Will we get streaming wars again?

The reality looks more like a skirmish than a war

If you missed Friday’s Notadeepdive, catch up here.

If this newsletter was forwarded to you, subscribe here for free:

TOGETHER WITH CREDIT DIRECT

Nigeria’s inflation is easing, but not for everyone. Despite a third straight drop in headline inflation to 22.22%, food inflation rose sharply in June, especially in the South East and conflict-hit states like Borno.

Our June inflation report breaks down the uneven impact across regions and reveals growing pressure in food-producing regions, slower price increases in some states, and signs that insecurity and flooding are reshaping Nigeria’s inflation map.

Netflix’s last big Nollywood commissions are trickling out, leaving a $100‑million funding hole; two home‑grown studios gearing up to fill it. Can a pair of diaspora‑first streamers succeed where IrokoTV couldn’t?

On Friday, I knocked out all eight episodes of To Kill A Monkey, Kemi Adetiba’s slick new cybercrime mini‑series, on Netflix. It was fun and frenetic, and according to people in the know, it’s one of the last big‑budget Nollywood titles still trickling out from the streamer’s 2020–22 shopping spree.

That spree is basically over. Netflix and Prime Video have cooled on Nigeria; the films we’re seeing now are from deals inked years ago. When the remaining deals finish their crawl through post‑production, the cheques disappear with them.

It has pushed the industry’s most recognisable names to move to YouTube with a simpler playbook: lighter scripts, quick turnarounds, and total control of ad revenue + brand integrations. It’s similar to the 90s VHS era.

The upside is global reach and instant payouts. But the catch is that the cost per thousand impressions in Nigeria still hovers at $0.80–$1.20, so you need millions of weekly views to cover an A‑lister’s ₦4 m day rate. Discoverability is solved; unit economics are not.

“SVOD can’t work here” — Jason Njoku

“Between the revenues we generated and the $35 million in VC we raised, we spent $100 million trying to win. In 2023, we accepted there was no Nigerian market for paid premium streaming and exited.” — Jason Njoku, interview May 2024

Even after pivoting to higher‑paying diaspora subs in 2020, Iroko plateaued. Peak 2022 active users stood at 192 000 with Average Revenue Per User at under $10.

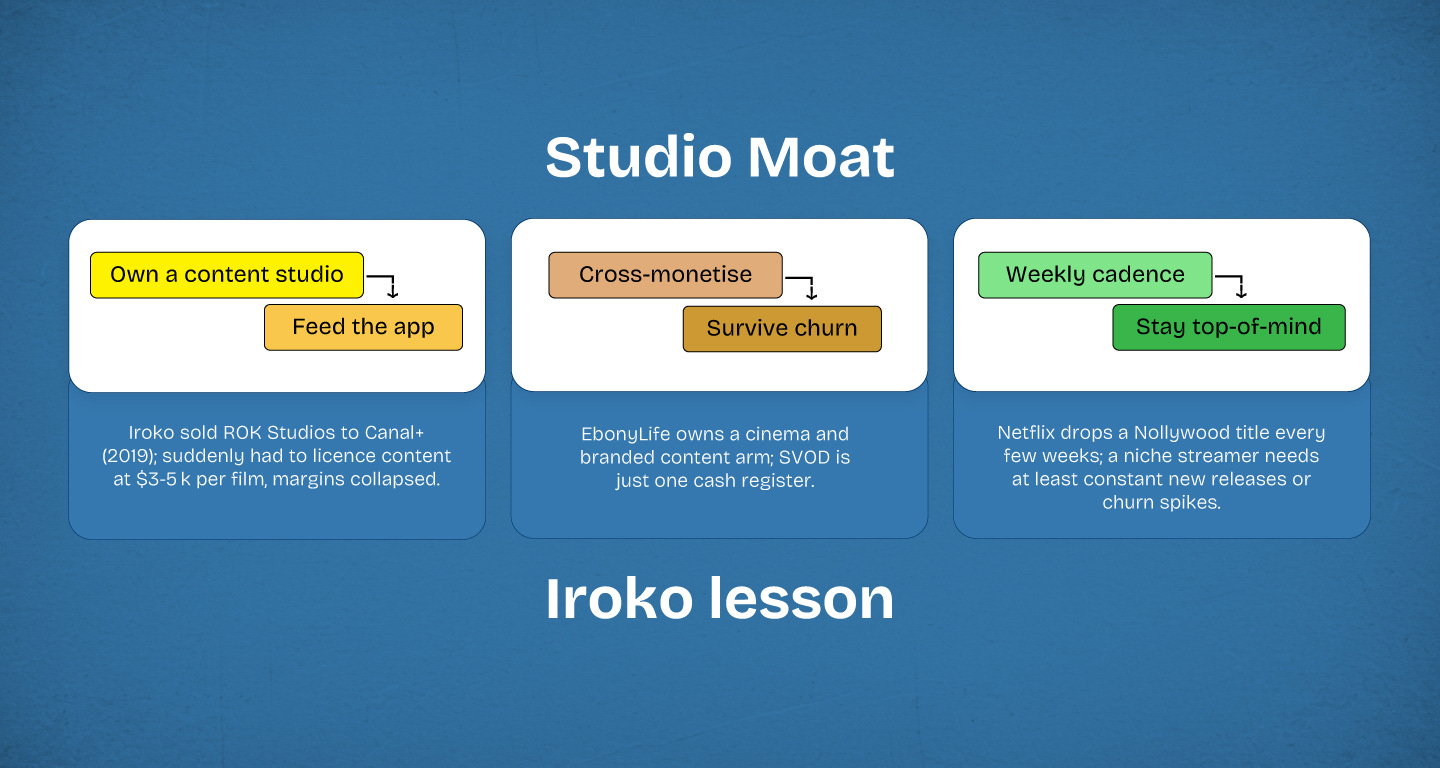

In 2019, it sold its content factory ROK Studios to Canal+.

Despite Iroko’s well-chronicled struggles, the dream of a successful streaming platform is still alive.

EbonyLife ON Plus: Mo Abudu’s new service promises “authentic and diverse narratives” for Nigerians at home and abroad. Sub‑pricing isn’t public yet, but Abudu is touting community features and diaspora bundling to fight churn.

Unnamed Major Producer: One insider tells me another major producer is also scheduled to announce a streaming platform before the end of the year.

Why the next streaming bets all target the diaspora

(the common thread EbonyLife ON Plus and “Producer X” don’t say out loud)

Nigerians abroad (roughly 2 million in the U.S./U.K. alone and 5 million globally) send home more than $600 million every month and are already comfortable with $8–15 subscription prices. That is the bankable market both new platforms are chasing.

Iroko pivoted to this playbook in 2020: “We will revert to focusing on higher‑ARPU customers in North America and Western Europe,” the company said at the time.

Without a steady content factory, diaspora alone won’t float the boat.

Nollywood’s bottleneck isn’t just distribution, it’s unit economics. Diaspora wallets are a logical upgrade, but the ceiling is low:

If you capture 10 % of US/UK migrants, it translates to 250k subscribers and $2.5 m gross revenue.

A prestige 10‑episode series costs $250–$300k; eight originals a year eats half that revenue before servers or marketing.

The winners will run a multi‑exit flywheel: cinema weekend → SVOD window → airline deals → YouTube → brand integrations. The pure-play SVOD dream is probably dead. The golden age of $400k Netflix cheques might be gone, but so is waiting 18 months for a commissioning editor in Amsterdam to email back. Own your masters; spin up the channel; build the community.

Will we get an actual war?

Probably not. EbonyLife ON Plus and Producer will likely X treat SVOD as one spoke in a bigger money wheel, not the wheel itself.

SVOD is simply the fourth or fifth revenue tap, useful for data and diaspora dollars, but not something they’d bet the house on. So instead of a war, we’ll see measured skirmishes: each studio feeling out how many of its superfans it can siphon into a $10‑a‑month niche library without wrecking the bigger flywheel.

Expect experimental pricing, periodic catalog drops, and lots of cross‑promotion with cinema premieres, but don’t expect blockbuster firefights over market share.

That’s it for today. As always, I’d love to hear your thoughts in the comments.

See you next Friday!

Interesting read!

What about MTN? They announced plans to enter the industry some months back.