The wrong way to kill a $92 million startup

Failing without context means people will write the ending for you

If you missed last week’s newsletters, catch up here and here.

And if this newsletter was forwarded to you, subscribe here for free:

TOGETHER WITH CREDIT DIRECT

Zuck is not done poaching; this time, he has lured an Apple Executive with a $200 million. That’s more than Tim Cook’s salary. Maybe I should finish my Master's.

The Nigerian Stock Market, NGX, is on fire as supposedly illiquid stocks are making triple-digit percentage moves. You can buy, but you can't sell. Stop listening to Influencers

GTCO announces plans to list on the LSE, joining Seplat and Airtel as the only Nigerian companies with double listings.

Robinhood is not “actually” selling you OpenAI tokens

Soham Parekh can get 79 jobs and a TBPN interview. You? Not a chance #skillissue

Stripe has finally obtained its banking charter. Wise, Ripple, and Circle are now following. This is a big win for the GENIUS Act.

And PAPPS just launched a card scheme to enable intra-African payments under the Discover network—A missed opportunity to go local, but let’s talk about that another day.

There’s an announcement at the end of the newsletter. Please stick around to find out.

Two weeks ago, when we wrote about the Chowdeck + Mira acquisition in this newsletter, it was notable that the press release and media run left no room for hot takes. The what, why, and how were fully detailed, leaving no stone unturned in stakeholder communication. (Let's ignore the fact that the acquisition price wasn't mentioned, but small steps.)

This is strategy class and one thing to keep top of mind is that stakeholders can be infinite. Your job is to identify and communicate clearly with all of them when making business decisions.

The benefit of communication is that you reduce the overhead of policing reactions. You don’t have to drag people for their tweets or complain that folks “don’t understand startups.” If your comms are clear, people won’t need to guess, or worse, fill in the blanks.

When the going is good, you let us know you were hiring, raising money, or expanding to new product verticals (Okra raised $16 million and had a valuation of $92 million in its Series A round). Keep the same energy when you need to call an end to the business.

Last week’s Okra shutdown and CEO job announcement was a major gaffe. A carefully packaged “comeback story” from the CEO’s handlers, designed to celebrate her new chapter, backfired.

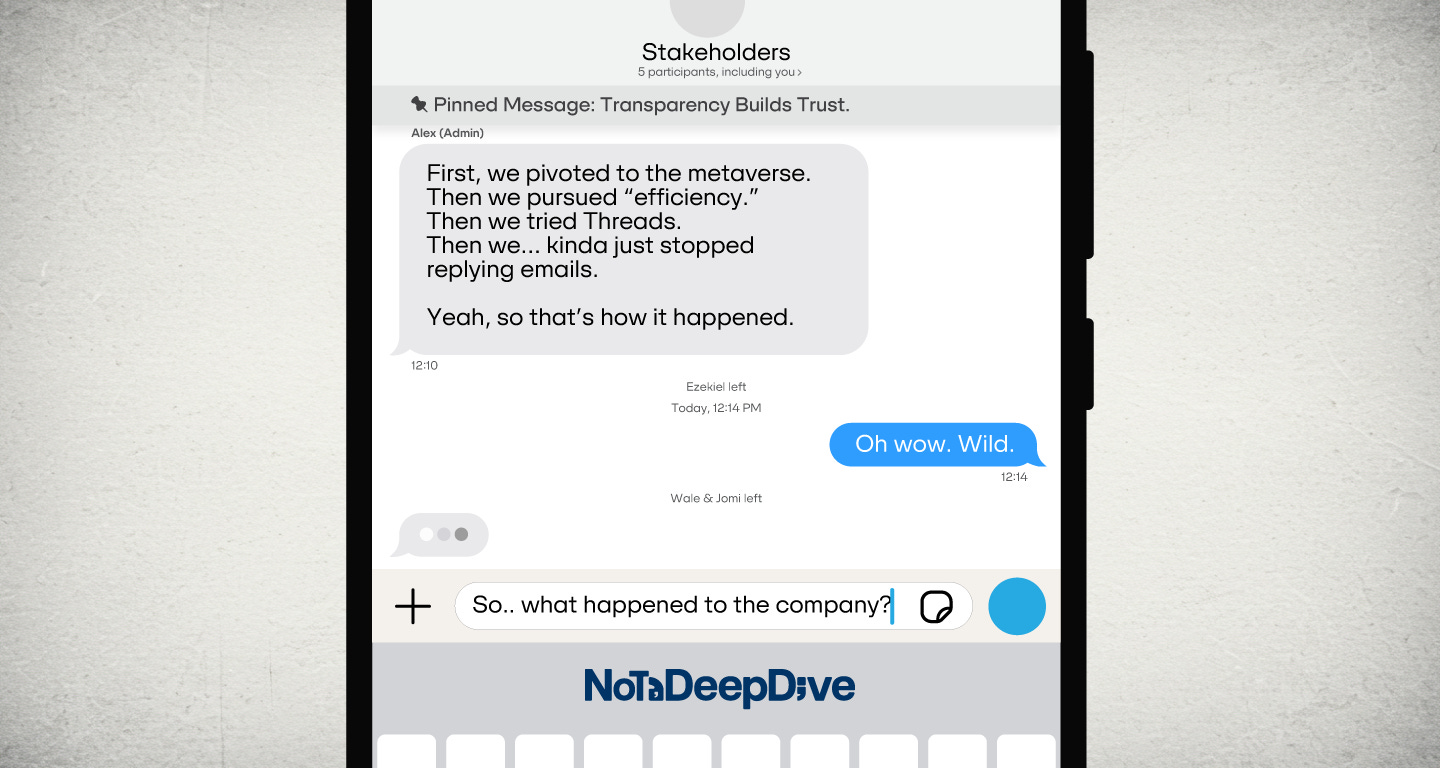

The company’s actual fate, its pivot, shutdown, severance, and the refunding of investor capital, was never formally communicated. So instead of a standing ovation, the internet asked: “Wait, what happened to the company?” and then filled the silence with fraud accusations and unsavoury projections. It didn’t have to go that way.

99% of startups fail, and post-mortems are how we all learn. We are all standing on the shoulders of giants, one way or another and can never go it alone.

Whether it's Patricia, Okra, Brass, Helicarrier, Heroshe, etc, pivots, incidents, and shutdowns will happen. But how you communicate them (or not) sets you apart.

Do you let people guess? Or do you overcommunicate, like Eyowo, and earn respect in the process? The real cost of silence is speculation. And speculation quickly turns into insinuations and those ignorant LinkedIn posts.

Speaking of Comms: Nigerian Banks and International Card Payments

Speaking of comms, let's head over to another notorious set of players: Nigerian banks, the CBN, and the federal government.

It's no longer news that Nigerian banks have allegedly turned back on the functionality of naira cards to be used for international payments (Caveats apply).

Over the last 8 years, Nigerian banks started introducing limits on their cards for international payments, eventually reaching zero. This forced the market to rely on plain dollar cards from the banks, virtual card issuers, or new banks trying to make a dent in the market and acquire customers.

While no official communication and explanation was ever made by all involved, most banks had their credit lines from their offshore partners, and Mastercard cut off due to the currency crisis and scarcity of FX.

Faced with treasury and FX liquidity problems, the banks made a judgment call. Why owe Mastercard $5-10 million monthly on card transactions when my allocation from the CBN per month is in the $50-200 million range? Money I could use to issue loans and settle import obligations for my biggest customers with liabilities ranging in billions.

After all, at the time, micropayments of $20-$100 per month per customer and the occasional $2k flight purchase were not strong justifications to run a business.

That was until the virtual cards and class of 2020 commercial banks entered the chat.

Business Case? I think Not

Little wonder the banks have capped it at $1k-$5k per month/quarter as part of the rollout.

Their credit lines have been restored due to a reversal of some of the previous regime's FX policies, leading to better price discovery and availability of the dollar in Nigerian markets.

However, the banks are now more cautious. No one wants to incur single debits of $500K on unauthorised LC settlements via a card anymore, which can cause a liquidity crisis for the treasury team. The good times are back. If you'd like more stories like this, please let's discuss in the comments.

The Culture of Secrecy

There is generally a culture of secrecy and opacity in this country and industry that fuels misinformed takes and bad projections.

It hurts seeing people run with falsehoods about the industry you play in or stories you know about, simply because those responsible did not deem it fit to make a proper public communications plan, especially in this era where every development can be politicised and dissected on the altar of the agenda of the day by all sides.

Good comms fixes this.

Okra could have given the industry a learning moment to be celebrated and applauded, and the CBN and Nigerian banks could have done better in handling the communications behind the cards.

Communication brings clarity and helps with better judgment and analysis.

Until we learn the no-fault post-mortems of the airline industry, we will always complain about ill-informed takes.

While we are at it, get your places of work to adopt more open and educative communication styles, and maybe there won't be a newsletter to write.

What the man said

Announcement

It's coalition season in Nigeria. If you made it this far, we are pleased to announce another coalition: Notadeepdive and Fintechiseasy will be collaborating a lot for the foreseeable future on a few topics. After previously contributing paragraphs here, here, here, and here and a full guest newsletter like this one.

Nothing is expected to change, just more context and collaborative content for the audience by two Man City fans who complain about Pep Guardiola and the Nigerian tech industry.

The two newsletters will still exist in their standalone forms, and the occasional collaborative articles will be sent out using Substack's co-author feature.

If Naira cards can come back, so can 2017-2019 Man City.

A few Nice Links.

Silence isn’t always “golden” after all…