.

GetEquity allows you to invest in some of Africa’s most promising startups, ensuring you can own the next African startup unicorn. Learn more about GetEquity here.

If you missed last week’s newsletters, catch up here and here.

Also, when was the last time you shared the newsletter? Don’t be a shadow partner, do it for Capua.

How popular are investment apps in Nigeria?

Mixed fortunes are so routine in startup investing that the iconic quote, “it was the best of times, it was the worst of times,” might as well be the opener for a textbook on business. In the same year that the share price of Robinhood—the startup that popularised fractional investing— is in free fall, a similar startup in Nigeria, Bamboo, is enjoying the spotlight. This week, Bamboo, which allows Nigerians to buy foreign stocks with as little as $10, raised $15 million.

The fundraising round was led by Tiger Global, a VC firm famous for writing cheques quickly. In Q1 2021, Tiger Global funded 60 companies worldwide, averaging four deals per week. In the middle of that blitzkrieg, it backed Robinhood and later, Public, a rival startup. It’s fair to say that Tiger is big on retail investing startups.

While the size of the opportunity for retail investment in the U.S is clear and was especially boosted by the pandemic—Robinhood posted $363 million in revenue in Q4 2021—the size of the Nigerian market is not as clear. With Bamboo and its competitors: Chaka, Trove, RiseVest being private companies, any hopes of figuring out their revenue is slim.

But here’s what we can figure out: how Nigerians use these apps, how much they typically invest and what their returns are. It’s especially interesting when you consider that one familiar trope is that every product and service in Nigeria is competing with food. We put out a survey that was taken by 68 respondents and the results make for a decent Friday conversation.

Nigerian retail investors are similar to retail investors in other countries. They’re young, mostly male, well educated and love growth stocks. The majority of our respondents (73%) are between the ages of 23-30 and have undergraduate degrees. They invest in stocks to grow wealth, save money and hedge against inflation.

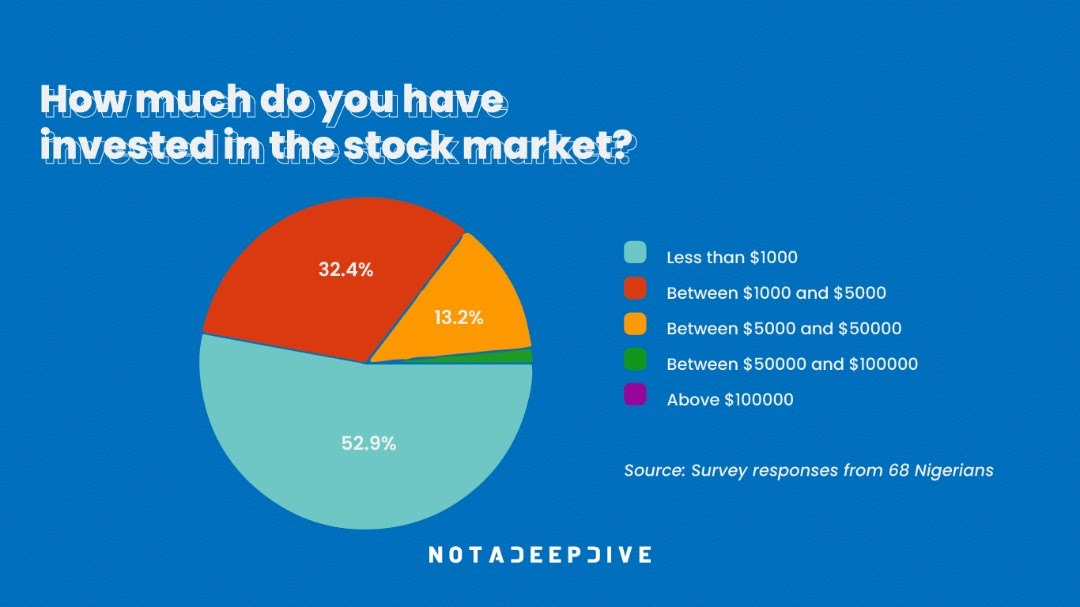

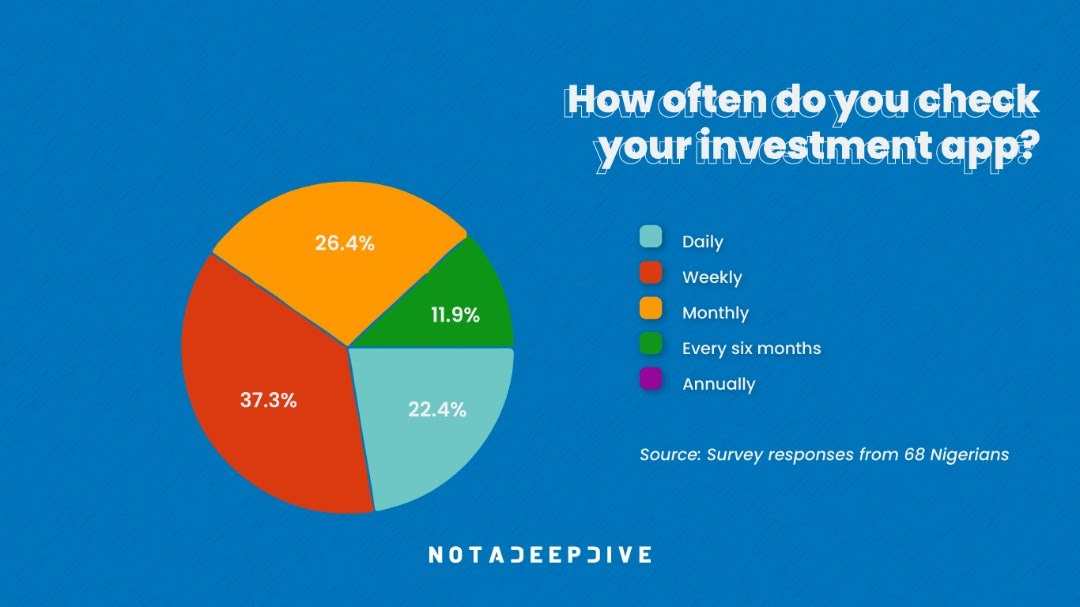

Many of our retail investors don’t have a lot of money invested in stocks, and half of the reported investment portfolios are worth less than $1000. Also, most of these investors check their investment apps often, one predictor of underperformance. The majority of our respondents underperformed the major indexes in the past year.

“Looking at your portfolio frequently can make you feel like it’s performing worse than it actually is, and the less likely you’ll invest correctly for long-term success. Excessive monitoring of short-term returns can lead to knee-jerk reactions and impulsive decision-making that doesn’t lend itself to letting your money grow over time.” - Dan Egan.

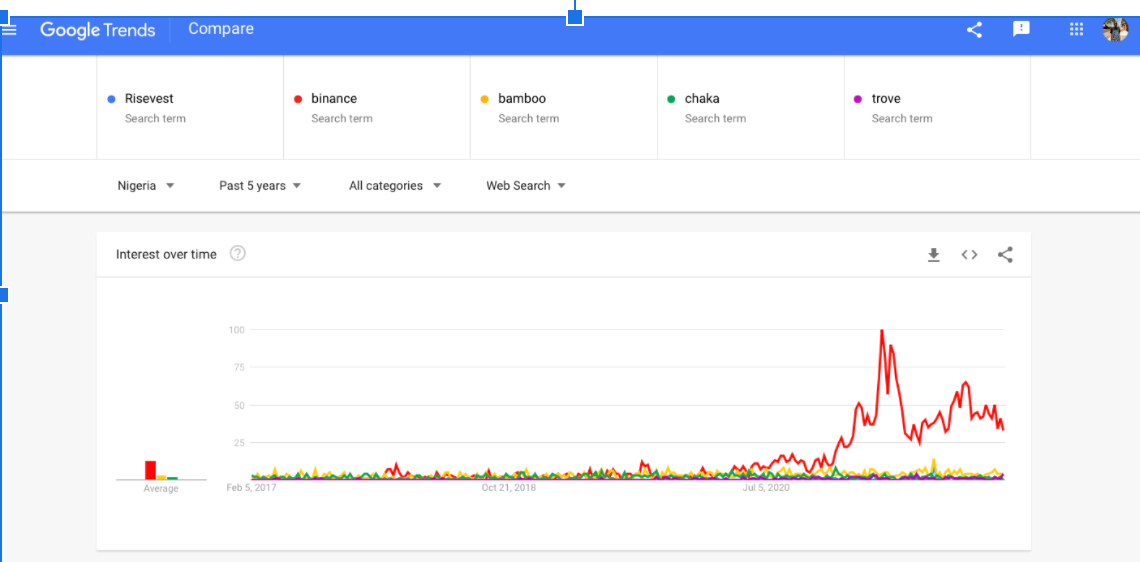

What retail investing startups lead the market? According to our survey which was distributed on Twitter and Whatsapp, Risevest was the most commonly used app by some distance—two-thirds of respondents use it. Bamboo came in as the second most-used app. However, things seem different in reality; Bamboo claims to have 300k users while Risevest says it has 100k.

Regardless of what both startups claim, there’s no doubt that Risevest is on the come up with users. One theory for its growing popularity is that it picks stocks for users, taking out the need to do their own research. Users also appreciate its excellent interface, and its array of investment options—bonds, real estate, etc.

Here’s something to consider: Almost all the time, apps or companies that pick investments for their customers underperform the market. This holds true for the US, Europe, emerging markets, the real estate market and the bond market.

Fees - Regardless of where you stand on picking stocks, one thing is common to all the retail investing apps in Nigeria: fees. Risevest charges up to 1.5 per cent on Naira deposits and up to 3.9 per cent on dollar deposits. If your investment yields between 10-15% in returns, Risevest then takes between 1.5%. Bamboo, meanwhile, has a raft of fees. 1.4% on Naira deposits, 2.9% on deposits with a USD card. They also take 1.5% when you buy or sell stocks, and then a fee of ₦45 or 45 USD when you withdraw your money.

Are people happy to pay these fees? For the most part, our respondents have no issues at all paying these fees. It’s a contrast to the commission-free investing that is the hallmark of retail investing apps like Robinhood and Trading 212. It’s worth asking when commission-free investing will become a thing in Nigeria. Yet, when we consider that Robinhood’s revenue is mostly from a process finance nerds call payments for order flow, it shows that commission-free trading is a long way from happening in Nigeria.

How much can these fees impact your investment? Even small fees can kill your investment returns in the long run. In the same way that money compounds over the years, fees can reverse compound, chopping off a huge chunk of your portfolio value after a few decades.

The bottom line – In the best case, Risevest and Bamboo have a combined 400k users. While these apps push a narrative of helping users avoid inflation by holding dollar-denominated assets, many soon learn that stocks are a slow game. The chance to make quick money will always be more appealing than the slow, steady gains of the stock market, hence the increased interest we’ve seen in crypto in the last few years.

While the promise of quick money almost never pans out, Nigeria’s economic situation will always see people lean towards it. The reality of the stock market remains a slow but steady long-term race where nothing exciting may happen for decades. Now try selling that to anyone.

TOGETHER WITH GETEQUITY

“Investing is a for the ultra-wealthy,” is something a few people may have said with the announcement that a prominent hedge fund, raised $11 billion for its latest venture capital fund this week. Some of that money would have come from pension and endowment funds. It’s easy to see why everyday people felt completely shut out from investing.

That’s why we created GetEquity, so that everyone can invest in some of the most promising startups in Africa with as little as $10. Check out the impressive array of startups you can start investing in right now.

Break out the cringe-worthy photo ops, it’s campaign season

Sunday’s newsletter: “Governance is over, it’s now campaign season,” could not have been more predictive even if it tried. Since we published that newsletter, we have seen this article on the Central Bank Governor titled, “The Godwin Emefiele I know.” The article comes at a time when there are rumours that the rice-loving Central Bank governor is eyeing a Presidency run. Here’s an excerpt of the article:

“The CBN helmsman has achieved this unparalleled and unprecedented feat through a single policy: The Anchor Borrowers Programme (ABP). Through his programme, Emefiele became a household name to millions of Nigerians who were hitherto forgotten and abandoned. He is now a friend of the silent majority of Nigerians who he rescued from the lethal fangs of abject poverty and squalor. Through ABP, he made them reaffirm their belief in Nigeria. He returned their self-esteem and self-worth by making them critical stakeholders in the socio-economic ecosystem in the country.”

But trust Nigerian politicians to not leave it to words only; after all, the going exchange rate is, 1 picture = 1,000 words. So, here’s Babajide Sanwo Olu, the governor of Lagos state, where 2 million children of school age are out of school, showing surprise and concern after seeing two such children on the road.

The games are only just beginning; expect to see more of these photo ops as 2023 gets closer!

What I’ve been reading

From Burna Boy to TV’s Big Brother Naija, Nigerian startups are spending millions on celebrity endorsements

This really short and sweet article on the responsibility matrix is bound to be helpful

Old but gold: the Nigerian writer, Igoni Barrett shares his writing journey. I think everyone should read this!

Meta Platforms a.k.a Facebook and sons Limited, has pulled the market downwards after losing $200b of its market capitalization in one day of trading

*Data analysis and editorial contribution by Obinna Onwuchekwa.

See you on Sunday!

Really enjoyed this piece. I think lots of millennials and GenZ need to understand why most of these investment Apps are really pushing. To me, they are all after the commission and fees they will get for that reason lots of VC firms will see them profitable to invest in. Just like you said stocks is slow game...only those that are patience will reap its benefits. Meanwhile I'm you will do a piece on the NGX... just read your view on it.

Cheers!